KKR Real Estate Finance Trust Results Presentation Deck

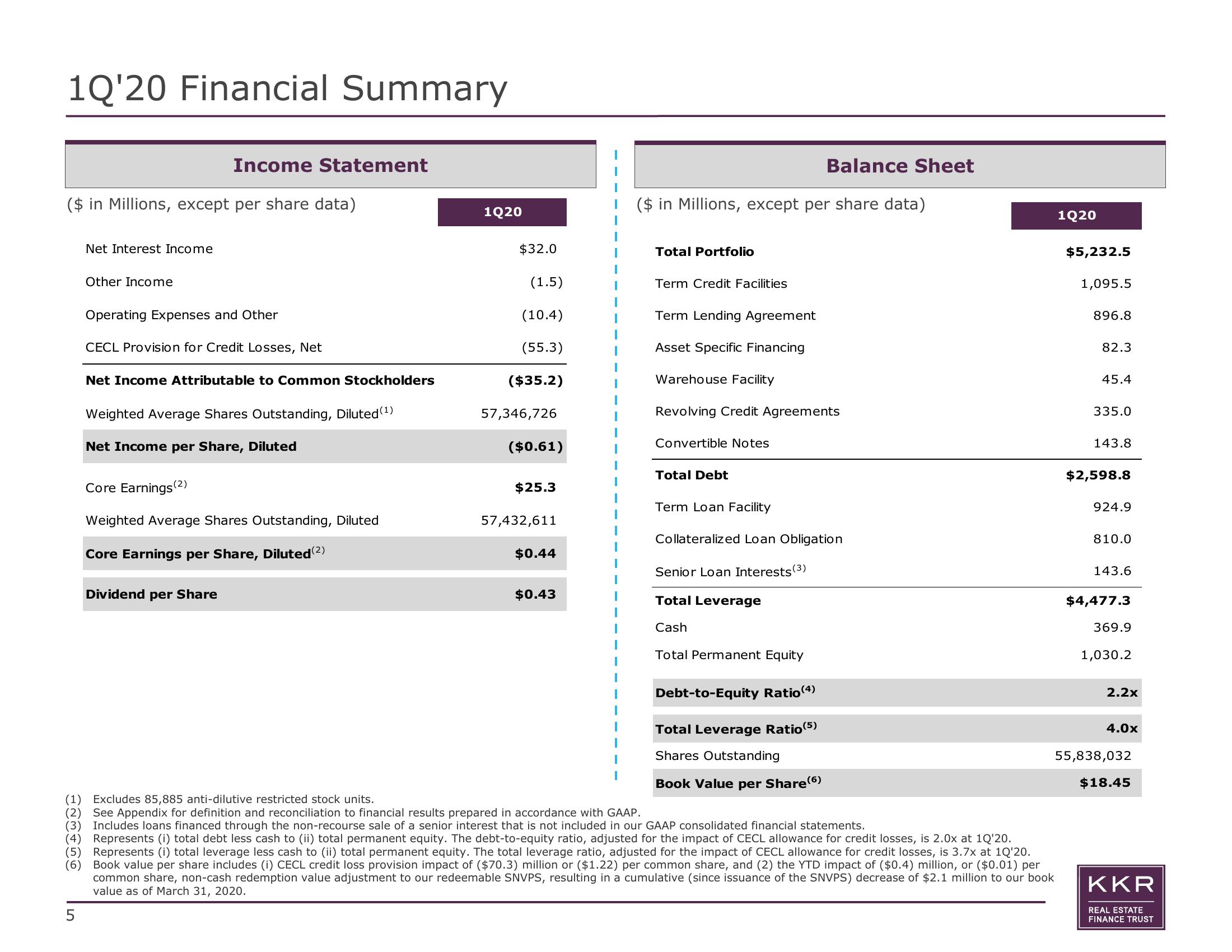

1Q'20 Financial Summary

($ in Millions, except per share data)

LO

Net Interest Income

5

Other Income

Income Statement

Operating Expenses and Other

CECL Provision for Credit Losses, Net

Net Income Attributable to Common Stockholders

Weighted Average Shares Outstanding, Diluted (¹)

Net Income per Share, Diluted

Core Earnings (2)

Weighted Average Shares Outstanding, Diluted

Core Earnings per Share, Diluted (²)

Dividend per Share

1Q20

$32.0

(1.5)

(10.4)

(55.3)

($35.2)

57,346,726

($0.61)

$25.3

57,432,611

$0.44

$0.43

($ in Millions, except per share data)

Total Portfolio

Term Credit Facilities

Term Lending Agreement

Asset Specific Financing

Warehouse Facility

Revolving Credit Agreements

Convertible Notes

Total Debt

Balance Sheet

Term Loan Facility

Collateralized Loan Obligation

Senior Loan Interests (3)

Total Leverage

Cash

Total Permanent Equity

Debt-to-Equity Ratio (4)

Total Leverage Ratio (5)

Shares Outstanding

Book Value per Share (6)

(1) Excludes 85,885 anti-dilutive restricted stock units.

(2) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP.

(3) Includes loans financed through the non-recourse sale of a senior interest that is not included in our GAAP consolidated financial statements.

(4) Represents (i) total debt less cash to (ii) total permanent equity. The debt-to-equity ratio, adjusted for the impact of CECL allowance for credit losses, is 2.0x at 1Q'20.

(5) Represents (i) total leverage less cash to (ii) total permanent equity. The total leverage ratio, adjusted for the impact of CECL allowance for credit losses, is 3.7x at 1Q'20.

(6) Book value per share includes (i) CECL credit loss provision impact of ($70.3) million or ($1.22) per common share, and (2) the YTD impact of ($0.4) million, or ($0.01) per

common share, non-cash redemption value adjustment to our redeemable SNVPS, resulting in a cumulative (since issuance of the SNVPS) decrease of $2.1 million to our book

value as of March 31, 2020.

1Q20

$5,232.5

1,095.5

896.8

82.3

45.4

335.0

143.8

$2,598.8

924.9

810.0

143.6

$4,477.3

369.9

1,030.2

2.2x

4.0x

55,838,032

$18.45

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation