Apollo Global Management Investor Day Presentation Deck

Providing Originators with Flexible Capital at Favorable Attachment Point

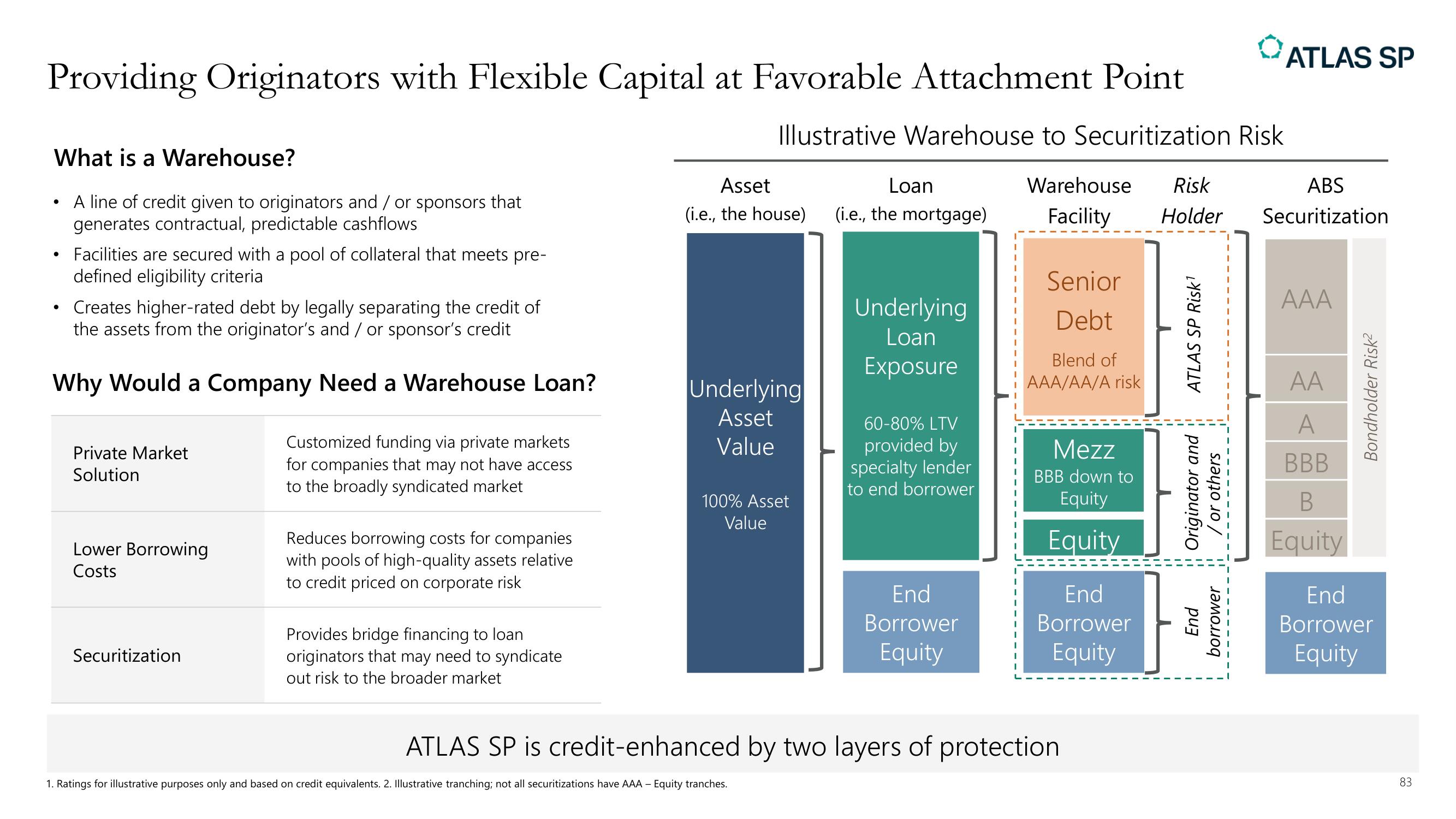

Illustrative Warehouse to Securitization Risk

What is a Warehouse?

A line of credit given to originators and / or sponsors that

generates contractual, predictable cashflows

●

Facilities are secured with a pool of collateral that meets pre-

defined eligibility criteria

●

Creates higher-rated debt by legally separating the credit of

the assets from the originator's and/or sponsor's credit

Why Would a Company Need a Warehouse Loan?

Private Market

Solution

Lower Borrowing

Costs

Securitization

Customized funding via private markets

for companies that may not have access

to the broadly syndicated market

Reduces borrowing costs for companies

with pools of high-quality assets relative

to credit priced on corporate risk

Provides bridge financing to loan

originators that may need to syndicate

out risk to the broader market

Asset

(i.e., the house)

Underlying

Asset

Value

100% Asset

Value

Loan

(i.e., the mortgage)

1. Ratings for illustrative purposes only and based on credit equivalents. 2. Illustrative tranching; not all securitizations have AAA - Equity tranches.

Underlying

Loan

Exposure

60-80% LTV

provided by

specialty lender

to end borrower

End

Borrower

Equity

Warehouse Risk

Facility Holder

Senior

Debt

Blend of

AAA/AA/A risk

Mezz

BBB down to

Equity

Equity

End

Borrower

Equity

ATLAS SP is credit-enhanced by two layers of protection

ATLAS SP Risk¹

Originator and

/or others

End

borrower

ATLAS SP

ABS

Securitization

AAA

AA

A

BBB

B

Equity

Bondholder Risk²

End

Borrower

Equity

83View entire presentation