DraftKings Results Presentation Deck

PRO FORMA DRAFTKINGS P&L AND ADJUSTED EBITDA RECONCILIATION

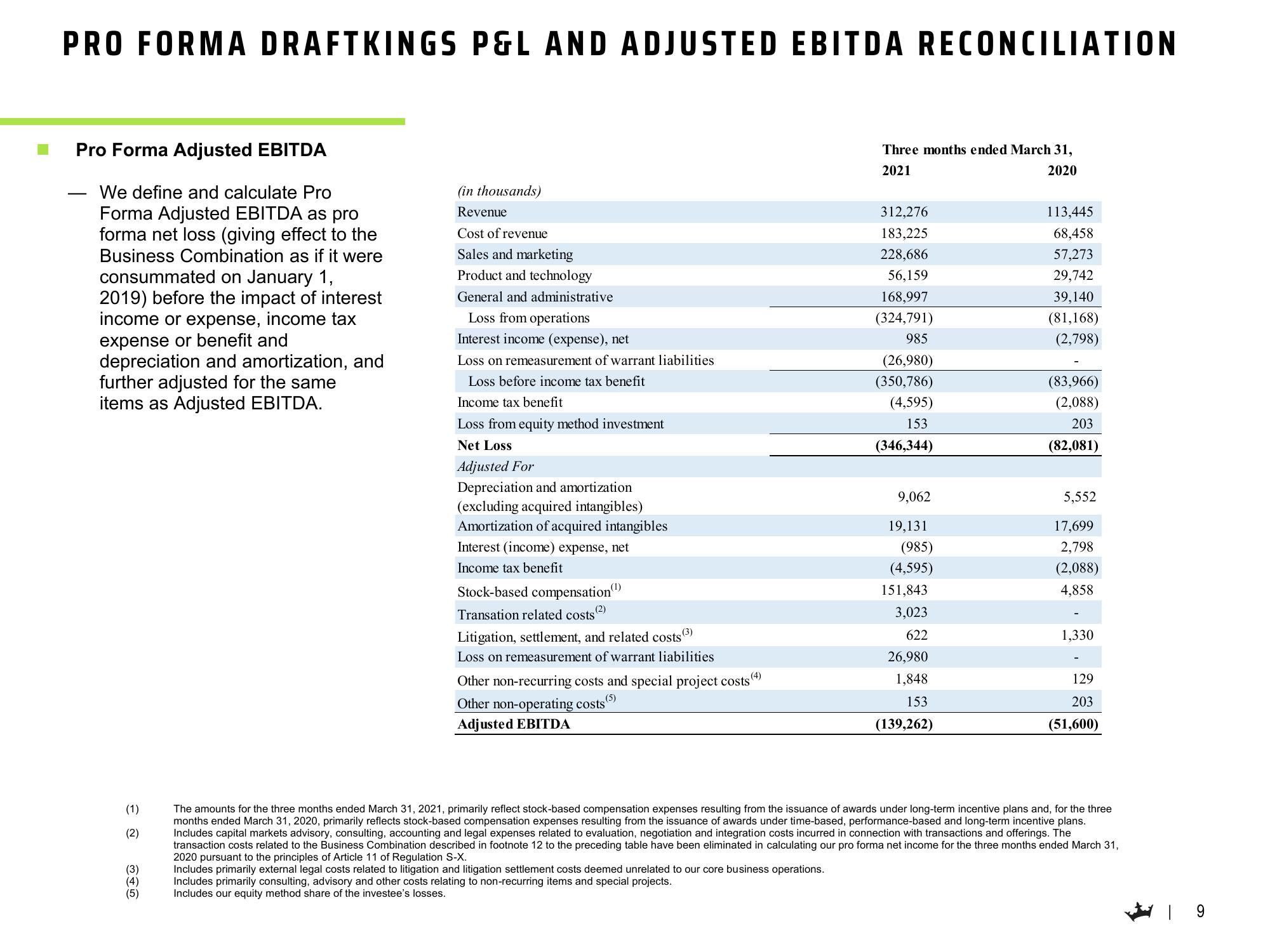

Pro Forma Adjusted EBITDA

We define and calculate Pro

Forma Adjusted EBITDA as pro

forma net loss (giving effect to the

Business Combination as if it were

consummated on January 1,

2019) before the impact of interest

income or expense, income tax

expense or benefit and

depreciation and amortization, and

further adjusted for the same

items as Adjusted EBITDA.

(1)

(2)

(3)

(4)

(5)

(in thousands)

Revenue

Cost of revenue

Sales and marketing

Product and technology

General and administrative

Loss from operations

Interest income (expense), net

Loss on remeasurement of warrant liabilities

Loss before income tax benefit

Income tax benefit

Loss from equity method investment

Net Loss

Adjusted For

Depreciation and amortization

(excluding acquired intangibles)

Amortization of acquired intangibles

Interest (income) expense, net

Income tax benefit

Stock-based compensation(¹)

Transation related costs

(2)

Litigation, settlement, and related costs (3)

Loss on remeasurement of warrant liabilities

Other non-recurring costs and special project costs (4)

Other non-operating costs

Adjusted EBITDA

(5)

Three months ended March 31,

2021

2020

312,276

183,225

228,686

56,159

168,997

(324,791)

985

(26,980)

(350,786)

(4,595)

153

(346,344)

9,062

19,131

(985)

(4,595)

151,843

3,023

622

26,980

1,848

153

(139,262)

113,445

68,458

57,273

29,742

39,140

(81,168)

(2,798)

(83,966)

(2,088)

203

(82,081)

5,552

17,699

2,798

(2,088)

4,858

1,330

129

203

(51,600)

The amounts for the three months ended March 31, 2021, primarily reflect stock-based compensation expenses resulting from the issuance of awards under long-term incentive plans and, for the three

months ended March 31, 2020, primarily reflects stock-based compensation expenses resulting from the issuance of awards under time-based, performance-based and long-term incentive plans.

Includes capital markets advisory, consulting, accounting and legal expenses related to evaluation, negotiation and integration costs incurred in connection with transactions and offerings. The

transaction costs related to the Business Combination described in footnote 12 to the preceding table have been eliminated in calculating our pro forma net income for the three months ended March 31,

2020 pursuant to the principles of Article 11 of Regulation S-X.

Includes primarily external legal costs related to litigation and litigation settlement costs deemed unrelated to our core business operations.

Includes primarily consulting, advisory and other costs relating to non-recurring items and special projects.

Includes our equity method share of the investee's losses.View entire presentation