Bank of America Investment Banking Pitch Book

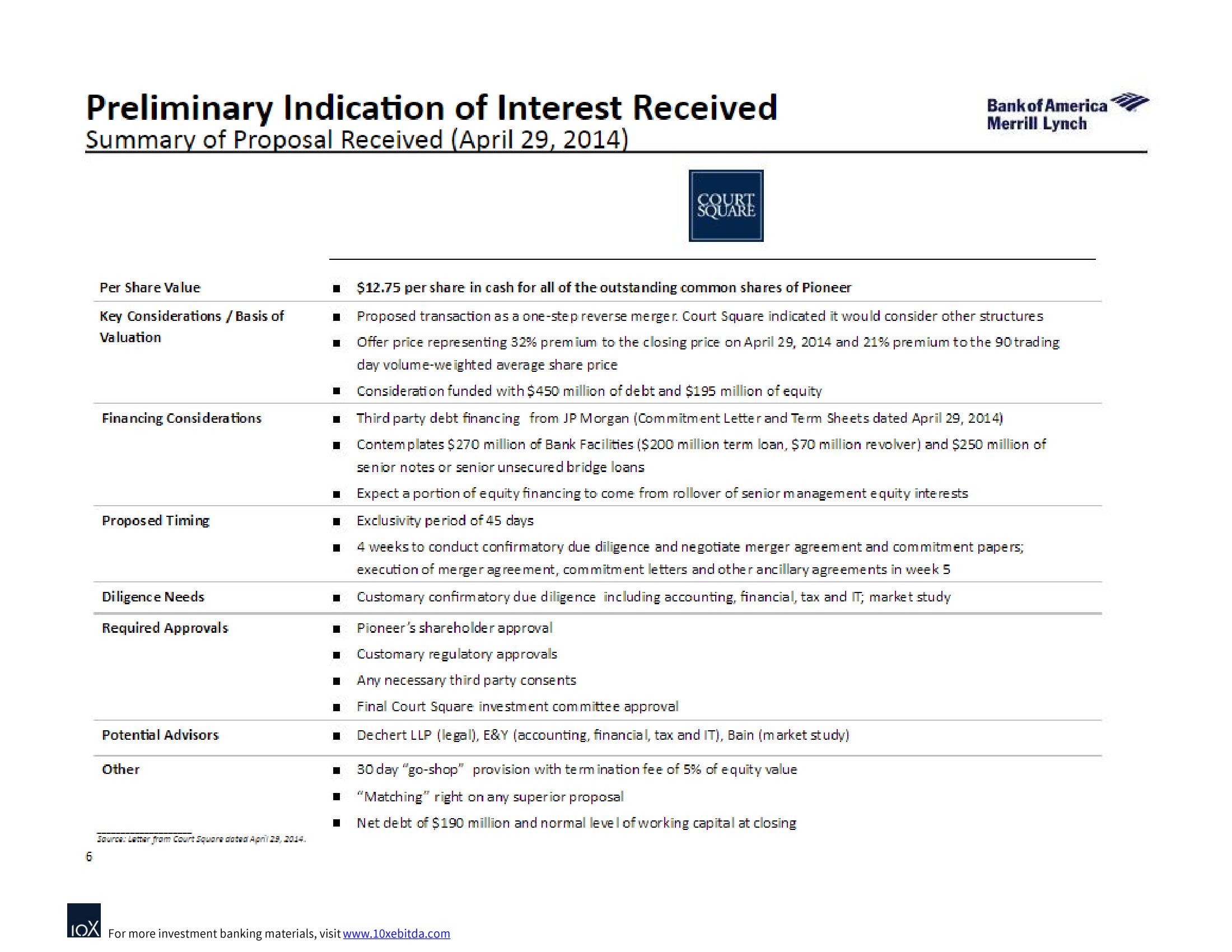

Preliminary Indication of Interest Received

Summary of Proposal Received (April 29, 2014)

6

Per Share Value

Key Considerations / Basis of

Valuation

Financing Considerations

Proposed Timing

Diligence Needs

Required Approvals

Potential Advisors

Other

Source: Latter from Court Square dated April 29, 2014.

■

■ $12.75 per share in cash for all of the outstanding common shares of Pioneer

■ Proposed transaction as a one-step reverse merger. Court Square indicated it would consider other structures

Offer price representing 32% premium to the closing price on April 29, 2014 and 21% premium to the 90 trading

day volume-weighted average share price

1 Consideration funded with $450 million of debt and $195 million of equity

I

■ Third party debt financing from JP Morgan (Commitment Letter and Term Sheets dated April 29, 2014)

Contemplates $270 million of Bank Facilities ($200 million term loan, $70 million revolver) and $250 million of

senior notes or senior unsecured bridge loans

■ Expect a portion of equity financing to come from rollover of senior management e quity interests

Exclusivity period of 45 days

4 weeks to conduct confirmatory due diligence and negotiate merger agreement and commitment papers;

execution of merger agreement, commitment letters and other ancillary agreements in week 5

Customary confirmatory due diligence including accounting, financial, tax and IT; market study

1 Pioneer's shareholder approval

7 Customary regulatory approvals

Any necessary third party consents

Final Court Square investment committee approval

1 Dechert LLP (legal), E&Y (accounting, financial, tax and IT), Bain (market study)

L

COURT

7

Bank of America

Merrill Lynch

30 day "go-shop" provision with termination fee of 5% of equity value

"Matching" right on any superior proposal

Net debt of $190 million and normal level of working capital at closing

LOX For more investment banking materials, visit www.10xebitda.comView entire presentation