Sonder Investor Presentation Deck

Financial Overview

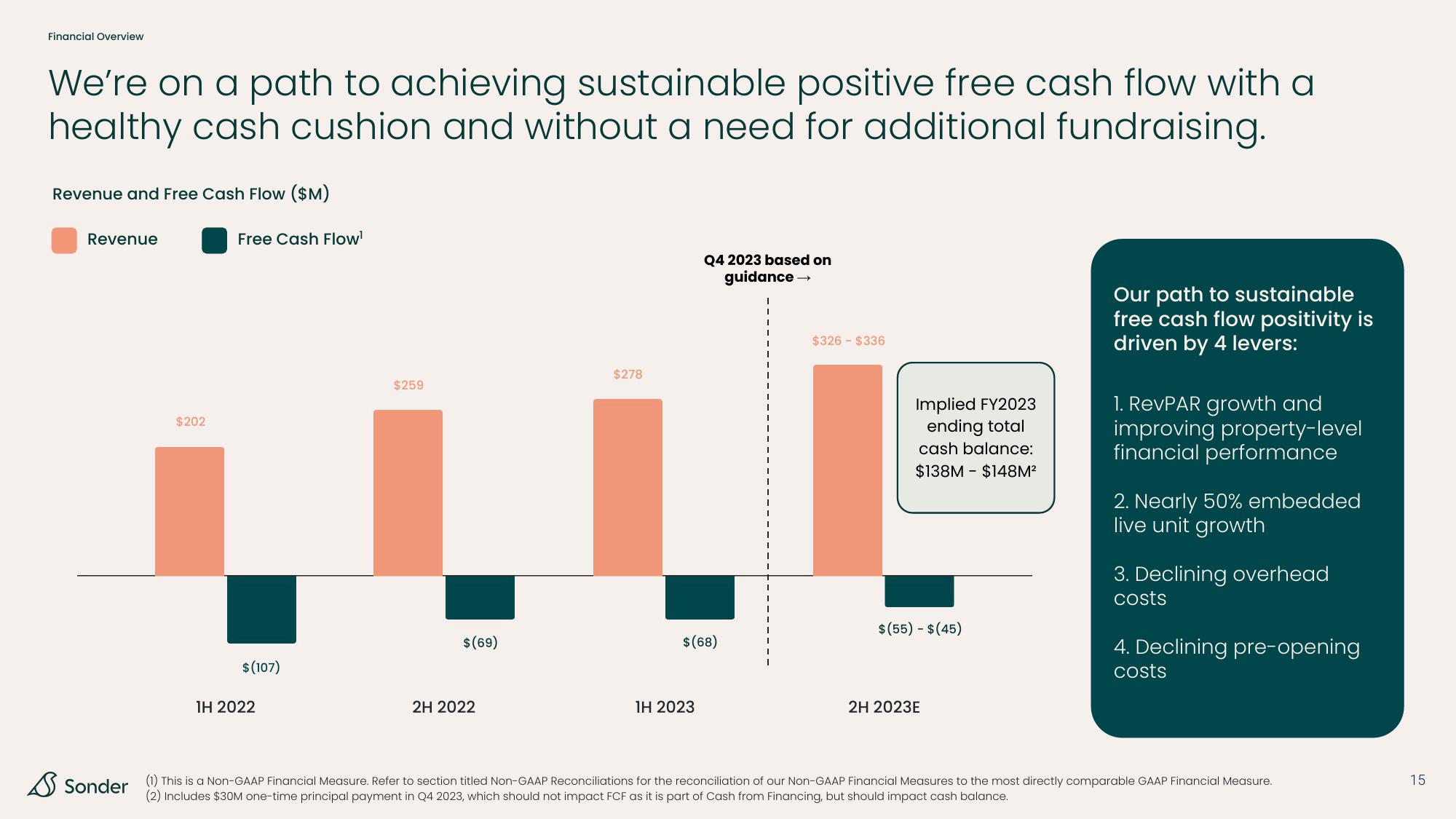

We're on a path to achieving sustainable positive free cash flow with a

healthy cash cushion and without a need for additional fundraising.

Revenue and Free Cash Flow ($M)

Revenue

$202

Free Cash Flow¹

$ (107)

1H 2022

$259

$ (69)

2H 2022

$278

Q4 2023 based on

guidance →

$ (68)

1H 2023

I

$326 - $336

Implied FY2023

ending total

cash balance:

$138M $148M²

$(55) - $(45)

2H 2023E

Our path to sustainable

free cash flow positivity is

driven by 4 levers:

1. RevPAR growth and

improving property-level

financial performance

2. Nearly 50% embedded

live unit growth

3. Declining overhead

costs

4. Declining pre-opening

costs

SonderThis is a Non-GAAP Financial Measure. Refer to section titled Non-GAAP Reconciliations for the reconciliation of our Non-GAAP Financial Measures to the most directly comparable GAAP Financial Measure.

(2) $30M one-time principal payment in Q4 2023, which should not impact FCF as it is part of Cash from Financing, but should impact cash balance.

15View entire presentation