Credit Suisse Investment Banking Pitch Book

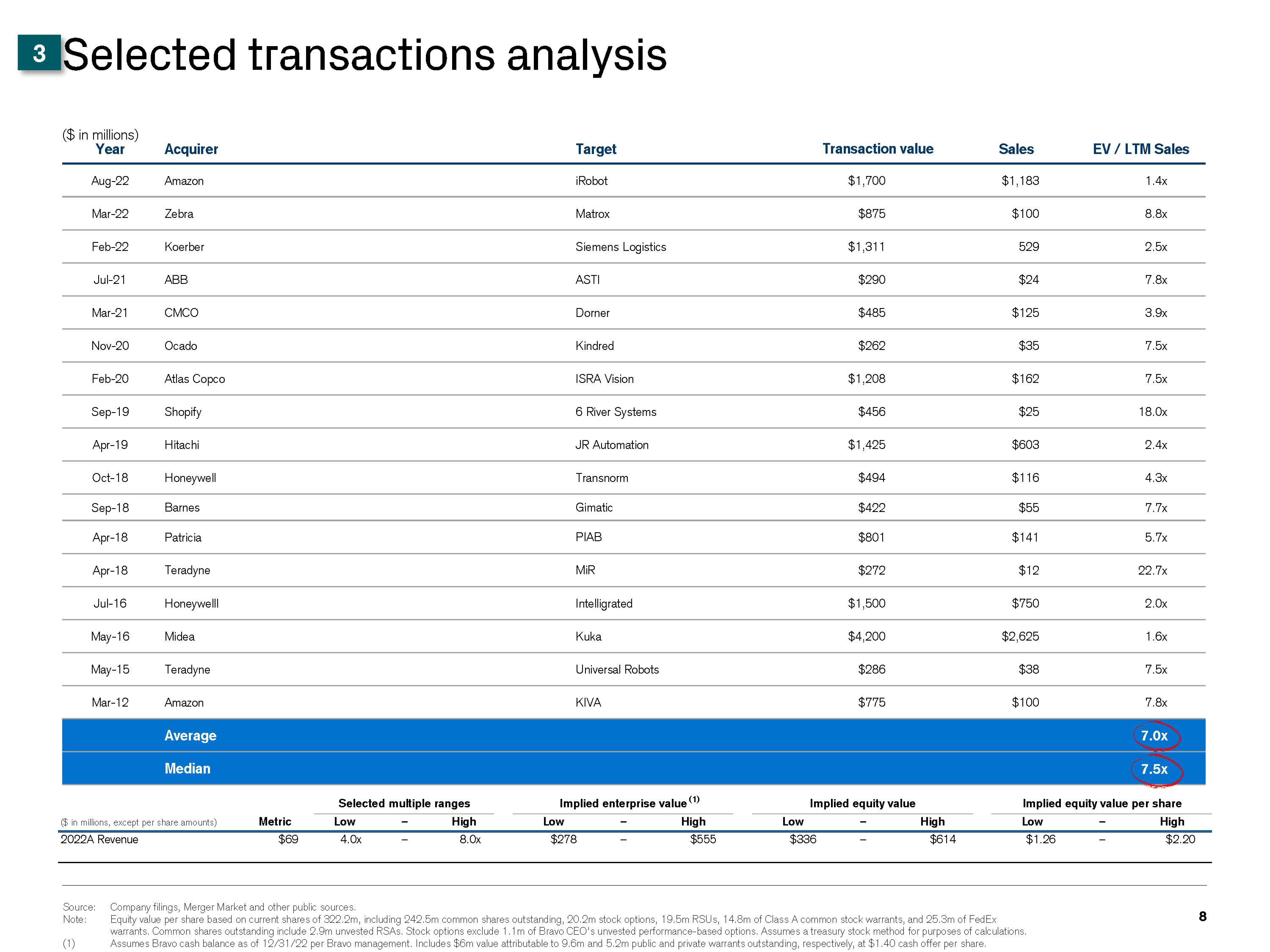

3 Selected transactions analysis

($ in millions)

Year

Aug-22

Mar-22

Feb-22

Jul-21

Mar-21

Nov-20

Feb-20

Sep-19

Apr-19

Oct-18

Jul-16

May-16

May-15

Mar-12

Acquirer

Amazon

Source:

Note:

(1)

Zebra

Koerber

ABB

CMCO

Ocado

Atlas Copco

Sep-18

Apr-18

Apr-18 Teradyne

Honeywelll

Shopify

Hitachi

Honeywell

Barnes

Patricia

Midea

Teradyne

Amazon

Average

Median

($ in millions, except per share amounts)

2022A Revenue

Metric

$69

Selected multiple ranges

High

Low

4.0x

8.0x

Target

Low

iRobot

Matrox

Siemens Logistics

ASTI

Dorner

Kindred

ISRA Vision

6 River Systems

JR Automation

Transnorm

Gimatic

PIAB

MiR

Intelligrated

Kuka

Universal Robots

KIVA

Implied enterprise value (1)

$278

High

$555

Transaction value

Low

$336

$1,700

$875

$1,311

$290

$485

$262

$1,208

$456

$1,425

$494

$422

$801

$272

$1,500

$4,200

$286

$775

Implied equity value

High

$614

Sales

$1,183

$100

529

$24

$125

$35

$162

$25

$603

$116

$55

$141

$12

$750

$2,625

$38

$100

$1.26

EV / LTM Sales

Company filings, Merger Market and other public sources.

Equity value per share based on current shares of 322.2m, including 242.5m common shares outstanding, 20.2m stock options, 19.5m RSUS, 14.8m of Class A common stock warrants, and 25.3m of FedEx

warrants. Common shares outstanding include 2.9m unvested RSAs. Stock options exclude 1.1m of Bravo CEO's unvested performance-based options. Assumes a treasury stock method for purposes of calculations.

Assumes Bravo cash balance as of 12/31/22 per Bravo management. Includes $6m value attributable to 9.6m and 5.2m public and private warrants outstanding, respectively, at $1.40 cash offer per share.

1.4x

8.8x

2.5x

7.8x

3.9x

7.5x

7.5x

18.0x

2.4x

4.3x

7.7x

5.7x

22.7x

2.0x

1.6x

7.5x

7.8x

7.0x

Implied equity value per share

Low

High

7.5x

$2.20

8View entire presentation