SoftBank Results Presentation Deck

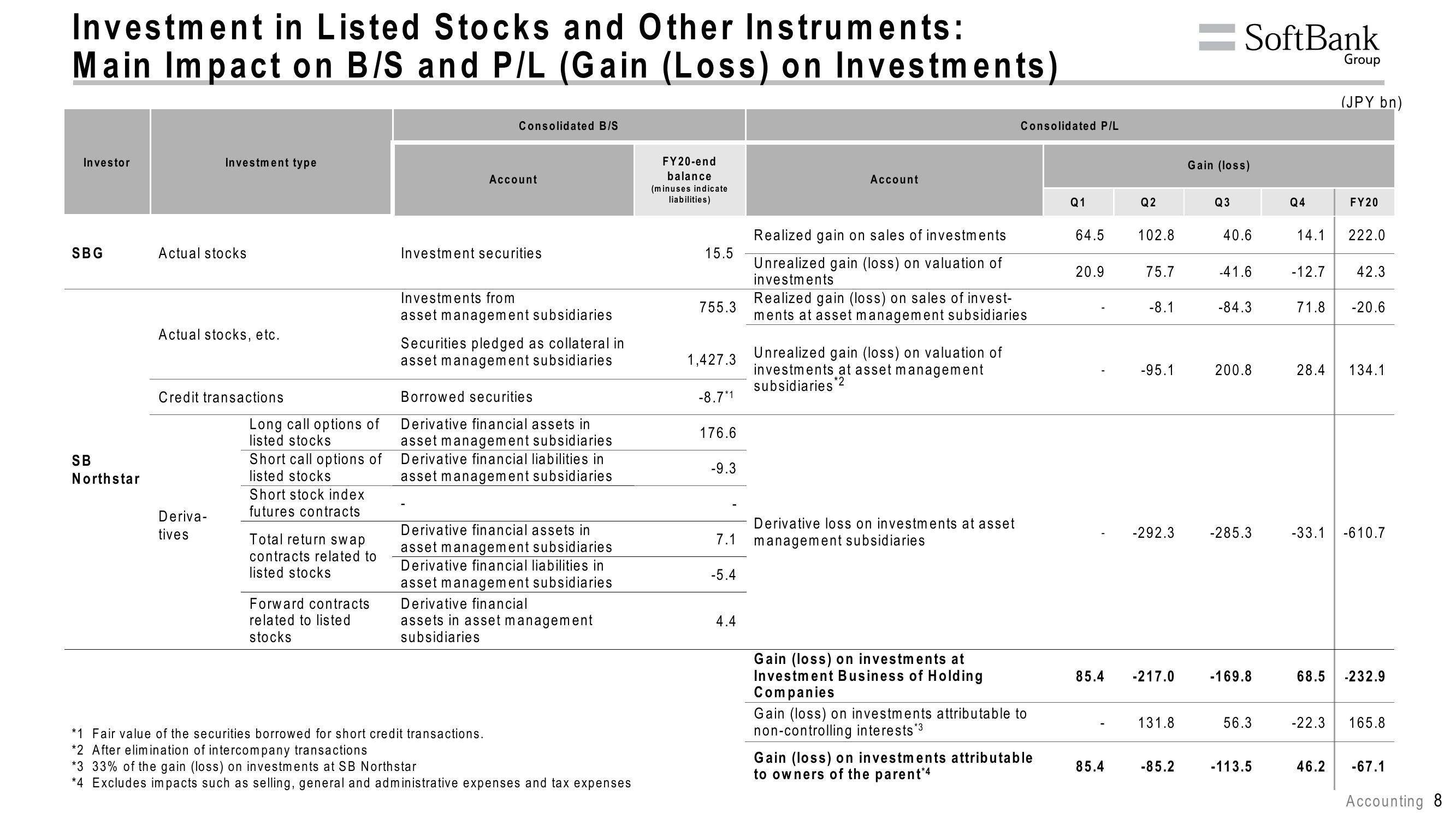

Investment in Listed Stocks and Other Instruments:

Main Impact on B/S and P/L (Gain (Loss) on Investments)

Investor

SBG

SB

Northstar

Investment type

Actual stocks

Actual stocks, etc.

Credit transactions

Deriva-

tives

Long call options of

listed stocks

Short call options of

listed stocks

Short stock index

futures contracts

Total return swap

contracts related to

listed stocks

Forward contracts

related to listed

stocks

Consolidated B/S

Account

Investment securities

Investments from

asset management subsidiaries

Securities pledged as collateral in

asset management subsidiaries

Borrowed securities

Derivative financial assets in

asset management subsidiaries

Derivative financial liabilities in

asset management subsidiaries

Derivative financial assets in

asset management subsidiaries

Derivative financial liabilities in

asset management subsidiaries

Derivative financial

assets in asset management

subsidiaries

*1 Fair value of the securities borrowed for short credit transactions.

*2 After elimination of intercompany transactions

*3 33% of the gain (loss) on investments at SB Northstar

*4 Excludes impacts such as selling, general and administrative expenses and tax expenses

FY20-end

balance

(minuses indicate

liabilities)

15.5

755.3

1,427.3

-8.7*1

176.6

-9.3

7.1

-5.4

4.4

Account

Realized gain on sales of investments

Unrealized gain (loss) on valuation of

investments

Realized gain (loss) on sales of invest-

ments at asset management subsidiaries

Unrealized gain (loss) on valuation of

investments at asset management

subsidiaries *2

Derivative loss on investments at asset

management subsidiaries

Consolidated P/L

Gain (loss) on investments at

Investment Business of Holding

Companies

Gain (loss) on investments attributable to

non-controlling interests*³

Gain (loss) on investments attributable

to owners of the parent*4

Q1

64.5

20.9

85.4

85.4

Q2

102.8

75.7

-8.1

-95.1

-292.3

-217.0

131.8

-85.2

SoftBank

Gain (loss)

Q3

40.6

-41.6

-84.3

200.8

-285.3

-169.8

56.3

-113.5

Q4

14.1

Group

28.4

(JPY bn)

FY20

-12.7 42.3

222.0

71.8 -20.6

46.2

134.1

-33.1 -610.7

68.5 -232.9

-22.3 165.8

-67.1

Accounting 8View entire presentation