Baird Investment Banking Pitch Book

ANTERO FAMILY STRUCTURAL ISSUES (CONT.)

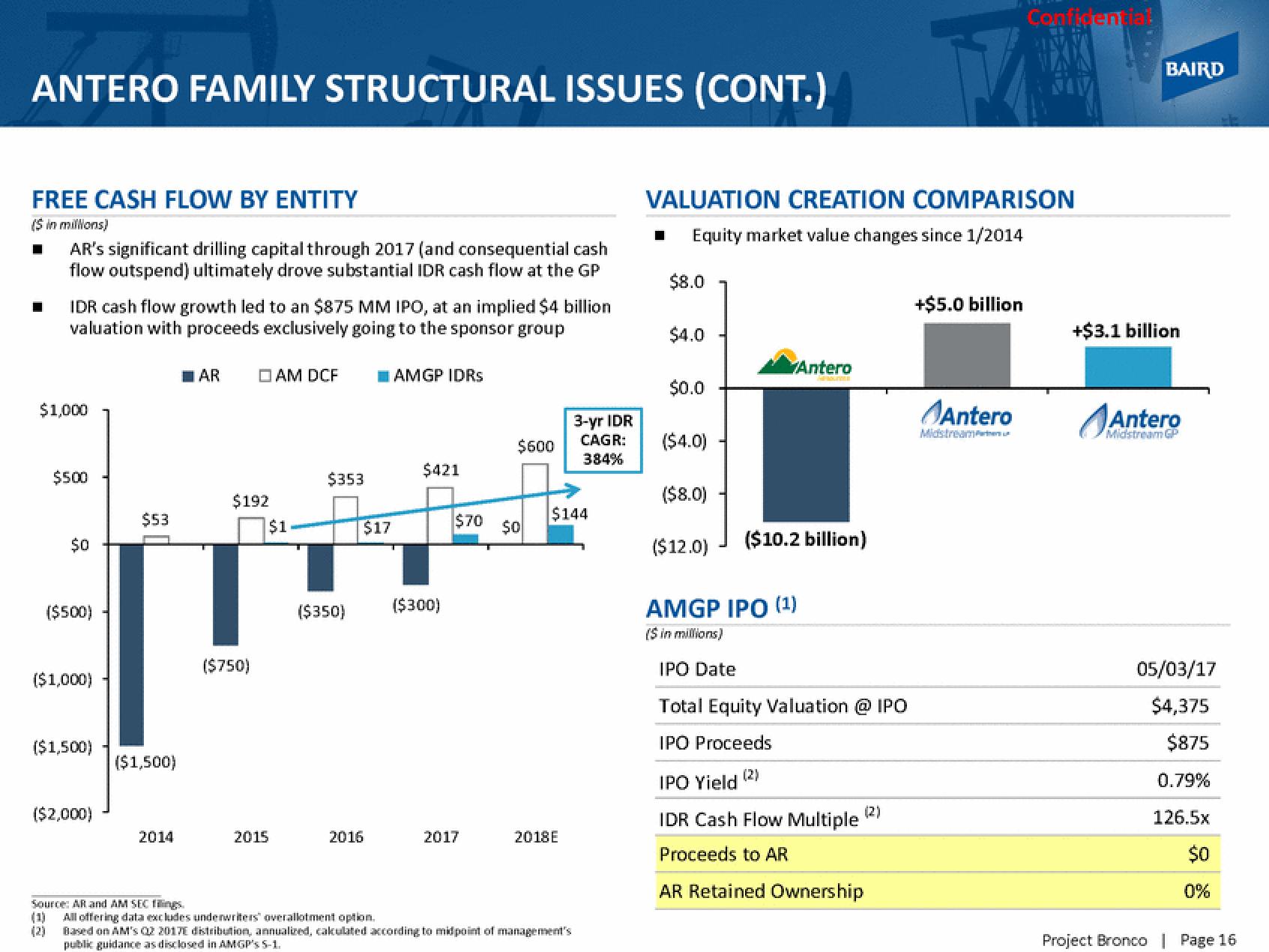

FREE CASH FLOW BY ENTITY

(5 in millions)

■ AR's significant drilling capital through 2017 (and consequential cash

flow outspend) ultimately drove substantial IDR cash flow at the GP

IDR cash flow growth led to an $875 MM IPO, at an implied $4 billion

valuation with proceeds exclusively going to the sponsor group

$1,000

$500

$0

($500)

($1,000)

($1,500)

($2,000)

$53

($1,500)

2014

AR □AM DCF

$192

($750)

$1

2015

$353

($350)

$17

2016

Source: AR and AM SEC filings

(1) All offering data excludes underwriters" overallotment option.

AMGP IDRs

$421

($300)

$600

$70 $0

2017

$144

2018E

3-yr IDR

CAGR:

384%

Based on AM's Q2 2017 distribution, annualized, calculated according to midpoint of management's

public guidance as disclosed in AMGP's S-1.

VALUATION CREATION COMPARISON

Equity market value changes since 1/2014

$8.0

$4.0

$0.0

($4.0)

($8.0)

($12.0)

Antero

MESIME

($10.2 billion)

AMGP IPO (1)

($ in millions)

IPO Date

Total Equity Valuation @ IPO

IPO Proceeds

IPO Yield

IDR Cash Flow Multiple

Proceeds to AR

AR Retained Ownership

(2)

+$5.0 billion

Antero

Confidentia!

Midstreamen

BAIRD

+$3.1 billion

S Antero

Midstream GP

05/03/17

$4,375

$875

0.79%

126.5x

$0

0%

Project Bronco | Page 16View entire presentation