Evercore Investment Banking Pitch Book

Appendix

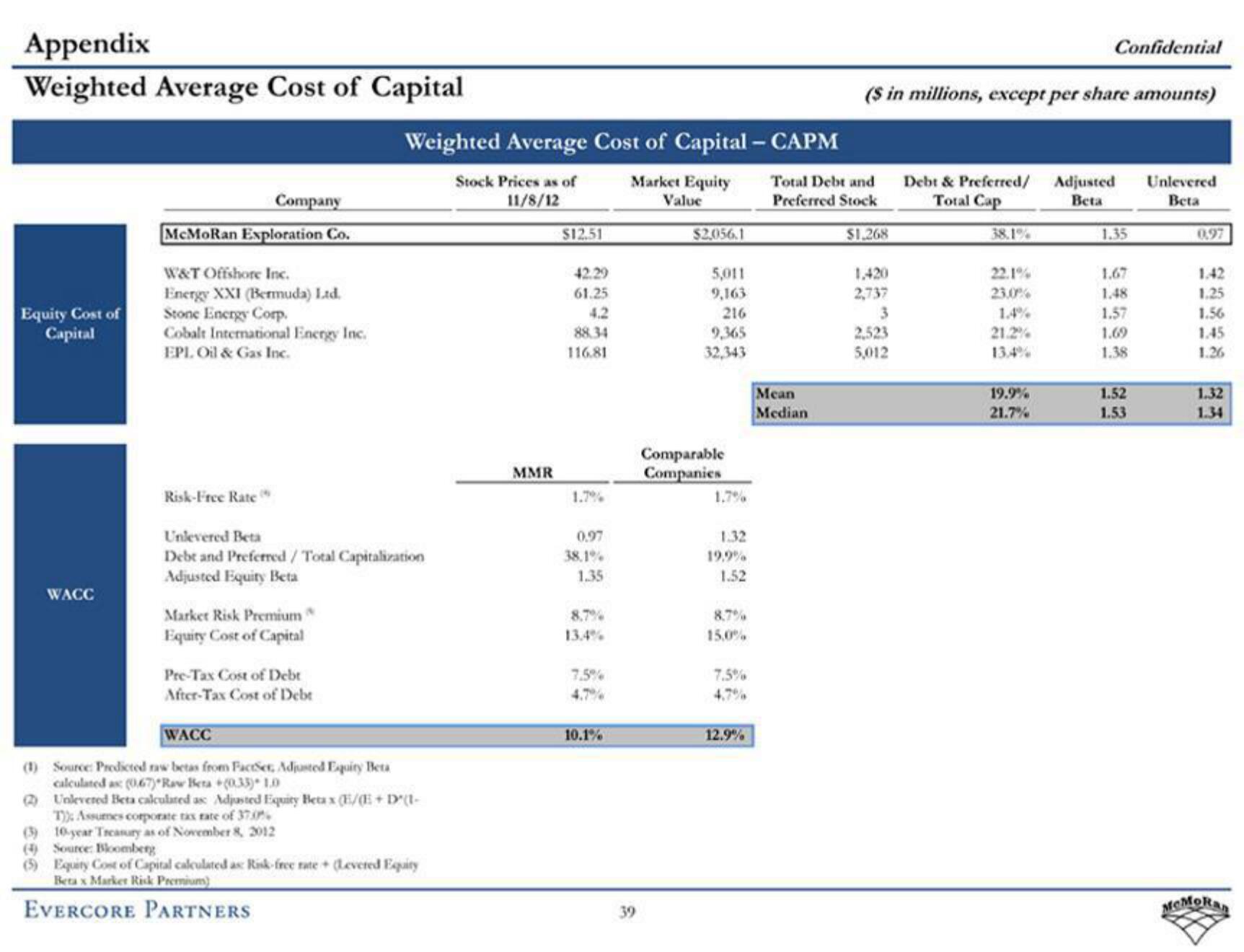

Weighted Average Cost of Capital

Equity Cost of

Capital

WACC

Company

McMoRan Exploration Co.

W&T Offshore Inc.

Energy XXI (Bermuda) Ltd.

Stone Energy Corp.

Cobalt International Energy Inc.

EPI. Oil & Gas Inc.

(3)

(4) Source: Bloomberg

Risk-Free Rate

Unlevered Beta

Debe and Preferred / Total Capitalization

Adjusted Equity Beta

Market Risk Premium

Equity Cost of Capital

Weighted Average Cost of Capital - CAPM

Stock Prices as of

11/8/12

Market Equity

Value

Pre-Tax Cost of Debt

After-Tax Cost of Debt

WACC

(1) Source: Predicted raw betas from FactSet Adjusted Equity Beta

calculated as: (067) Raw Beta +(0.33) 1.0

Unlevered Beta calculated as Adjusted Equity Betax (E/E+D (1-

T) Assumes corporate tax rate of 37.50%

10-year Treasury as of November 8, 2012

(5) Equity Cost of Capital calculated as Risk-free rate+ (Levered Equity

Betax Market Risk Premium)

EVERCORE PARTNERS

MMR

$12.51

42.29

61.25

4.2

88.34

116.81

0.97

38.1%

1.35

8.7%

7,5%

4.7%

10.1%

39

$2,056.1

5,011

9,163

216

9,365

32,343

Comparable

Companies

1.32

19.9%

1.52

8,7%

15.0%

7.5%

4.7%

12.9%

Total Debt and

Preferred Stock

$1.268

Mean

Median

($ in millions, except per share amounts)

1,420

2,737

3

2.523

5,012

Debt & Preferred/

Total Cap

38.1%

22.1%

23.0%

1.4%

21.2%

13.4%

19.9%

21.7%

Confidential

Adjusted

Beta

1.35

1.67

1.48

1.57

1.69

1.38

1.52

1.53

Unlevered

Beta

0.97

1.42

1.25

1.56

1.45

1.26

1.32

1.34

MCMoRanView entire presentation