Pershing Square Activist Presentation Deck

V. Developing a Response to the

Company

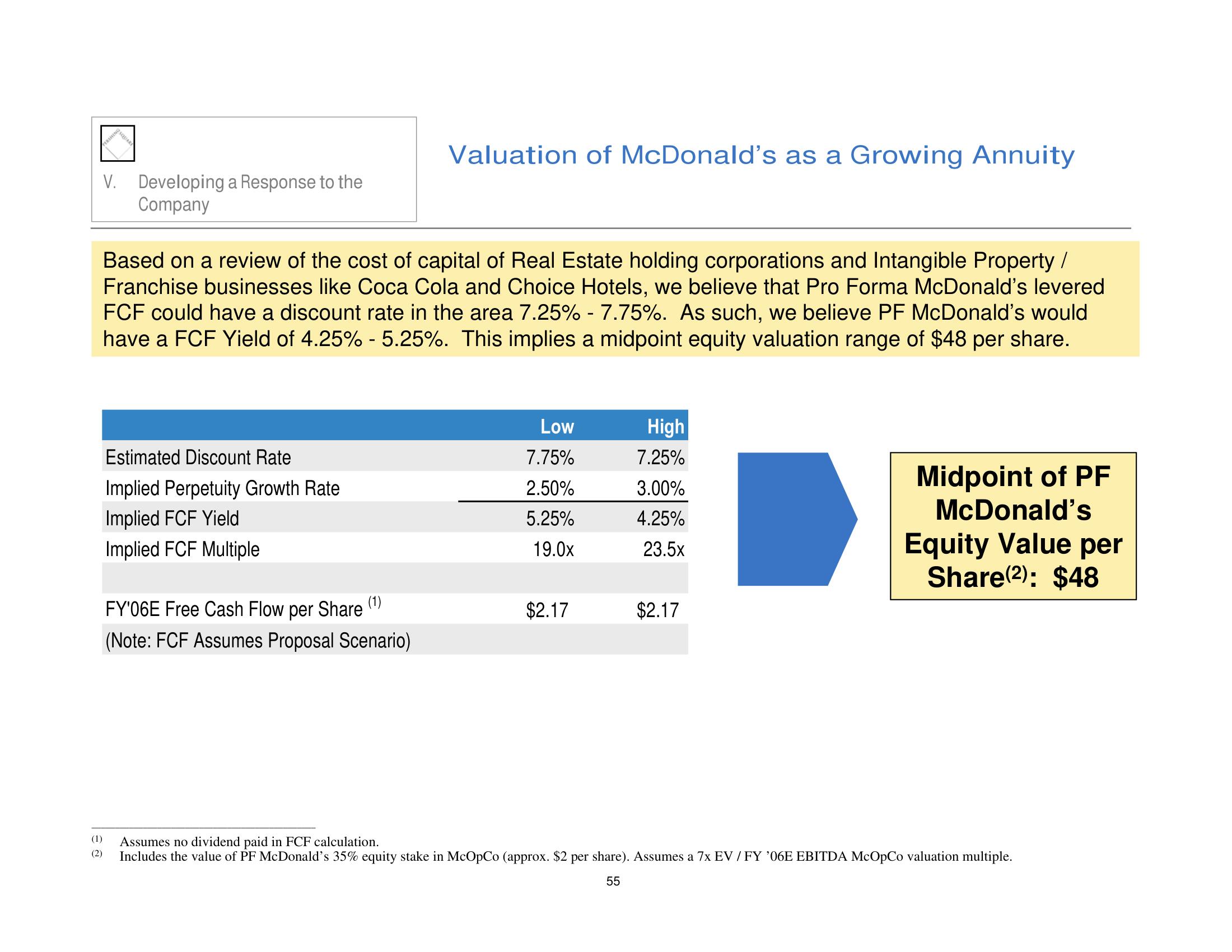

Based on a review of the cost of capital of Real Estate holding corporations and Intangible Property/

Franchise businesses like Coca Cola and Choice Hotels, we believe that Pro Forma McDonald's levered

FCF could have a discount rate in the area 7.25% - 7.75%. As such, we believe PF McDonald's would

have a FCF Yield of 4.25% - 5.25%. This implies a midpoint equity valuation range of $48 per share.

Estimated Discount Rate

Implied Perpetuity Growth Rate

Implied FCF Yield

Implied FCF Multiple

Valuation of McDonald's as a Growing Annuity

(1)

FY'06E Free Cash Flow per Share

(Note: FCF Assumes Proposal Scenario)

Low

7.75%

2.50%

5.25%

19.0x

$2.17

High

7.25%

3.00%

4.25%

23.5x

$2.17

Midpoint of PF

McDonald's

Equity Value per

Share(2): $48

(1) Assumes no dividend paid in FCF calculation.

(2)

Includes the value of PF McDonald's 35% equity stake in McOpCo (approx. $2 per share). Assumes a 7x EV / FY '06E EBITDA McOpCo valuation multiple.

55View entire presentation