Central Pacific Financial Investor Presentation Deck

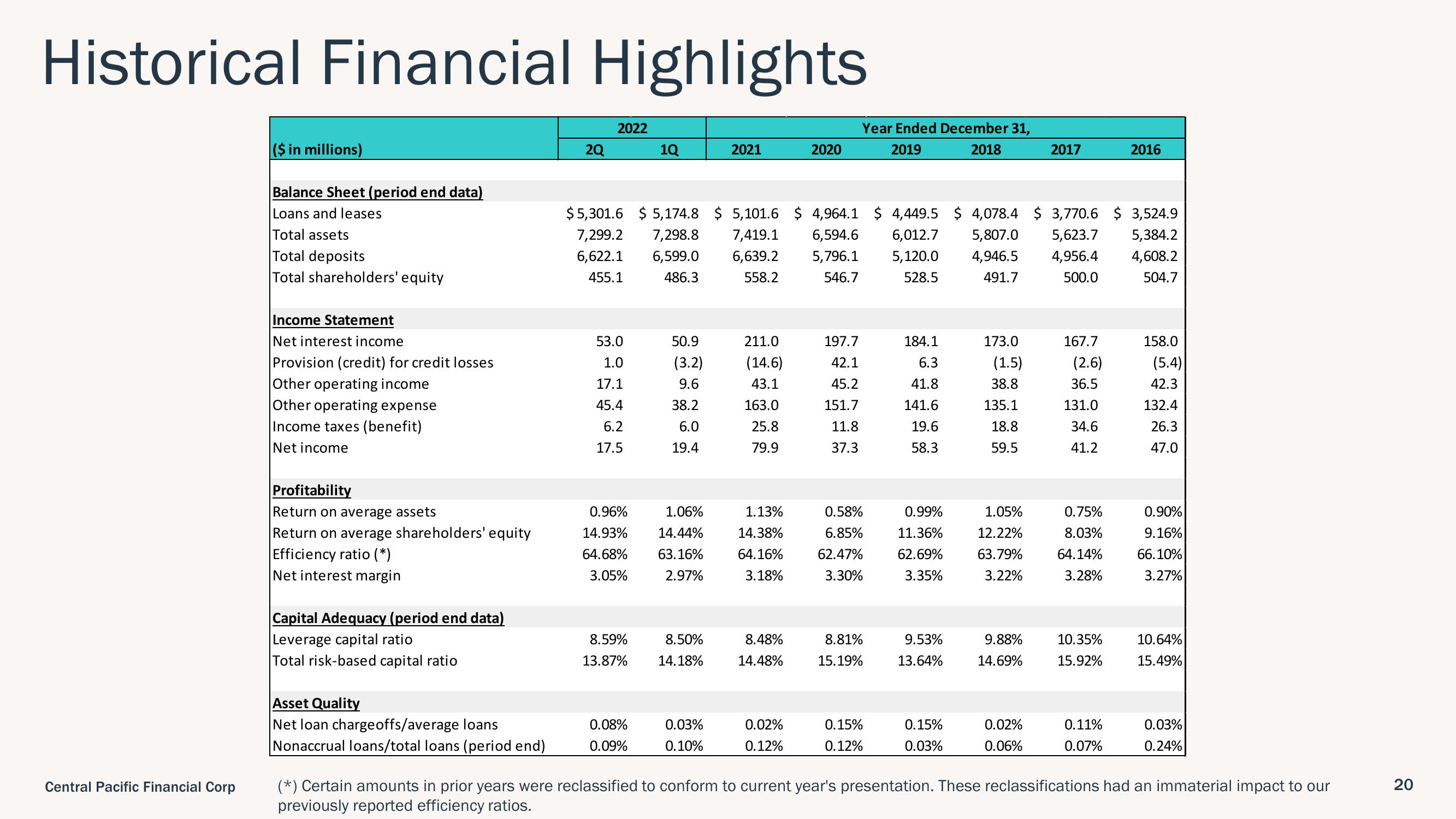

Historical Financial Highlights

Central Pacific Financial Corp

($ in millions)

Balance Sheet (period end data)

Loans and leases

Total assets

Total deposits

Total shareholders' equity

Income Statement

Net interest income

Provision (credit) for credit losses

Other operating income

Other operating expense

Income taxes (benefit)

Net income

Profitability

Return on average assets

Return on average shareholders' equity

Efficiency ratio (*)

Net interest margin

Capital Adequacy (period end data)

Leverage capital ratio

Total risk-based capital ratio

Asset Quality

Net loan charge offs/average loans

Nonaccrual loans/total loans (period end)

2Q

2022

$5,301.6

7,299.2

6,622.1

455.1

53.0

1.0

17.1

45.4

6.2

17.5

0.96%

14.93%

64.68%

3.05%

8.59%

13.87%

0.08%

0.09%

1Q

50.9

(3.2)

9.6

38.2

6.0

19.4

$5,174.8 $ 5,101.6 $ 4,964.1 $ 4,449.5

7,298.8 7,419.1 6,594.6 6,012.7

6,599.0 6,639.2 5,796.1 5,120.0

486.3

558.2

546.7

528.5

1.06%

14.44%

63.16%

2.97%

8.50%

14.18%

2021

0.03%

0.10%

211.0

(14.6)

43.1

163.0

25.8

79.9

1.13%

14.38%

64.16%

3.18%

8.48%

14.48%

2020

0.02%

0.12%

Year Ended December 31,

2019

2018

197.7

42.1

45.2

151.7

11.8

37.3

0.58%

6.85%

62.47%

3.30%

8.81%

15.19%

0.15%

0.12%

184.1

6.3

41.8

141.6

19.6

58.3

0.99%

11.36%

62.69%

3.35%

9.53%

13.64%

0.15%

0.03%

$ 4,078.4 $ 3,770.6

5,807.0

4,946.5

491.7

173.0

(1.5)

38.8

135.1

18.8

59.5

1.05%

12.22%

63.79%

3.22%

9.88%

14.69%

2017

0.02%

0.06%

$ 3,524.9

5,623.7 5,384.2

4,956.4 4,608.2

500.0

504.7

167.7

(2.6)

36.5

131.0

34.6

41.2

0.75%

8.03%

64.14%

3.28%

10.35%

15.92%

2016

0.11%

0.07%

158.0

(5.4)

42.3

132.4

26.3

47.0

0.90%

9.16%

66.10%

3.27%

10.64%

15.49%

0.03%

0.24%

(*) Certain amounts in prior years were reclassified to conform to current year's presentation. These reclassifications had an immaterial impact to our

previously reported efficiency ratios.

20View entire presentation