Massachusetts Water Resources Authority (“MWRA”) Employees’ Retirement System

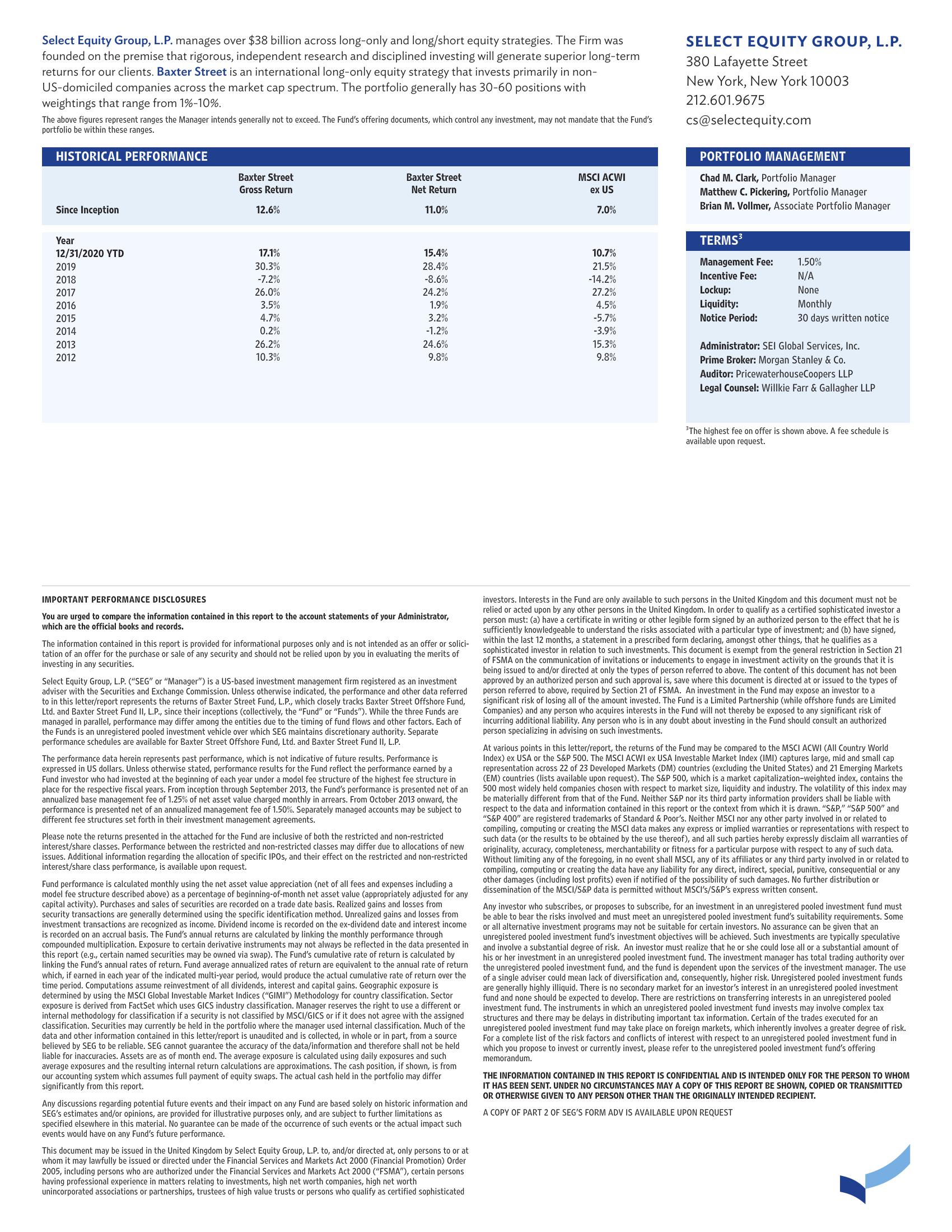

Select Equity Group, L.P. manages over $38 billion across long-only and long/short equity strategies. The Firm was

founded on the premise that rigorous, independent research and disciplined investing will generate superior long-term

returns for our clients. Baxter Street is an international long-only equity strategy that invests primarily in non-

US-domiciled companies across the market cap spectrum. The portfolio generally has 30-60 positions with

weightings that range from 1%-10%.

The above figures represent ranges the Manager intends generally not to exceed. The Fund's offering documents, which control any investment, may not mandate that the Fund's

portfolio be within these ranges.

HISTORICAL PERFORMANCE

Since Inception

Year

12/31/2020 YTD

2019

2018

2017

2016

2015

2014

2013

2012

Baxter Street

Gross Return

12.6%

17.1%

30.3%

-7.2%

26.0%

3.5%

4.7%

0.2%

26.2%

10.3%

Baxter Street

Net Return

11.0%

15.4%

28.4%

-8.6%

24.2%

1.9%

3.2%

-1.2%

24.6%

9.8%

IMPORTANT PERFORMANCE DISCLOSURES

You are urged to compare the information contained in this report to the account statements of your Administrator,

which are the official books and records.

