Hanmi Financial Results Presentation Deck

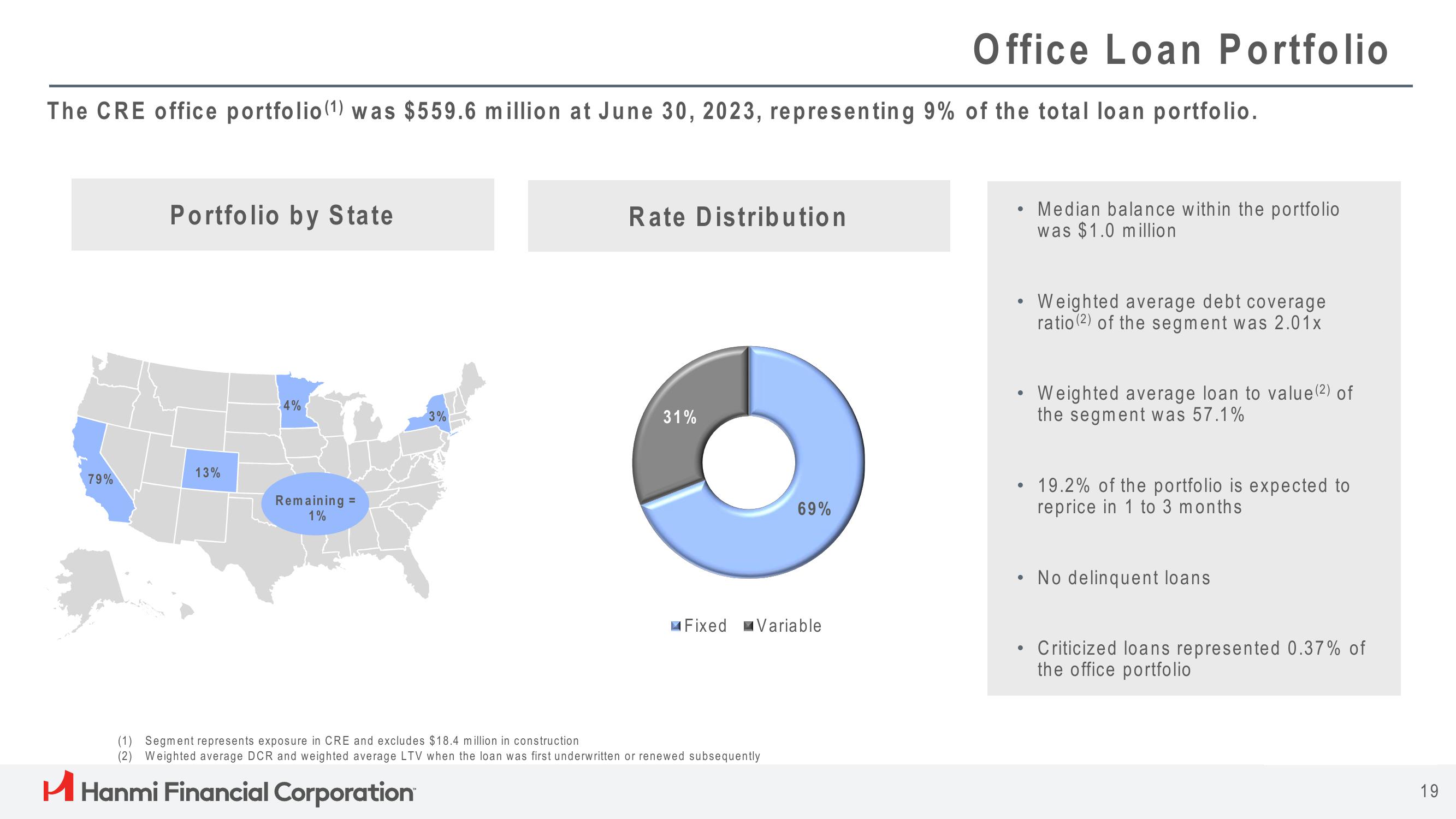

The CRE office portfolio (¹) was $559.6 million at June 30, 2023, representing 9% of the total loan portfolio.

79%

Portfolio by State

13%

4%

Remaining =

1%

3%

H Hanmi Financial Corporation

Rate Distribution

31%

(1) Segment represents exposure in CRE and excludes $18.4 million in construction

(2) Weighted average DCR and weighted average LTV when the loan was first underwritten or renewed subsequently

69%

Fixed Variable

Office Loan Portfolio

●

●

●

●

Median balance within the portfolio

was $1.0 million

●

Weighted average debt coverage

ratio (2) of the segment was 2.01x

• 19.2% of the portfolio is expected to

reprice in 1 to 3 months

Weighted average loan to value (2) of

the segment was 57.1%

No delinquent loans

Criticized loans represented 0.37% of

the office portfolio

19View entire presentation