Evercore Investment Banking Pitch Book

Valuation Perpectives

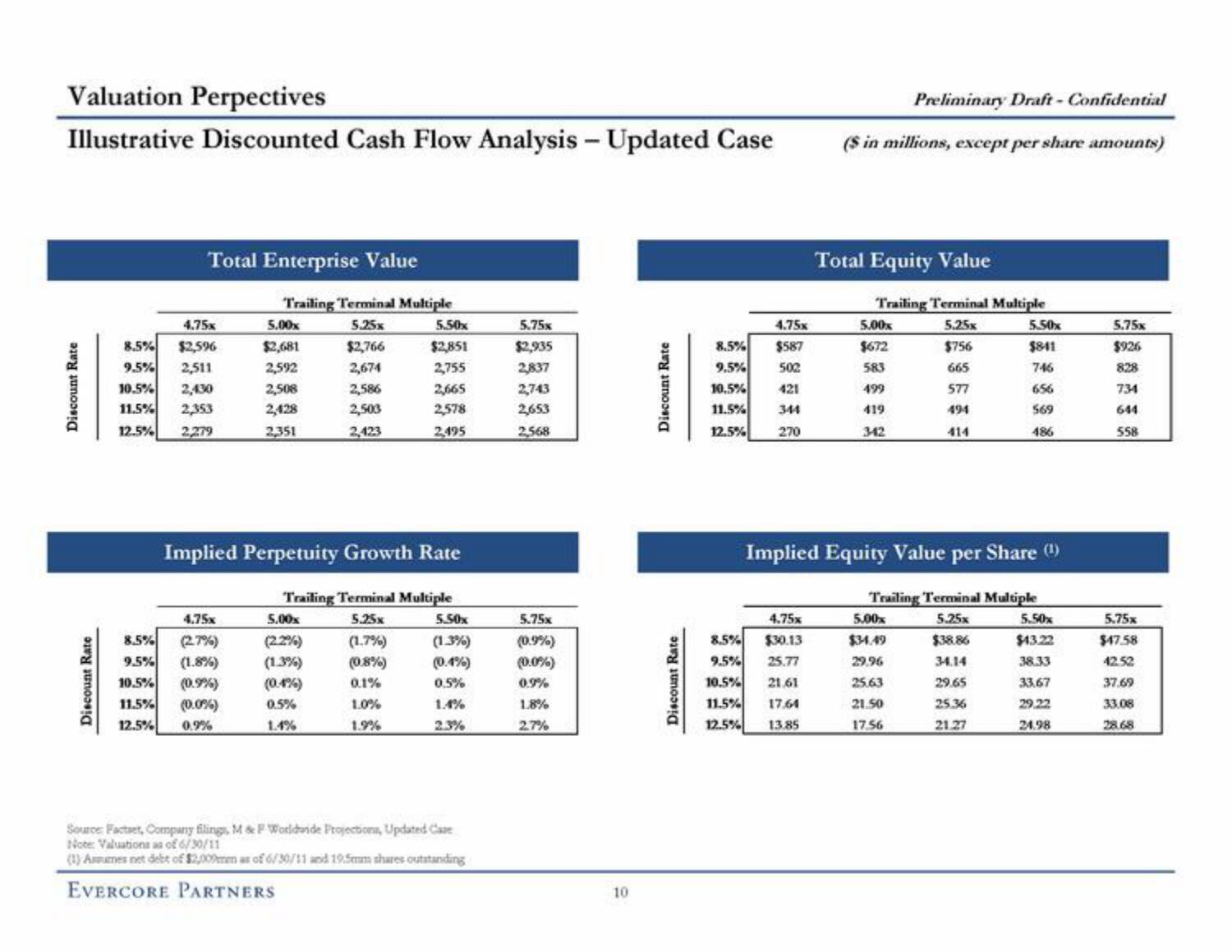

Illustrative Discounted Cash Flow Analysis - Updated Case

Discount Rate

Discount Rate

Total Enterprise Value

4.75x

8.5% $2,596

9.5% 2,511

10.5% 2,430

11.5% 2,353

12.5% 2,279

Trailing Terminal Multiple

5.25x

$2,766

2,674

2,586

2,503

2,423

4.75x

8.5% (2.7%)

9.5% (1.8%)

10.5%

(0.9%)

11.5%

(0.0%)

12.5% 0.9%

5.00x

$2,681

2,592

2,508

2,428

2,351

Implied Perpetuity Growth Rate

5.50x

$2,851

2,755

5.00x

(2.2%)

(1.3%)

(0.4%)

0.5%

1.4%

2,665

2,578

2,495

Trailing Terminal Multiple

5.25x

(1.7%)

(0.8%)

0.1%

1.0%

1.9%

5.50x

(1.3%)

(0.4%)

0.5%

1.4%

2.3%

Source Factaet, Company filings, M & F Worldwide Projections, Updated Case

Note: Valuations as of 6/30/11

(1) Assumes net debt of $2,000mm as of 6/30/11 and 19.5mm shares outstanding

EVERCORE PARTNERS

5.75%

$2,935

2,837

2,743

2,653

2,568

5.75x

(0.9%)

(0.0%)

0.9%

1.8%

2.7%

10

Discount Rate

Discount Rate

8.5%

9.5%

10.5%

11.5%

12.5%

4.75x

$587

502

421

344

270

Preliminary Draft - Confidential

($ in millions, except per share amounts)

4.75x

8.5%

$30.13

9.5% 25.77

10.5% 21.61

11.5%

17.64

12.5%

13.85

Total Equity Value

Trailing Terminal Multiple

5.25x

$756

665

577

494

414

5.00x

$672

583

499

419

342

Implied Equity Value per Share (¹)

Trailing Terminal Multiple

5.25x

5.00%

29.96

25.63

21.50

17.56

5.50x

$841

746

656

569

486

$38.86

34.14

29.65

25.36

21.27

5.50%

$43.22

38.33

33.67

29.22

24.98

5.75x

$926

828

734

644

558

5.75x

$47.58

42.52

37.69

33.08

28.68View entire presentation