The information contained in this report is provided for informational purposes only and is not intended as an offer or solici-

tation of an offer for the purchase or sale of any security and should not be relied upon by you in evaluating the merits of

investing in any securities.

Select Equity Group, L.P. ("SEG" or "Manager") is a US-based investment management firm registered as an investment

adviser with the Securities and Exchange Commission. Unless otherwise indicated, the performance and other data referred

to in this letter/report represents the returns of Baxter Street Fund, L.P., which closely tracks Baxter Street Offshore Fund,

Ltd. and Baxter Street Fund II, L.P., since their inceptions (collectively, the "Fund" or "Funds"). While the three Funds are

managed in parallel, performance may differ among the entities due to the timing of fund flows and other factors. Each of

the Funds is an unregistered pooled investment vehicle over which SEG maintains discretionary authority. Separate

performance schedules are available for Baxter Street Offshore Fund, Ltd. and Baxter Street Fund II, L.P.

The performance data herein represents past performance, which is not indicative of future results. Performance is

expressed in US dollars. Unless otherwise stated, performance results for the Fund reflect the performance earned by a

Fund investor who had invested at the beginning of each year under a model fee structure of the highest fee structure in

place for the respective fiscal years. From inception through September 2013, the Fund's performance is presented net of an

annualized base management fee of 1.25% of net asset value charged monthly in arrears. From October 2013 onward, the

performance is presented net of an annualized management fee of 1.50%. Separately managed accounts may be subject to

different fee structures set forth in their investment management agreements.

Please note the returns presented in the attached for the Fund are inclusive of both the restricted and non-restricted

interest/share classes. Performance between the restricted and non-restricted classes may differ due to allocations of new

issues. Additional information regarding the allocation of specific IPOs, and their effect on the restricted and non-restricted

interest/share class performance, is available upon request.

Fund performance is calculated monthly using the net asset value appreciation (net of all fees and expenses including a

model fee structure described above) as a percentage of beginning-of-month net asset value (appropriately adjusted for any

capital activity). Purchases and sales of securities are recorded on a trade date basis. Realized gains and losses from

security transactions are generally determined using the specific identification method. Unrealized gains and losses from

investment transactions are recognized as income. Dividend income is recorded on the ex-dividend date and interest income

is recorded on an accrual basis. The Fund's annual returns are calculated by linking the monthly performance through

compounded multiplication. Exposure to certain derivative instruments may not always be reflected in the data presented in

this report (e.g., certain named securities may be owned via swap). The Fund's cumulative rate of return is calculated by

linking the Fund's annual rates of return. Fund average annualized rates of return are equivalent to the annual rate of return

which, if earned in each year of the indicated multi-year period, would produce the actual cumulative rate of return over the

time period. Computations assume reinvestment of all dividends, interest and capital gains. Geographic exposure is

determined by using the MSCI Global Investable Market Indices ("GIMI") Methodology for country classification. Sector

exposure is derived from FactSet which uses GICS industry classification. Manager reserves the right to use a different or

internal methodology for classification if a security is not classified by MSCI/GICS or if it does not agree with the assigned

classification. Securities may currently be held in the portfolio where the manager used internal classification. Much of the

data and other information contained in this letter/report is unaudited and is collected, in whole or in part, from a source

believed by SEG to be reliable. SEG cannot guarantee the accuracy of the data/information and therefore shall not be held

liable for inaccuracies. Assets are as of month end. The average exposure is calculated using daily exposures and such

average exposures and the resulting internal return calculations are approximations. The cash position, if shown, is from

our accounting system which assumes full payment of equity swaps. The actual cash held in the portfolio may differ

significantly from this report.

Any discussions regarding potential future events and their impact on any Fund are based solely on historic information and

SEG's estimates and/or opinions, are provided for illustrative purposes only, and are subject to further limitations as

specified elsewhere in this material. No guarantee can be made of the occurrence of such events or the actual impact such

events would have on any Fund's future performance.

This document may be issued in the United Kingdom by Select Equity Group, L.P. to, and/or directed at, only persons to or at

whom it may lawfully be issued or directed under the Financial Services and Markets Act 2000 (Financial Promotion) Order

2005, including persons who are authorized under the Financial Services and Markets Act 2000 ("FSMA"), certain persons

having professional experience in matters relating inves nents, high net worth companies, high net worth

unincorporated associations or partnerships, trustees of high value trusts or persons who qualify as certified sophisticated

MSCI ACWI

ex US

7.0%

10.7%

21.5%

-14.2%

27.2%

4.5%

-5.7%

-3.9%

15.3%

9.8%

SELECT EQUITY GROUP, L.P.

