LVMH Results Presentation Deck

Strong financial structure

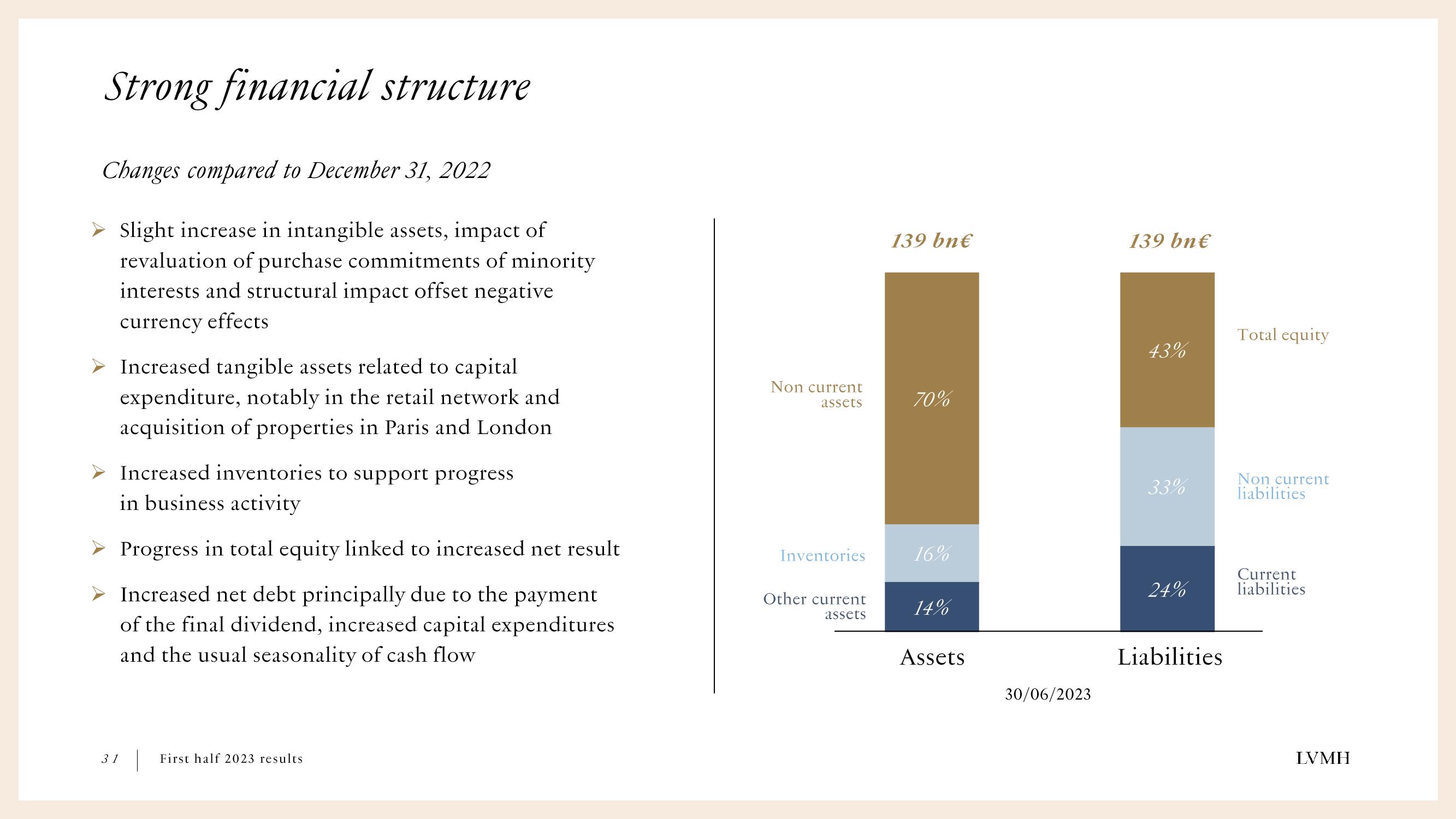

Changes compared to December 31, 2022

➤ Slight increase in intangible assets, impact of

revaluation of purchase commitments of minority

interests and structural impact offset negative

currency effects

Increased tangible assets related to capital

expenditure, notably in the retail network and

acquisition of properties in Paris and London

Increased inventories to support progress

in business activity

➤ Progress in total equity linked to increased net result

Increased net debt principally due to the payment

of the final dividend, increased capital expenditures

and the usual seasonality of cash flow

31 First half 2023 results

Non current

assets

Inventories

Other current

assets

139 bn€

70%

16%

14%

Assets

30/06/2023

139 bn€

43%

33%

24%

Liabilities

Total equity

Non current

liabilities

Current

liabilities

LVMHView entire presentation