Apollo Global Management Mergers and Acquisitions Presentation Deck

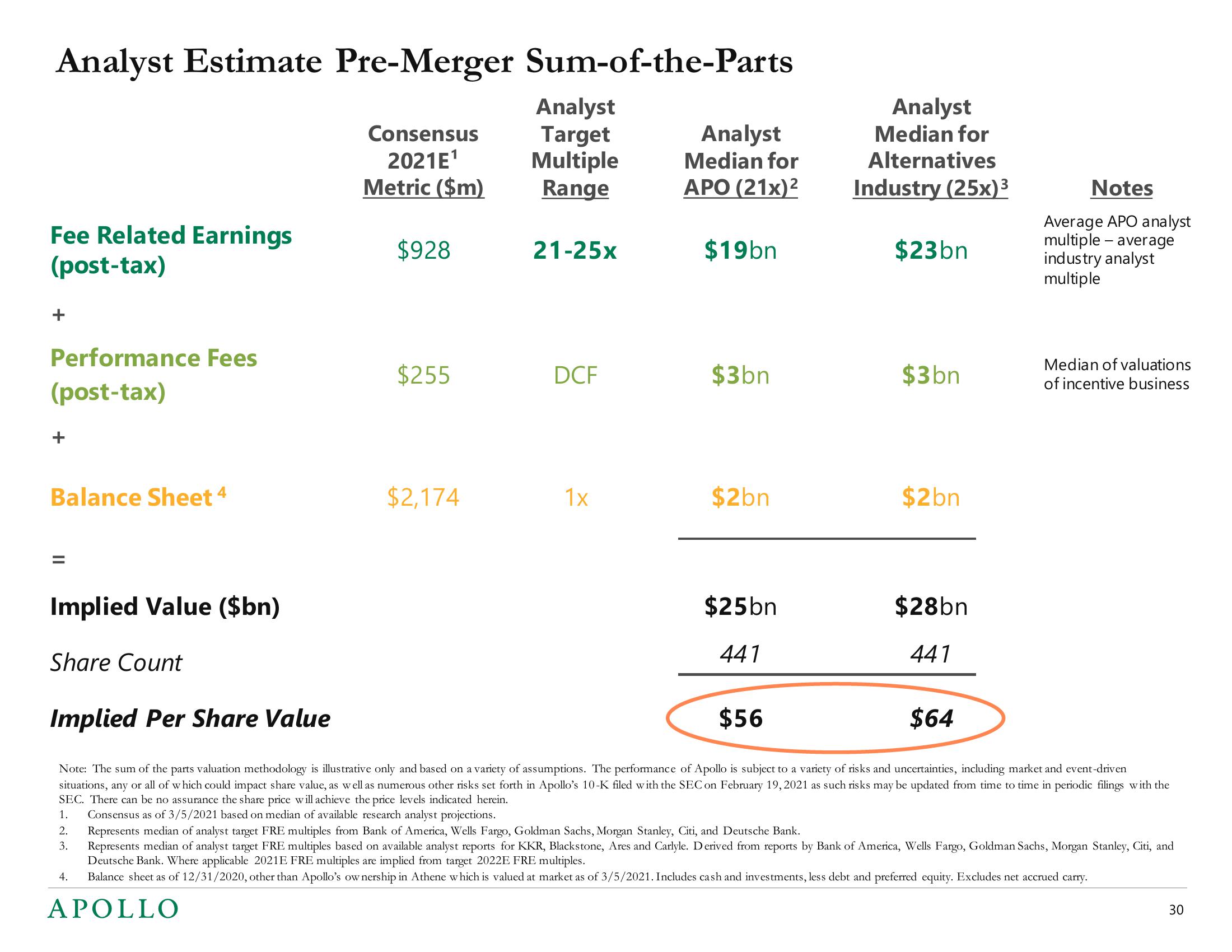

Analyst Estimate Pre-Merger Sum-of-the-Parts

Consensus

2021E¹

Metric ($m)

Fee Related Earnings

(post-tax)

+

Performance Fees

(post-tax)

Balance Sheet 4

=

Implied Value ($bn)

Share Count

$928

$255

4.

$2,174

Analyst

Target

Multiple

Range

21-25x

DCF

1x

Analyst

Median for

APO (21x)²

$19bn

$3bn

$2bn

$25bn

441

Analyst

Median for

Alternatives

Industry (25x)³

$23bn

$3bn

$2bn

$28bn

441

Notes

Average APO analyst

multiple - average

industry analyst

multiple

Median of valuations

of incentive business

Implied Per Share Value

$56

$64

Note: The sum of the parts valuation methodology is illustrative only and based on a variety of assumptions. The performance of Apollo is subject to a variety of risks and uncertainties, including market and event-driven

situations, any or all of which could impact share value, as well as numerous other risks set forth in Apollo's 10-K filed with the SEC on February 19, 2021 as such risks may be updated from time to time in periodic filings with the

SEC. There can be no assurance the share price will achieve the price levels indicated herein.

1. Consensus as of 3/5/2021 based on median of available research analyst projections.

2. Represents median of analyst target FRE multiples from Bank of America, Wells Fargo, Goldman Sachs, Morgan Stanley, Citi, and Deutsche Bank.

3. Represents median of analyst target FRE multiples based on available analyst reports for KKR, Blackstone, Ares and Carlyle. Derived from reports by Bank of America, Wells Fargo, Goldman Sachs, Morgan Stanley, Citi, and

Deutsche Bank. Where applicable 2021E FRE multiples are implied from target 2022E FRE multiples.

Balance sheet as of 12/31/2020, other than Apollo's ownership in Athene which is valued at market as of 3/5/2021. Includes cash and investments, less debt and preferred equity. Excludes net accrued carry.

APOLLO

30View entire presentation