Credit Suisse Investment Banking Pitch Book

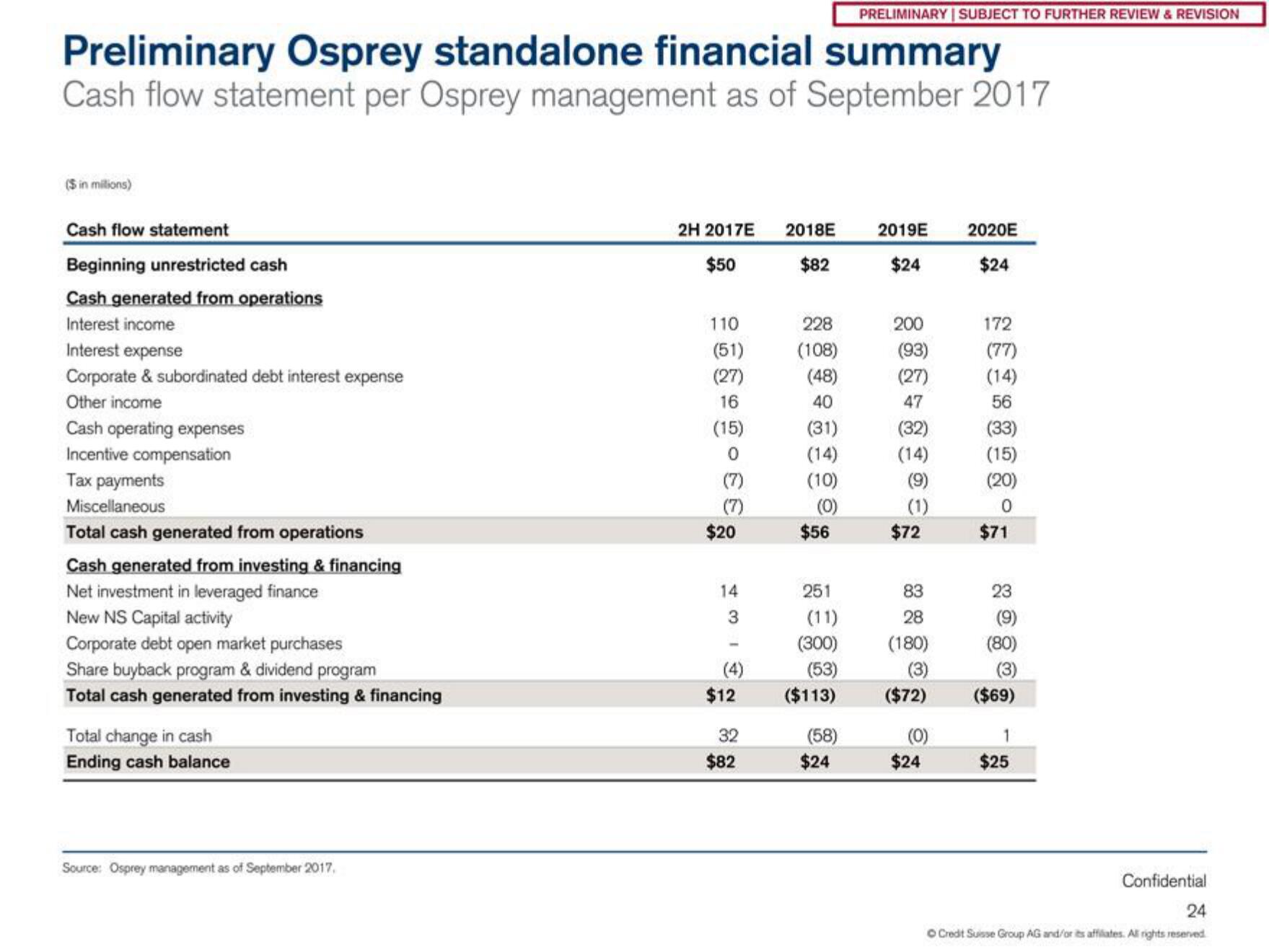

Preliminary Osprey standalone financial summary

Cash flow statement per Osprey management as of September 2017

($ in milions)

Cash flow statement

Beginning unrestricted cash

Cash generated from operations

Interest income

Interest expense

Corporate & subordinated debt interest expense

Other income

Cash operating expenses

Incentive compensation

Tax payments

Miscellaneous

Total cash generated from operations

Cash generated from investing & financing

Net investment in leveraged finance

New NS Capital activity

Corporate debt open market purchases

Share buyback program & dividend program

Total cash generated from investing & financing

Total change in cash

Ending cash balance

Source: Osprey management as of September 2017.

2H 2017E

$50

110

(51)

(27)

16

(15)

$20

14

3

(4)

$12

32

$82

2018E

$82

228

(108)

(48)

40

(31)

(14)

(10)

(0)

$56

251

(11)

(300)

(53)

($113)

(58)

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

$24

2019E

$24

200

(93)

(27)

47

(32)

(14)

(9)

(1)

$72

83

28

(180)

(3)

($72)

(0)

$24

2020E

$24

172

(77)

(14)

56

(33)

(15)

(20)

0

$71

23

(9)

(80)

($69)

1

$25

Confidential

24

Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation