Spotify Results Presentation Deck

Operating Expenses

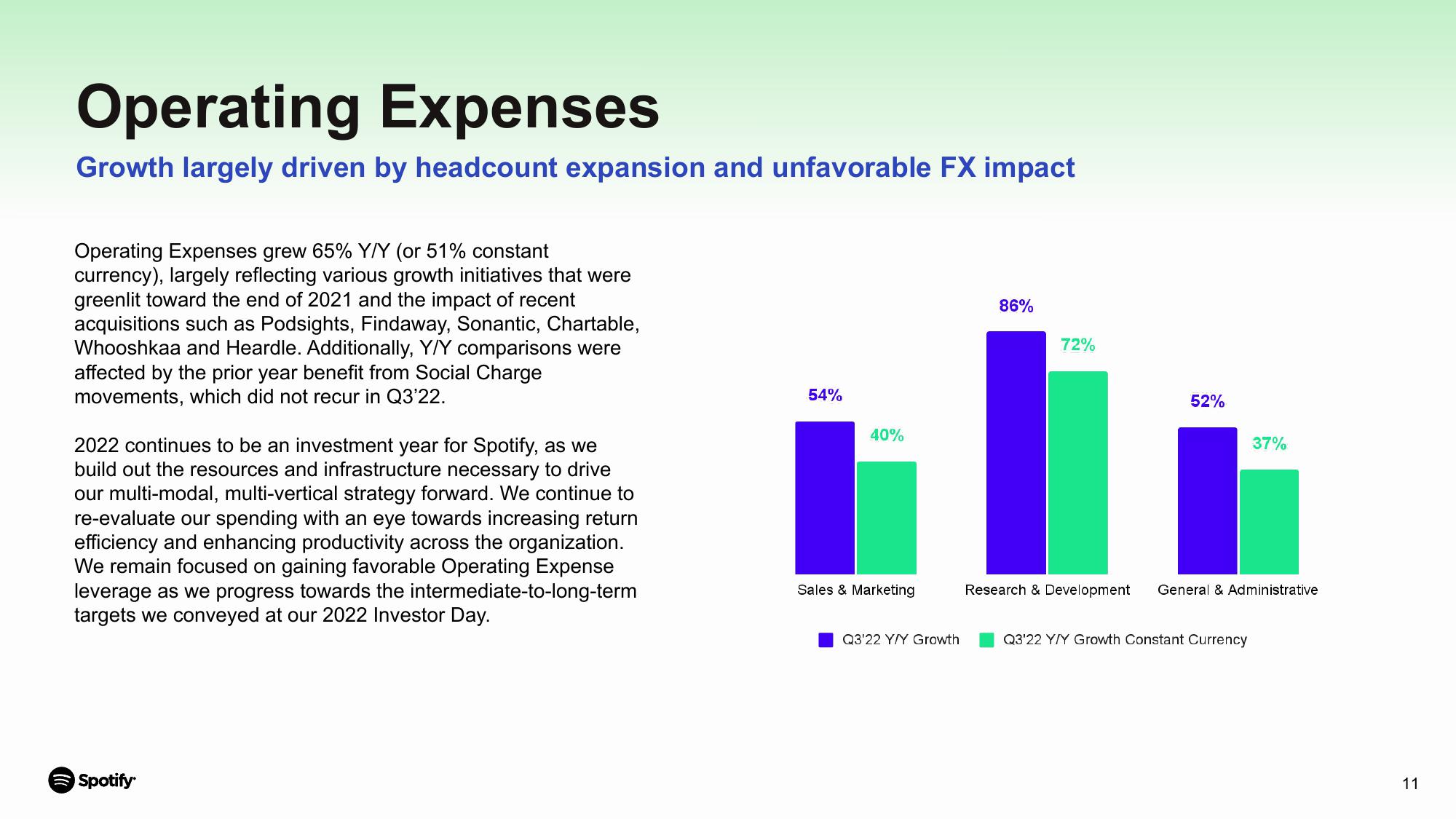

Growth largely driven by headcount expansion and unfavorable FX impact

Operating Expenses grew 65% Y/Y (or 51% constant

currency), largely reflecting various growth initiatives that were

greenlit toward the end of 2021 and the impact of recent

acquisitions such as Podsights, Findaway, Sonantic, Chartable,

Whooshkaa and Heardle. Additionally, Y/Y comparisons were

affected by the prior year benefit from Social Charge

movements, which did not recur in Q3'22.

2022 continues to be an investment year for Spotify, as we

build out the resources and infrastructure necessary to drive

our multi-modal, multi-vertical strategy forward. We continue to

re-evaluate our spending with an eye towards increasing return

efficiency and enhancing productivity across the organization.

We remain focused on gaining favorable Operating Expense

leverage as we progress towards the intermediate-to-long-term

targets we conveyed at our 2022 Investor Day.

Spotify

54%

40%

Sales & Marketing

Q3'22 Y/Y Growth

86%

72%

52%

37%

Research & Development General & Administrative

Q3'22 Y/Y Growth Constant Currency

11View entire presentation