jetBlue Results Presentation Deck

Keeping Costs Low to Drive Long-Term Earnings Generation

jetBlue

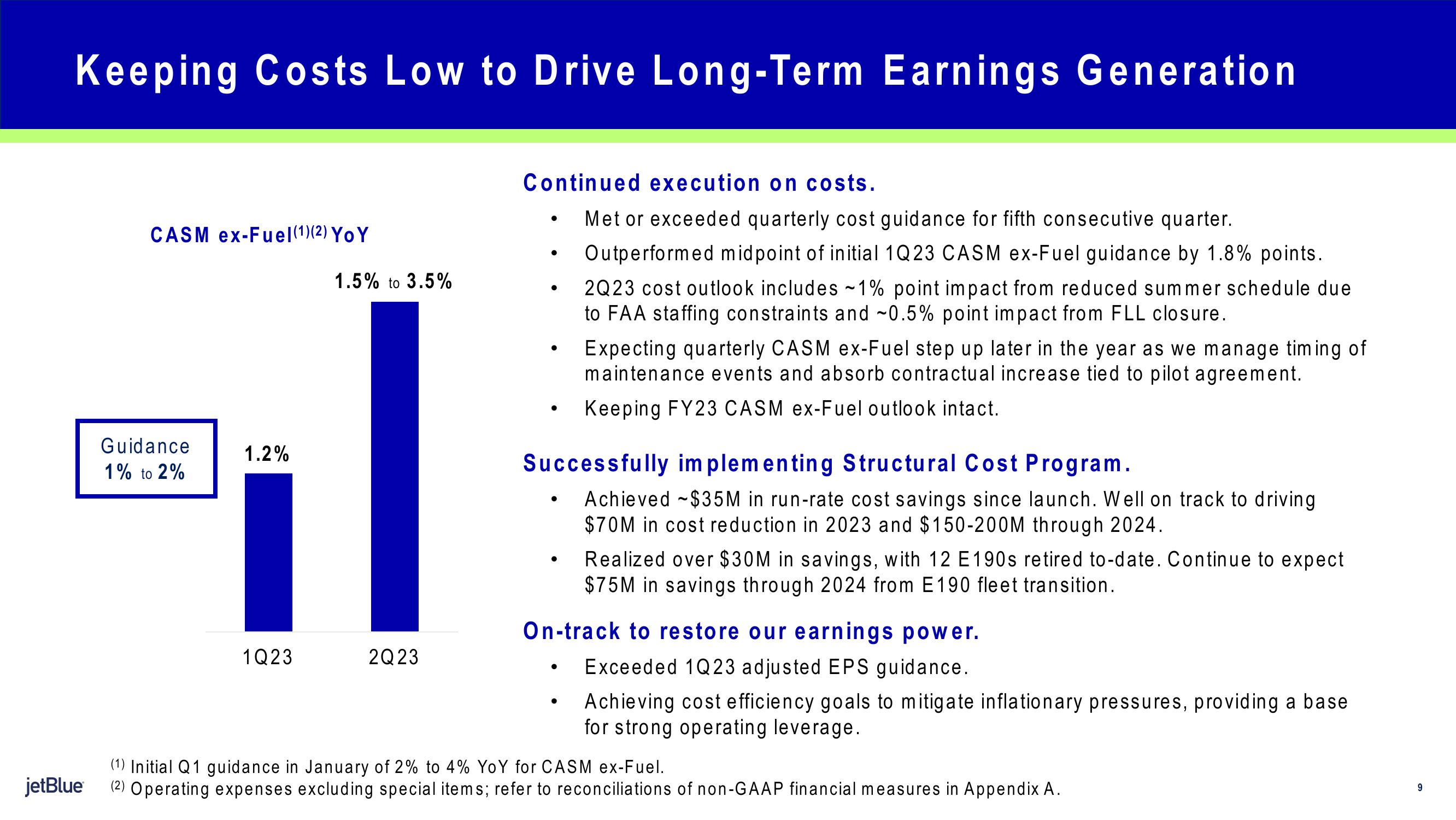

CASM ex-Fuel (1)(2) YoY

Guidance

1% to 2%

1.2%

1Q23

1.5% to 3.5%

2Q23

Continued execution on costs.

Met or exceeded quarterly cost guidance for fifth consecutive quarter.

Outperformed midpoint of initial 1Q23 CASM ex-Fuel guidance by 1.8% points.

●

●

●

●

●

●

Successfully implementing Structural Cost Program.

Achieved $35M in run-rate cost savings since launch. Well on track to driving

$70M in cost reduction in 2023 and $150-200M through 2024.

●

2Q23 cost outlook includes ~1% point impact from reduced summer schedule due

to FAA staffing constraints and ~0.5% point impact from FLL closure.

Expecting quarterly CASM ex-Fuel step up later in the year as we manage timing of

maintenance events and absorb contractual increase tied to pilot agreement.

Keeping FY23 CASM ex-Fuel outlook intact.

●

Realized over $30M in savings, with 12 E190s retired to-date. Continue to expect

$75M in savings through 2024 from E190 fleet transition.

On-track to restore our earnings power.

Exceeded 1Q23 adjusted EPS guidance.

Achieving cost efficiency goals to mitigate inflationary pressures, providing a base

for strong operating leverage.

(1) Initial Q1 guidance in January of 2% to 4% YoY for CASM ex-Fuel.

(2) Operating expenses excluding special items; refer to reconciliations of non-GAAP financial measures in Appendix A.

9View entire presentation