Evercore Investment Banking Pitch Book

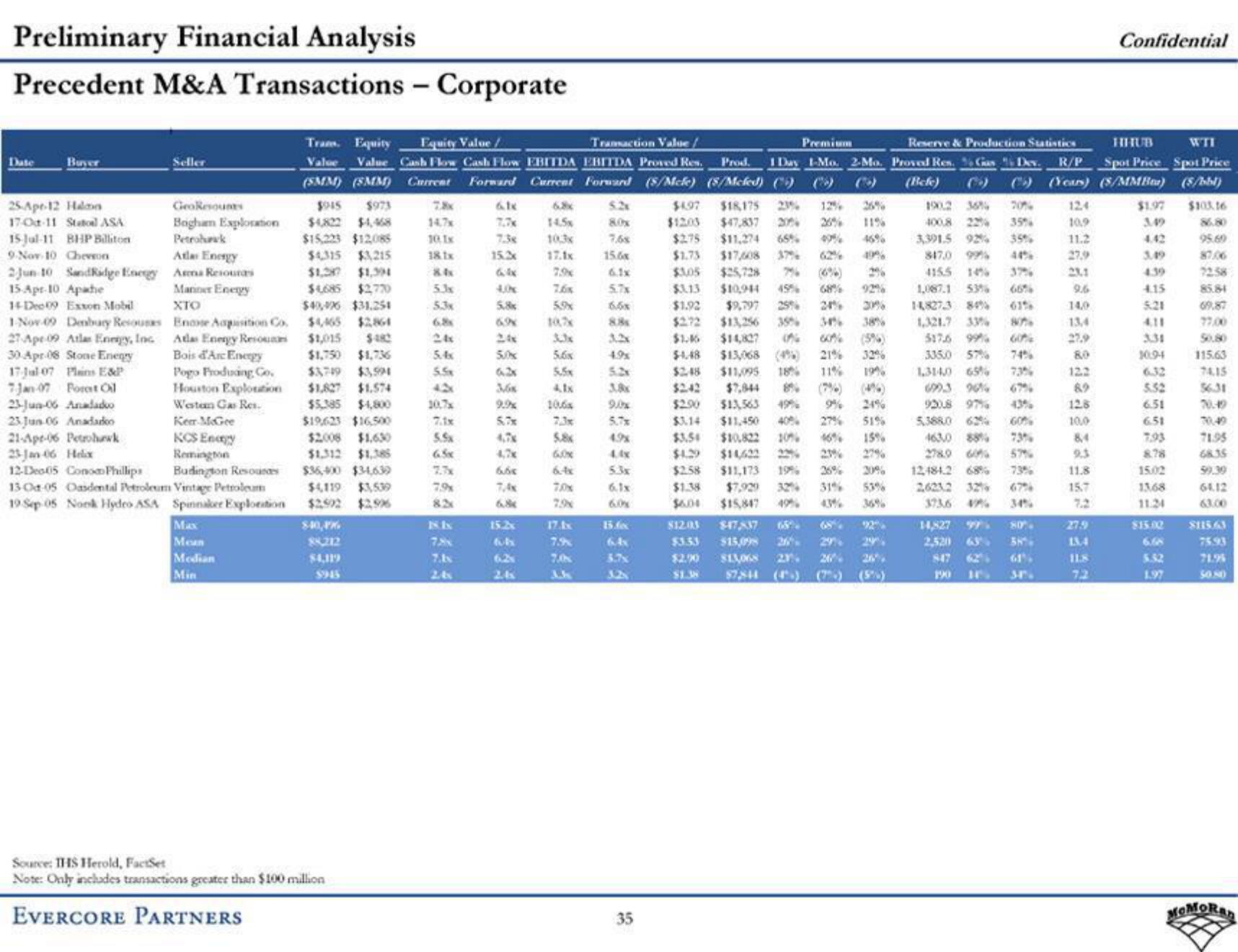

Preliminary Financial Analysis

Precedent M&A Transactions - Corporate

Date

Buyer

25-Apr-12 Halmon

170-11 Statoil ASA

15-Jul-11 BHP Billiton

9-Nov-10 Chevron

Seller

GeoResounts

Boghan Exploration

Petrohrak

Atlas Energy

2-Jun-10 SandRidge Energy Arena Resouras

15-Apr-10 Apache

14-Dec 09 Exxon Mobil

1-Nov-09 Denbury Resouras

27 Apr 09 Atlas Energy, Inc.

30-Apr-08 Stone Enegry

17-Jul 07 Plains E&P

7-Jan-07 Port Ol

23-Jun-06 Analado

23 Jun 06 Anadarko

21-Apr-06 Petrohuwk

23-Jan 06 Helix

12-Dec 05 Conom Phillips

Mariner Energy

XTO

Enoose Acquisition Co.

