UBS Results Presentation Deck

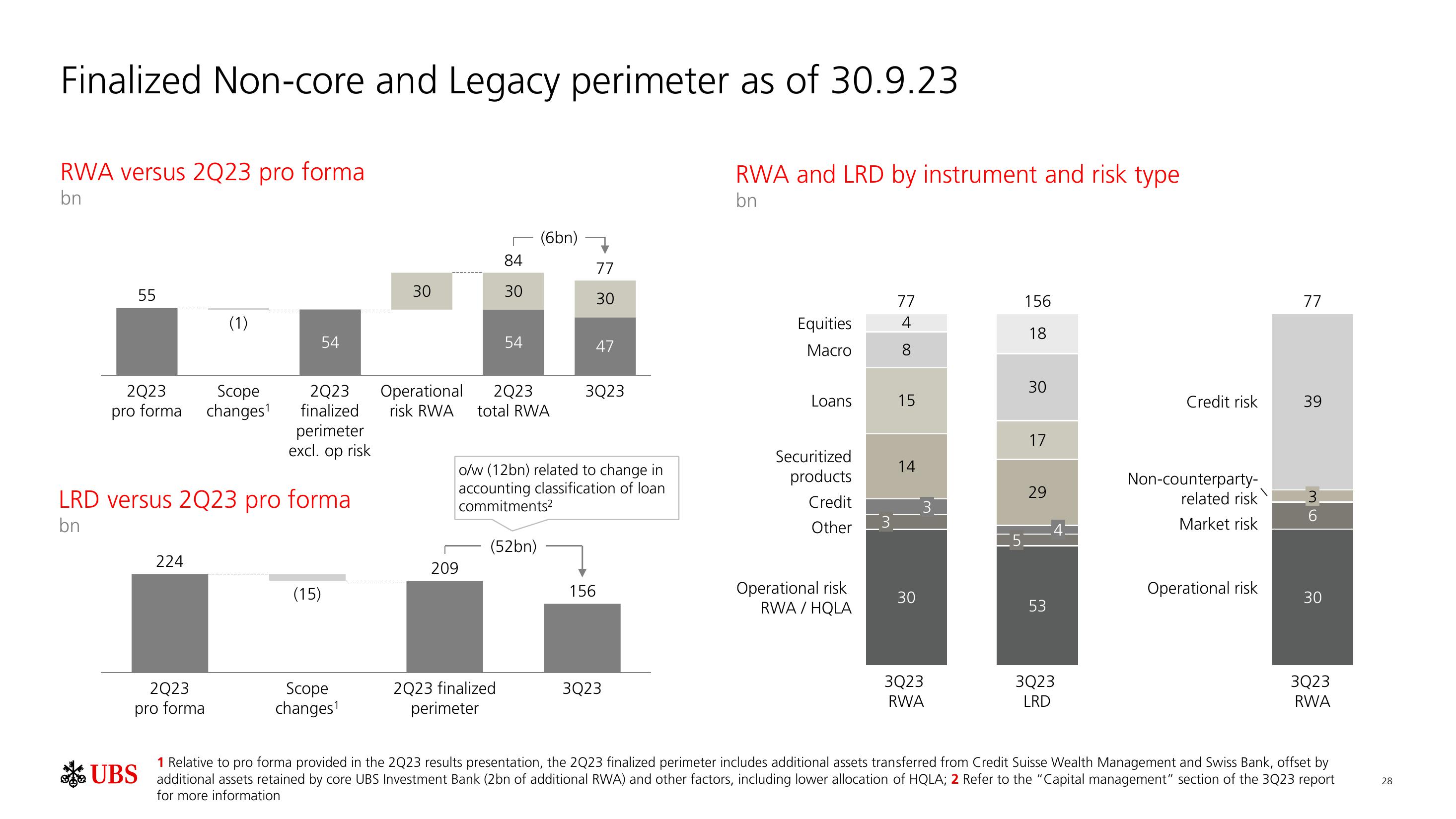

Finalized Non-core and Legacy perimeter as of 30.9.23

RWA versus 2Q23 pro formal

bn

55

2Q23

pro forma

224

(1)

2Q23

pro forma

Scope

changes¹

54

LRD versus 2Q23 pro formal

bn

2Q23 Operational

finalized

risk RWA

perimeter

excl. op risk

(15)

30

Scope

changes¹

209

84

30

54

2Q23 finalized

perimeter

(6bn)

2Q23

total RWA

77

30

47

o/w (12bn) related to change in

accounting classification of loan

commitments²

(52bn)

3Q23

156

3Q23

RWA and LRD by instrument and risk type

bn

Equities

Macro

Loans

Securitized

products

Credit

Other

Operational risk

RWA/HQLA

3

77

4

15

14

30

3Q23

RWA

5

156

18

30

17

29

53

4

3Q23

LRD

Credit risk

Non-counterparty-

related risk

Market risk

Operational risk

77

39

6

30

3Q23

RWA

1 Relative to pro forma provided in the 2Q23 results presentation, the 2Q23 finalized perimeter includes additional assets transferred from Credit Suisse Wealth Management and Swiss Bank, offset by

UBS additional assets retained by core UBS Investment Bank (2bn of additional RWA) and other factors, including lower allocation of HQLA; 2 Refer to the "Capital management" section of the 3Q23 report

for more information

28View entire presentation