Tudor, Pickering, Holt & Co Investment Banking

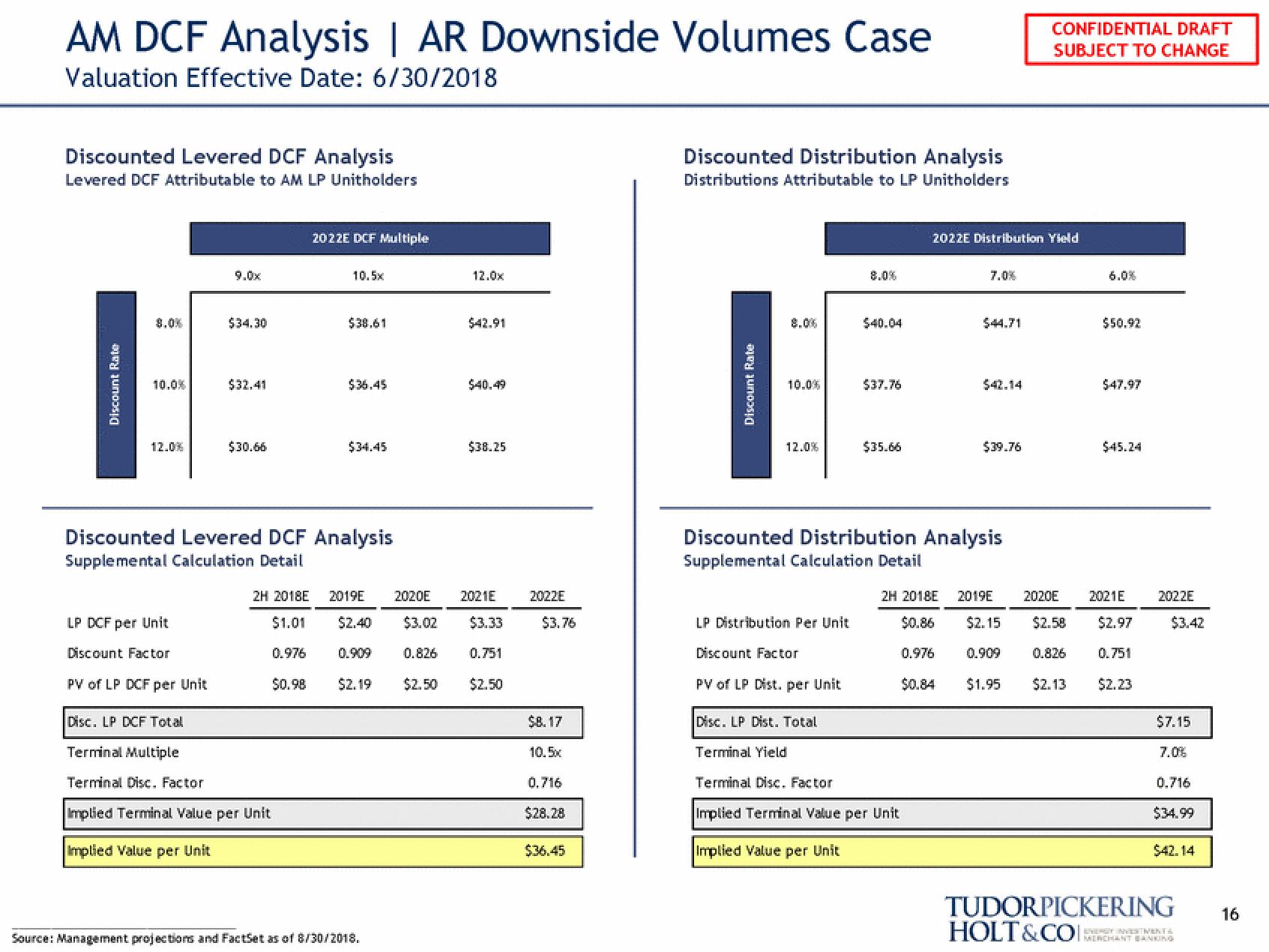

AM DCF Analysis | AR Downside Volumes Case

Valuation Effective Date: 6/30/2018

Discounted Levered DCF Analysis

Levered DCF Attributable to AM LP Unitholders

Discount Rate

10.0%

12.0%

9.0x

LP DCF per Unit

Discount Factor

PV of LP DCF per Unit

$34.30

$32.41

$30.66

2H 2018E

$1.01

0.976

$0.98

2022E DCF Multiple

Disc. LP DCF Total

Terminal Multiple

Terminal Disc. Factor

Implied Terminal Value per Unit

Implied Value per Unit

10.5x

$38.61

Discounted Levered DCF Analysis

Supplemental Calculation Detail

$36.45

$34.45

2019E

$2.40 $3.02

0.826

$2.50

$2.19

Source: Management projections and FactSet as of 8/30/2018.

12.0x

$42.91

$40.49

$38.25

2020E 2021E

$3.33

0.751

$2.50

2022E

$3.76

$8.17

10.5

0.716

$28.28

$36.45

Discounted Distribution Analysis

Distributions Attributable to LP Unitholders

Discount Rate

8.0%

10.0%

12.0%

LP Distribution Per Unit

8.0%

Discount Factor

PV of LP Dist. per Unit

$40.04

$37.76

$35.66

2022E Distribution Yield

7.0%

Disc. LP Dist. Total

Terminal Yield

Terminal Disc. Factor

Implied Terminal Value per Unit

Implied Value per Unit

$44.71

Discounted Distribution Analysis

Supplemental Calculation Detail

$42.14

$39.76

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

6.0%

$50.92

$47.97

$45.24

2021E

2H 2018E 2019E 2020E

$0.86 $2.15 $2.58 $2.97

0.976 0.909 0.826

$0.84 $1.95 $2.13

0.751

$2.23

2022E

$3.42

$7.15

7.0%

0.716

$34.99

$42.14

TUDORPICKERING

HOLT&COI:

EYERGY NYESTMENTS

MERCHANT BANKING

16View entire presentation