Adas Energy Resou

Bois d'Arc Energy

Pogo Producing Co.

Houston Exploution

Westen Gas Res.

Kem McGee

KCS Enagy

Remington

Budington Resources

13-04-05 Oasdental Petroleum Vintage Petroleum

19 Sep 05 Nok Hydro ASA Spinnaker Exploration

Max

Mean

Median

Min

Tram. Equity Equity Value/

Transaction Value/

Value Value Cash Flow Cash Flow EBITDA EBITDA Proved Res Prod.

(SMM) (SMM) Current Forward Current Forward (S/Mcle) (S/Meled) (9

61

$945 $973

$4,822 $4,468

$15,223 $12,085

$4,315 $3,215

$1,287 $1,394

$4,685 $2,770

$49,976 $31.254

$4,465 $2861

$1,015

$482

$1,750 $1,736

$3,749 $3,994

$1,827 $1.574

$5,385 $4,800

$19,623 $16.500

$2008 $1.630

$1,312 $1,385

$36,400 $34,639

$4,119 $3,539

$2,992 $2,996

840,4%

88,212

$4,119

Source: IHS Herold, FactSet

Note: Only includes transactions greater than $100 million

EVERCORE PARTNERS

14,7x

10.1x

18.1x

5.3x

5.3x

5.4x

5.5x

42x

5.5%

7.9%

82x

18. Ix

7%

7.38

15.3x

500%

6.3x

3,6%

4,7%

4,7x

66€

15.2x

68

15

5,9%

10,7x

5.6%

10.6%

7.3x

5.8

60%

70x

17.4x

7.0%

7.68

15.68

5.7x

6.6%

8.8

5.2x

3.8x

9.0%

5.7%

49%

4.4x

5.3x

6.1x

15. fex

6.4x

5.7x

35

Premium

1 Day 1-Mo. 2-Mo.

$4.97 $18,175

$1203 $47,837 200% 26% 11%

$275 $11,274 65% 49% 46%

$1.73 $17,008

49%

$3,05 $25,728 7%

$33.13 $10,944

68%

$1.92 $9,797 25% 24% 30%

$2.72 $13,256 35%

$1.16

$4,48

$2,48

$14,827

$13,068 (4%)

$11,095 18%

$7,844 8%

38%

(5%)

21% 32%

11% 19%

$2.90 $13,563 49%

$3.14 $11,450

$3.54 $10,822 20% 16%

$14,622

$1.29

23%

$11,173

$2.58

$1.38

$7,929

$6.04 $15,847 49%

51%

15%

27%

20%

$12.03 $47,837

$3.53 $15,098 26% 29%

$2.90 $13,068 21% 26% 26%

$7,844 (45) (7) (5%)

92%

Reserve & Production Statistics

Proved Res. % Gas Dev. R/P

(Befe) (9)

HHUB WTI

Spot Price Spot Price

() (Years) (S/MMB) (5/bbl)

70%

124

$1.97 $103.16

35%

10.9

86.80

35%

3.49

11.2

4.42

95.69

3.49

4.39

4.15

400.8 22%

3,391.5 92%

847.0 99%

4155

1,087.1 53%

14,827.3 84%

1,321.7 33%

5176 99% 60%

335.0 57%

1,3140 65%

699.3 96%

920.8 97%

5.388.0 62%

4630 88%

278.9 60

12484.2 68%

26232 32%

3736 47%

14,827 99

2,520 63%

847 62%

190 1

66%

73%

57%

67%

80%.

38%

61%

34%

9.6

14,0

13,4

80

122

89

128

10.0

8,4

9.3

11.8

15.7

Confidential

27.9

1.3.4

11.8

72

10.94

6.32

5.52

6.51

6.51

7.93

8.78

15.02

1368

$15.00

6.68

5.32

1.97

72.58

85.84

69.87

77.00

50.80

115.63

74.15

70.49

71.95

6835

99.39

64.12

63.00

8115.63

75.93

71.95

50.80

MOMORARView entire presentation