Baird Investment Banking Pitch Book

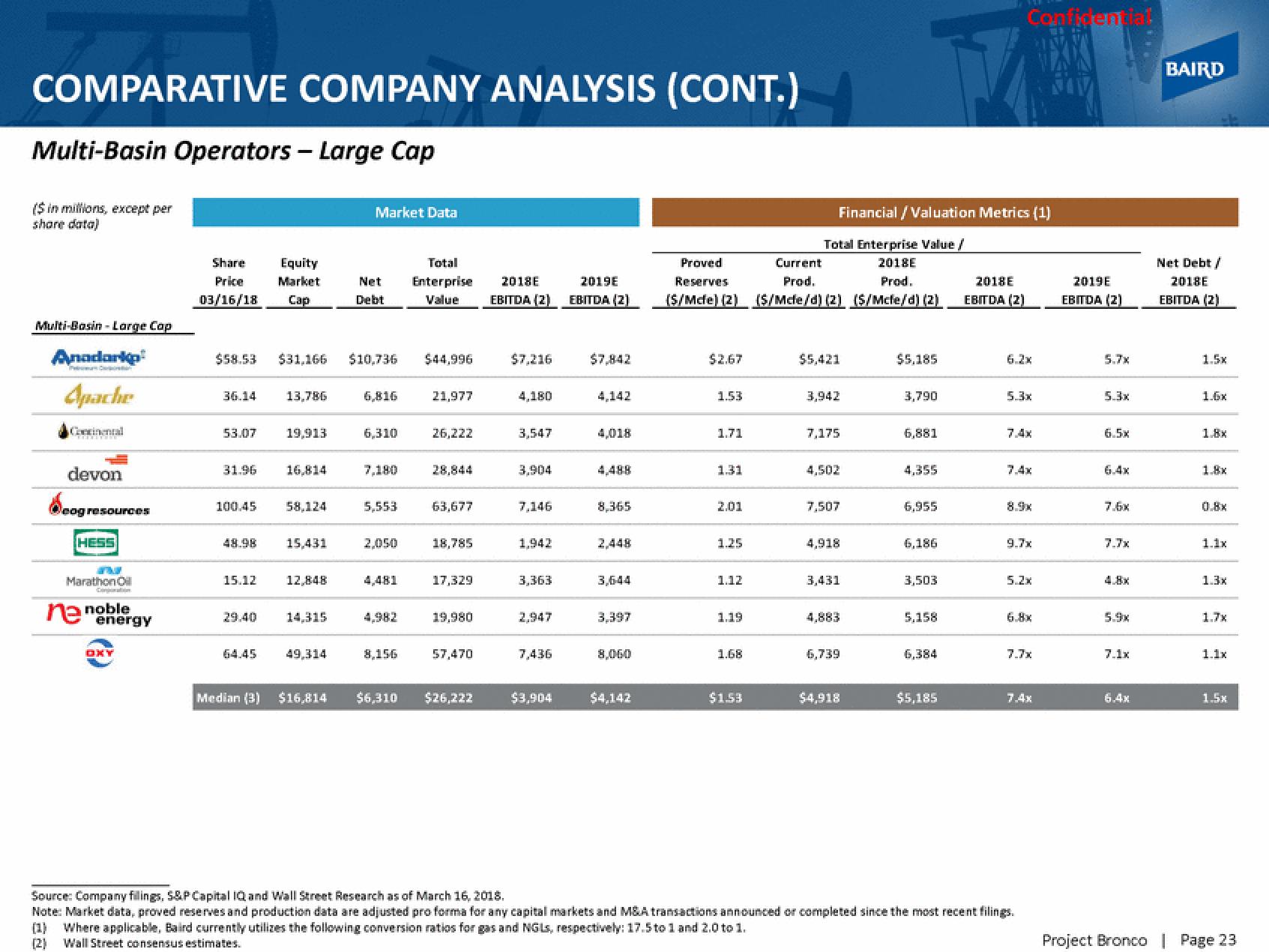

COMPARATIVE COMPANY ANALYSIS (CONT.)

Multi-Basin Operators - Large Cap

($ in millions, except per

share data)

Multi-Basin-Large Cap

Anadarko

Apache

Cerinental

devon

Deogresources

cog

HESS

Marathon Oil

ne noble

energy

OXY

Share

Price

03/16/18

36.14

53.07

$58.53 $31,166 $10,736

31.96

100.45

48.98

15.12

29.40

Equity

Market

Cap

64.45

13,786

19,913

16,814

58,124

15,431

12,848

14,315

Market Data

49,314

Total

Net Enterprise 2018E

Debt

6,816

6,310

7,180

5,553

2,050

4,481

4,982

8,156

2019E

Value EBITDA (2) EBITDA (2)

$44,996

21,977

26,222

28,844

63,677

18,785

17,329

19,980

57,470

Median (3) $16,814 $6,310 $26,222

$7,216

4,180

3,547

3,904

7,146

1,942

3,363

7,436

$3,904

$7,842

4,142

4,018

8,365

3,644

3,397

8,060

$4,142

Financial / Valuation Metrics (1)

Total Enterprise Value /

2018E

Proved

Current

Reserves

Prod.

(S/Mcle) (2) (S/Mcle/d) (2) (S/Mcle/d) (2)

Prod.

$2.67

1.53

1.71

1.31

2.01

1.25

1.12

1.19

1.68

$1.53

$5,421

3,942

7,175

4,502

7,507

4,918

3,431

4,883

6,739

$4,918

$5,185

3,790

6,881

4,355

6,955

6,186

3,503

5,158

6,384

$5,185

2018E

EBITDA (2)

Confidentiat

5.3x

7.4x

9.7x

5.2x

7.7x

7.4x

Source: Company filings, S&P Capital IQ and Wall Street Research as of March 16, 2018.

Note: Market data, proved reserves and production data are adjusted pro forma for any capital markets and M&A transactions announced or completed since the most recent filings.

(1) Where applicable, Baird currently utilizes the following conversion ratios for gas and NGLs, respectively: 17.5 to 1 and 2.0 to 1.

(2)

Wall Street consensus estimates.

2019E

EBITDA (2)

5.7x

5.3x

6.5x

6.4x

7.6x

7.7x

4.8x

5.9x

7.1x

6.4x

BAIRD

Net Debt /

2018F

EBITDA (2)

1.5x

1.6x

1.8x

0.8x

1.3x

1.7x

1.1x

1.5x

Project Bronco | Page 23View entire presentation