Bed Bath & Beyond Results Presentation Deck

Q2 PERFORMANCE HIGHLIGHTS & STRATEGIC UPDATE

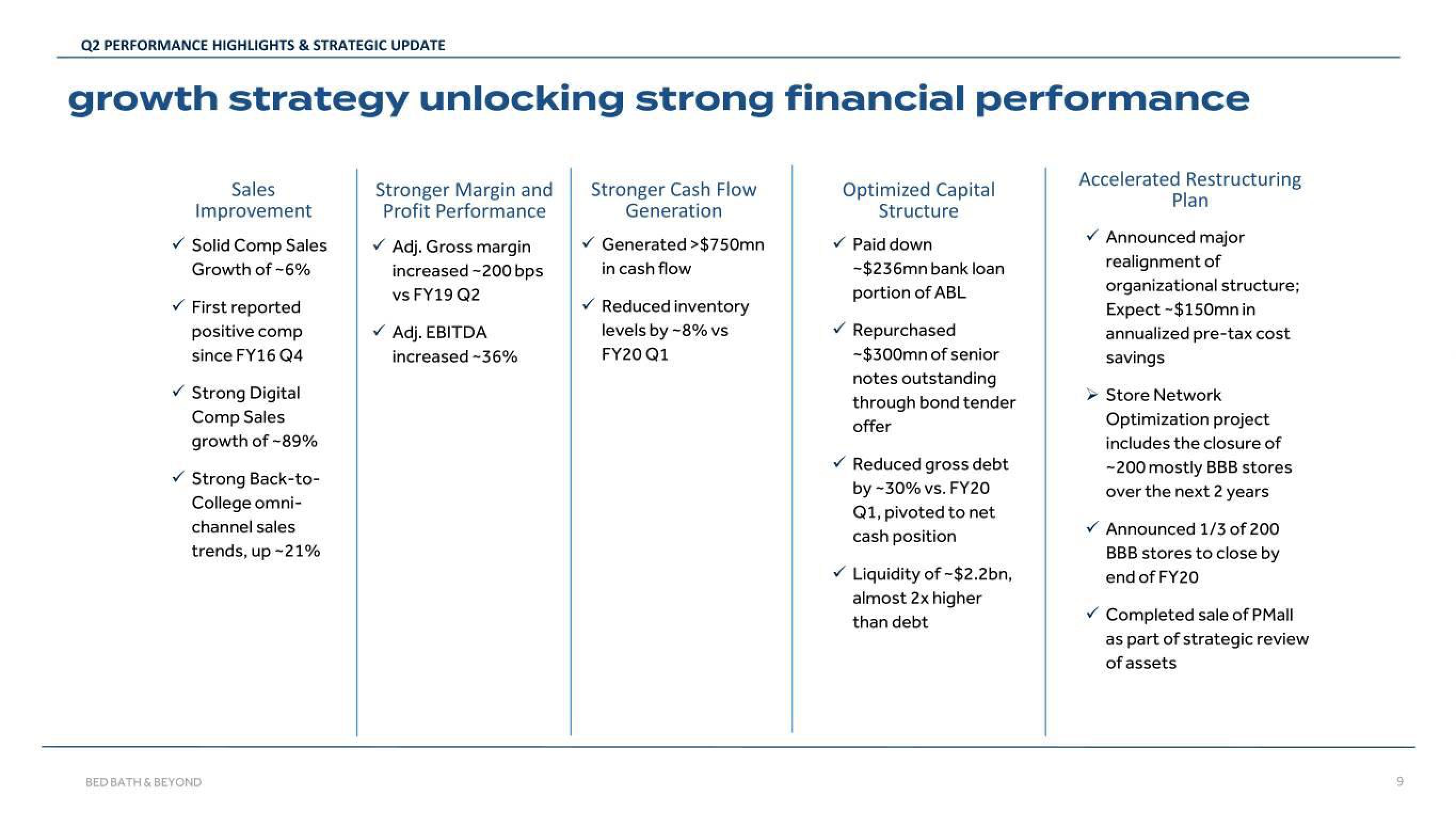

growth strategy unlocking strong financial performance

Sales

Improvement

✓ Solid Comp Sales

Growth of -6%

✓ First reported

positive comp

since FY16 Q4

✓ Strong Digital

Comp Sales

growth of -89%

✓ Strong Back-to-

College omni-

channel sales

trends, up -21%

BED BATH & BEYOND

Stronger Margin and

Profit Performance

✓ Adj. Gross margin

increased -200 bps

vs FY19 Q2

Adj. EBITDA

increased -36%

Stronger Cash Flow

Generation

Generated > $750mn

in cash flow

Reduced inventory

levels by -8% vs

FY20 Q1

Optimized Capital

Structure

✓ Paid down

-$236mn bank loan

portion of ABL

Repurchased

-$300mn of senior

notes outstanding

through bond tender

offer

✓ Reduced gross debt

by -30% vs. FY20

Q1, pivoted to net

cash position

✓ Liquidity of -$2.2bn,

almost 2x higher

than debt

Accelerated Restructuring

Plan

Announced major

realignment of

organizational structure;

Expect -$150mn in

annualized pre-tax cost

savings

Store Network

Optimization project

includes the closure of

-200 mostly BBB stores

over the next 2 years

Announced 1/3 of 200

BBB stores to close by

end of FY20

Completed sale of PMall

as part of strategic review

of assetsView entire presentation