J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

CREDIT-RELATED INFORMATION, CONTINUED

(in millions, except ratio data)

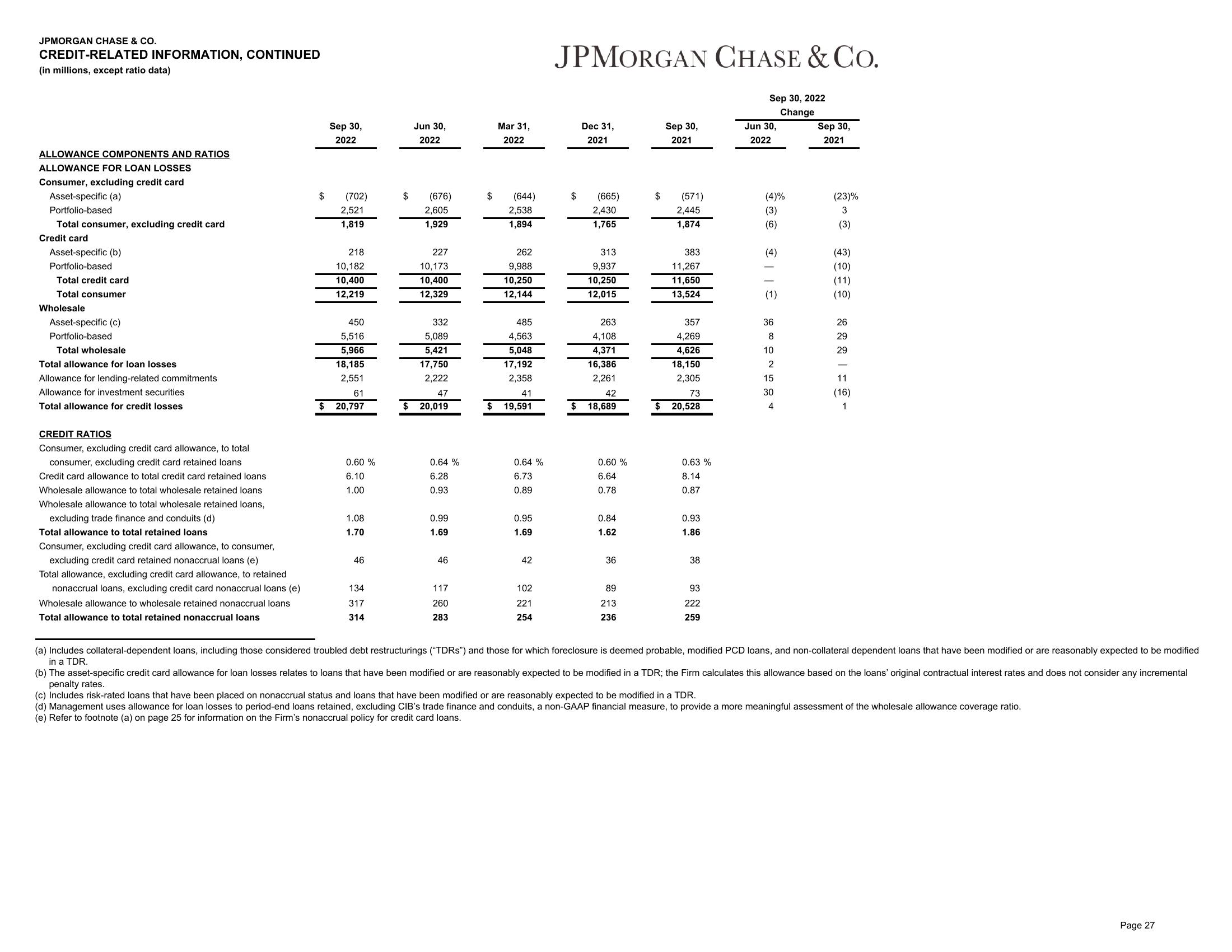

ALLOWANCE COMPONENTS AND RATIOS

ALLOWANCE FOR LOAN LOSSES

Consumer, excluding credit card

Asset-specific (a)

Portfolio-based

Total consumer, excluding credit card

Credit card

Asset-specific (b)

Portfolio-based

Total credit card

Total consumer

Wholesale

Asset-specific (c)

Portfolio-based

Total wholesale

Total allowance for loan losses

Allowance for lending-related commitments

Allowance for investment securities

Total allowance for credit losses

CREDIT RATIOS

Consumer, excluding credit card allowance, to total

consumer, excluding credit card retained loans

Credit card allowance to total credit card retained loans

Wholesale allowance to total wholesale retained loans

Wholesale allowance to total wholesale retained loans,

excluding trade finance and conduits (d)

Total allowance to total retained loans

Consumer, excluding credit card allowance, to consumer,

excluding credit card retained nonaccrual loans (e)

Total allowance, excluding credit card allowance, to retained

nonaccrual loans, excluding credit card nonaccrual loans (e)

Wholesale allowance to wholesale retained nonaccrual loans

Total allowance to total retained nonaccrual loans

$

Sep 30,

2022

(702)

2,521

1,819

218

10,182

10,400

12,219

450

5,516

5,966

18,185

2,551

61

20,797

0.60%

6.10

1.00

1.08

1.70

46

134

317

314

Jun 30,

2022

(676)

2,605

1,929

227

10,173

10,400

12,329

332

5,089

5,421

17,750

2,222

47

$ 20,019

0.64 %

6.28

0.93

0.99

1.69

46

117

260

283

$

$

Mar 31,

2022

(644)

2,538

1,894

262

9,988

10,250

12,144

485

4,563

5,048

17,192

2,358

41

19,591

0.64 %

6.73

0.89

0.95

1.69

42

102

221

254

JPMORGAN CHASE & CO.

Sep 30, 2022

Change

$

Dec 31,

2021

(665)

2,430

1,765

313

9,937

10,250

12,015

263

4,108

4,371

16,386

2,261

42

$ 18,689

0.60 %

6.64

0.78

0.84

1.62

36

89

213

236

$

$

Sep 30,

2021

(571)

2,445

1,874

383

11,267

11,650

13,524

357

4,269

4,626

18,150

2,305

73

20,528

0.63 %

8.14

0.87

0.93

1.86

38

93

222

259

Jun 30,

2022

(4)%

(3)

(6)

(4)

(1)

36

8

10

2

15

30

4

Sep 30,

2021

(23)%

3

(3)

(43)

(10)

(11)

(10)

26

29

29

11

(16)

1

(a) Includes collateral-dependent loans, including those considered troubled debt restructurings ("TDRs") and those for which foreclosure is deemed probable, modified PCD loans, and non-collateral dependent loans that have been modified or are reasonably expected to be modified

in a TDR.

(b) The asset-specific credit card allowance for loan losses relates to loans that have been modified or are reasonably expected to be modified in a TDR; the Firm calculates this allowance based on the loans' original contractual interest rates and does not consider any incremental

penalty rates.

(c) Includes risk-rated loans that have been placed on nonaccrual status and loans that have been modified or are reasonably expected to be modified in a TDR.

(d) Management uses allowance for loan losses to period-end loans retained, excluding CIB's trade finance and conduits, a non-GAAP financial measure, to provide a more meaningful assessment of the wholesale allowance coverage ratio.

(e) Refer to footnote (a) on page 25 for information on the Firm's nonaccrual policy for credit card loans.

Page 27View entire presentation