Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

Income

£1.7bn

Q420: £1.6bn

Cost: income

ratio

73%

Q420: 73%

Loan loss rate

n/a

Q420:31bps

ROTE

16.8%

Q420: 6.5%

PERFORMANCE

Loan: deposit

ratio

85%

Sep-21:86%

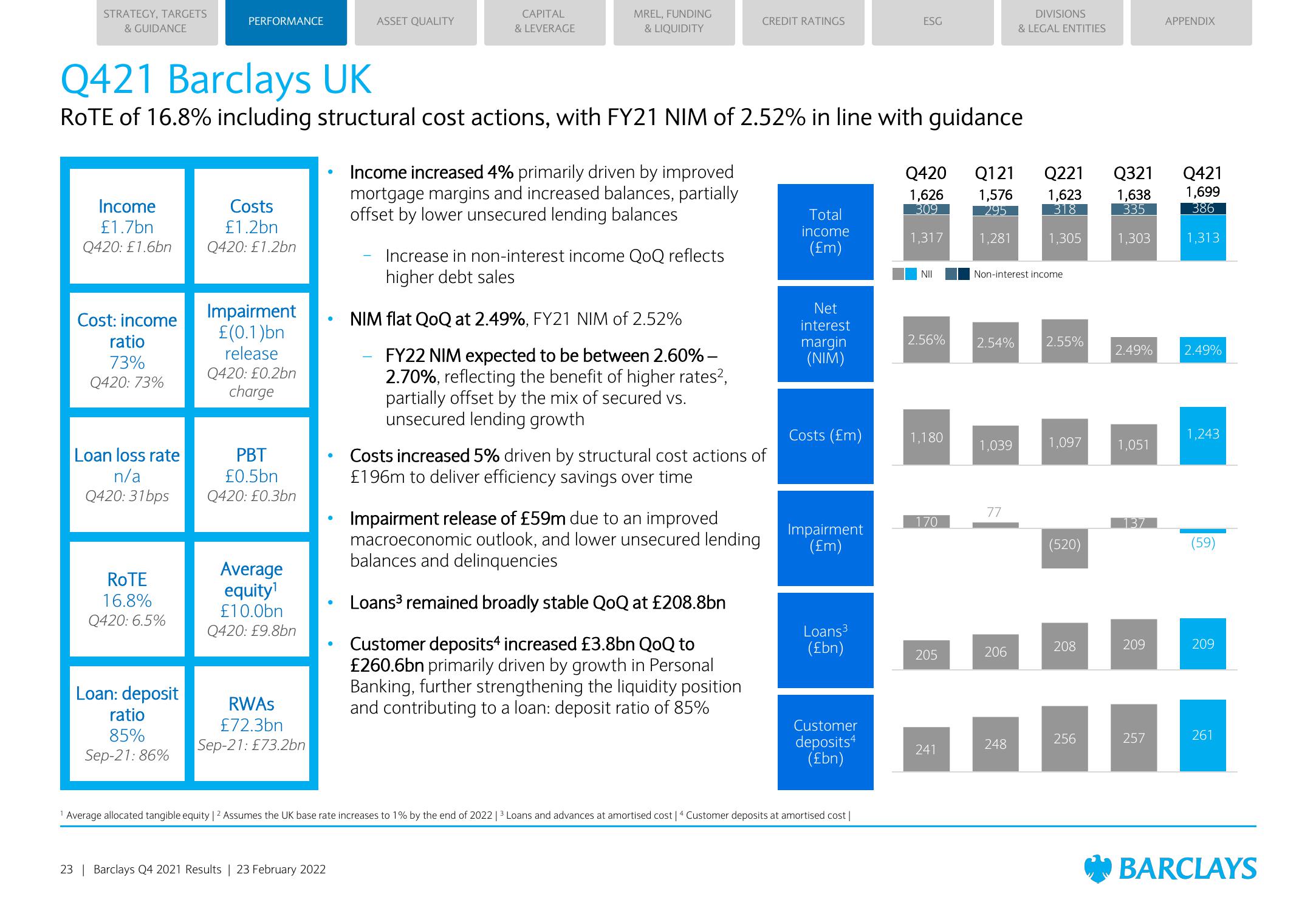

Q421 Barclays UK

ROTE of 16.8% including structural cost actions, with FY21 NIM of 2.52% in line with guidance

Costs

£1.2bn

Q420: £1.2bn

Impairment

£(0.1)bn

release

Q420: £0.2bn

charge

PBT

£0.5bn

Q420: £0.3bn

Average

equity¹

£10.0bn

Q420: £9.8bn

RWAS

£72.3bn

Sep-21: £73.2bn

●

23 | Barclays Q4 2021 Results | 23 February 2022

●

●

ASSET QUALITY

●

CAPITAL

& LEVERAGE

MREL, FUNDING

& LIQUIDITY

Income increased 4% primarily driven by improved

mortgage margins and increased balances, partially

offset by lower unsecured lending balances

Increase in non-interest income QoQ reflects

higher debt sales

NIM flat QoQ at 2.49%, FY21 NIM of 2.52%

FY22 NIM expected to be between 2.60% -

2.70%, reflecting the benefit of higher rates²,

partially offset by the mix of secured vs.

unsecured lending growth

CREDIT RATINGS

Costs increased 5% driven by structural cost actions of

£196m to deliver efficiency savings over time

Impairment release of £59m due to an improved

macroeconomic outlook, and lower unsecured lending

balances and delinquencies

Loans³ remained broadly stable QoQ at £208.8bn

Customer deposits4 increased £3.8bn QoQ to

£260.6bn primarily driven by growth in Personal

Banking, further strengthening the liquidity position

and contributing to a loan: deposit ratio of 85%

Total

income

(£m)

Net

interest

margin

(NIM)

Costs (Em)

Impairment

(£m)

Loans ³

(£bn)

Customer

deposits4

(£bn)

Average allocated tangible equity | ² Assumes the UK base rate increases to 1% by the end of 2022 | ³ Loans and advances at amortised cost | 4 Customer deposits at amortised cost |

ESG

Q420 Q121

1,626

309

1,317

1,576

295

1,281

NII

2.56%

1,180

170

205

241

2.54%

Non-interest income

1,039

77

DIVISIONS

& LEGAL ENTITIES

206

248

Q221

Q421

Q321

1,623 1,638 1,699

318

386

335

1,303

1,305

1,313

2.55%

1,097

(520)

208

256

2.49%

1,051

137

209

APPENDIX

257

2.49%

1,243

(59)

209

261

BARCLAYSView entire presentation