Q2 Quarter 2023

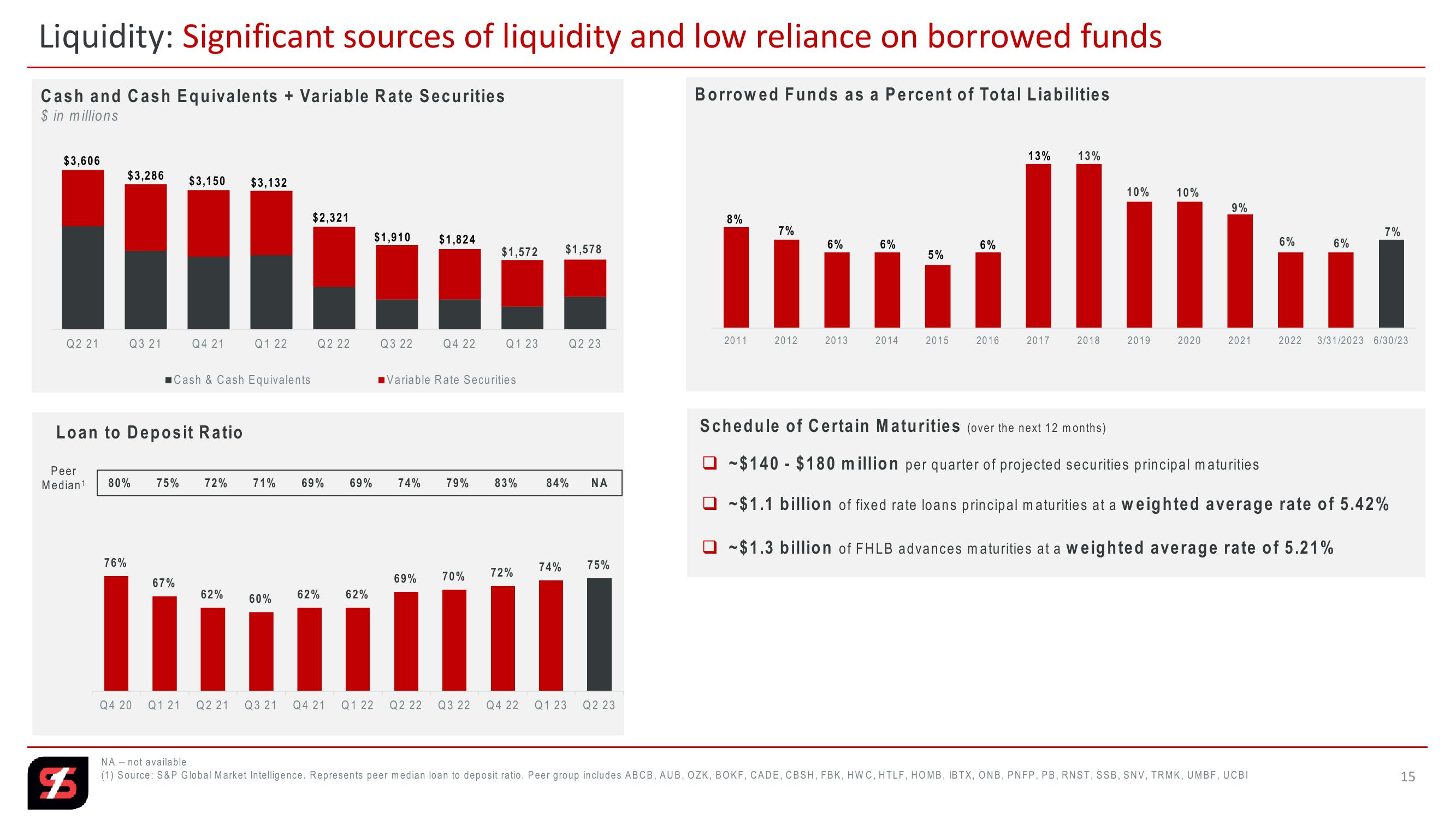

Liquidity: Significant sources of liquidity and low reliance on borrowed funds

Cash and Cash Equivalents + Variable Rate Securities

$ in millions

Borrowed Funds as a Percent of Total Liabilities

Q1 22

Q2 22

Q3 22

Q4 22

Q1 23

Q2 23

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

3/31/2023 6/30/23

ווווו-ויי ווייייווווויי

$3,606

13%

13%

7%

Q2 21

Q3 21

Q4 21

■Cash & Cash Equivalents

Loan to Deposit Ratio

Peer

Median¹ 80% 75% 72% 71%

■Variable Rate Securities

69% 69%

74% 79%

83%

84% NA

Schedule of Certain Maturities (over the next 12 months)

~$140 $180 million per quarter of projected securities principal maturities

~$1.1 billion of fixed rate loans principal maturities at a weighted average rate of 5.42%

☐ ~$1.3 billion of FHLB advances maturities at a weighted average rate of 5.21%

76%

74%

75%

67%

69%

70% 72%

62%

60%

62%

62%

III

Q4 20 Q1 21

Q2 21

Q3 21

Q4 21

Q1 22

Q2 22

Q3 22

Q4 22

Q1 23

Q2 23

NA not available

$5

(1) Source: S&P Global Market Intelligence. Represents peer median loan to deposit ratio. Peer group includes ABCB, AUB, OZK, BOKF, CADE, CBSH, FBK, HWC, HTLF, HOMB, IBTX, ONB, PNFP, PB, RNST, SSB, SNV, TRMK, UMBF, UCBI

15View entire presentation