Lyft Results Presentation Deck

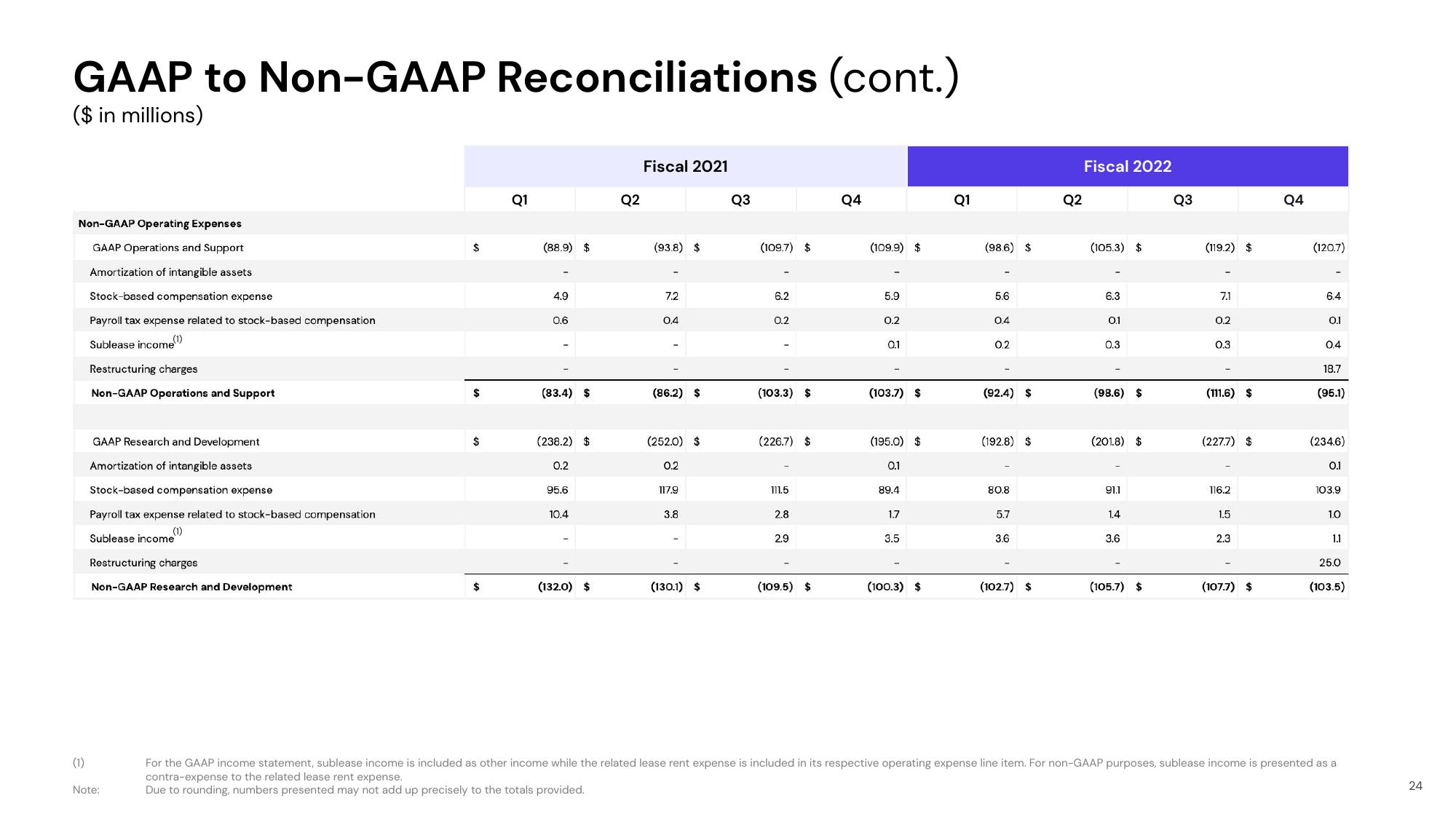

GAAP to Non-GAAP Reconciliations (cont.)

($ in millions)

Non-GAAP Operating Expenses

GAAP Operations and Support

Amortization of intangible assets

Stock-based compensation expense

(1)

Payroll tax expense related to stock-based compensation

Sublease income (¹)

Restructuring charges

Non-GAAP Operations and Support

GAAP Research and Development

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

(1)

Sublease income

Restructuring charges

Non-GAAP Research and Development

Note:

$

$

$

Q1

(88.9) $

4.9

0.6

(83.4) $

(238.2) $

0.2

95.6

10.4

(132.0) $

Q2

Fiscal 2021

(93.8) $

7.2

0.4

(86.2) $

(252.0) $

0.2

117.9

3.8

(130.1) $

Q3

(109.7) $

6.2

0.2

(103.3) $

(226.7) $

111.5

2.8

2.9

(109.5) $

Q4

(109.9) $

5.9

0.2

0.1

(103.7) $

(195.0) $

0.1

89.4

1.7

3.5

(100.3) $

Q1

(98.6) $

5.6

0.4

0.2

(92.4) $

(192.8) $

80.8

5.7

3.6

(102.7) $

Q2

Fiscal 2022

(105.3) $

6.3

0.1

0.3

(98.6) $

(201.8) $

91.1

1.4

3.6

(105.7) $

Q3

(119.2) $

7.1

0.2

0.3

(111.6) $

(227.7) $

116.2

1.5

2.3

(107.7) $

Q4

(120.7)

6.4

0.1

0.4

18.7

(95.1)

(234.6)

0.1

103.9

1.0

1.1

25.0

(103.5)

For the GAAP income statement, sublease income is included as other income while the related lease rent expense is included in its respective operating expense line item. For non-GAAP purposes, sublease income is presented as a

contra-expense to the related lease rent expense.

Due to rounding, numbers presented may not add up precisely to the totals provided.

24View entire presentation