380 Lafayette Street

New York, New York 10003

212.601.9675

[email protected]

PORTFOLIO MANAGEMENT

Chad M. Clark, Portfolio Manager

Matthew C. Pickering, Portfolio Manager

Brian M. Vollmer, Associate Portfolio Manager

TERMS³

Management Fee:

Incentive Fee:

Lockup:

Liquidity:

Notice Period:

1.50%

N/A

None

Monthly

30 days written notice

Administrator: SEI Global Services, Inc.

Prime Broker: Morgan Stanley & Co.

Auditor: PricewaterhouseCoopers LLP

Legal Counsel: Willkie Farr & Gallagher LLP

³The highest fee on offer is shown above. A fee schedule is

available upon request.

investors. Interests in the Fund are only available to such persons in the United Kingdom and this document must not be

relied or acted upon by any other persons in the United Kingdom. In order to qualify as a certified sophisticated investor a

person must: (a) have a certificate in writing or other legible form signed by an authorized person to the effect that he is

sufficiently knowledgeable to understand the risks associated with a particular type of investment; and (b) have signed,

within the last 12 months, a statement in a prescribed form declaring, amongst other things, that he qualifies as a

sophisticated investor in relation to such investments. This document is exempt from the general restriction in Section 21

of FSMA on the communication of invitations or inducements to engage in investment activity on the grounds that it is

being issued to and/or directed at only the types of person referred to above. The content of this document has not been

approved by an authorized person and such approval is, save where this document is directed at or issued to the types of

person referred to above, required by Section 21 of FSMA. An investment in the Fund may expose an investor to a

significant risk of losing all of the amount invested. The Fund is a Limited Partnership (while offshore funds are Limited

Companies) and any person who acquires interests in the Fund will not thereby be exposed to any significant risk of

incurring additional liabilit Any person who is in any doubt about investing in the Fund should consult an authorized

person specializing in advising on such investments.

At various points in this letter/report, the returns of the Fund may be compared to the MSCI ACWI (All Country World

Index) ex USA or the S&P 500. The MSCI ACWI ex USA Investable Market Index (IMI) captures large, mid and small cap

representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 21 Emerging Markets

(EM) countries (lists available upon request). The S&P 500, which is a market capitalization-weighted index, contains the

500 most widely held companies chosen with respect to market size, liquidity and industry. The volatility of this index may

be materially different from that of the Fund. Neither S&P nor its third party information providers shall be liable with

respect to the data and information contained in this report or the context from which it is drawn. "S&P," "S&P 500" and

"S&P 400" are registered trademarks of Standard & Poor's. Neither MSCI nor any other party involved in or related to

compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to

such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of

originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data.

Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to

compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any

other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or

dissemination of the MSCI/S&P data is permitted without MSCI's/S&P's express written consent.

Any investor who subscribes, or proposes to subscribe, for an investment in an unregistered pooled investment fund must

be able to bear the risks involved and must meet an unregistered pooled investment fund's suitability requirements. Some

or all alternative investment programs may not be suitable for certain investors. No assurance can be given that an

unregistered pooled investment fund's investment objectives will be achieved. Such investments are typically speculative

and involve a substantial degree of risk. An investor must realize that he or she could lose all or a substantial amount of

his or her investment in an unregistered pooled investment fund. The investment manager has total trading authority over

the unregistered pooled investment fund, and the fund is dependent upon the services of the investment manager. The use

of a single adviser could mean lack of diversification and, consequently, higher risk. Unregistered pooled investment funds

are generally highly illiquid. There is no secondary market for an investor's interest in an unregistered pooled investment

fund and none should be expected to develop. There are restrictions on transferring interests in an unregistered pooled

investment fund. The instruments in which an unregistered pooled investment fund invests may involve complex tax

structures and there may be delays in distributing important tax information. Certain of the trades executed for an

unregistered pooled investment fund may take place on foreign markets, which inherently involves a greater degree of risk.

For a complete list of the risk factors and conflicts of interest with respect to an unregistered pooled investment fund in

which you propose to invest or currently invest, please refer to the unregistered pooled investment fund's offering

memorandum.

THE INFORMATION CONTAINED IN THIS REPORT IS CONFIDENTIAL AND IS INTENDED ONLY FOR THE PERSON TO WHOM

IT HAS BEEN SENT. UNDER NO CIRCUMSTANCES MAY A COPY OF THIS REPORT BE SHOWN, COPIED OR TRANSMITTED

OR OTHERWISE GIVEN TO ANY PERSON OTHER THAN THE ORIGINALLY INTENDED RECIPIENT.

A COPY OF PART 2 OF SEG'S FORM ADV IS AVAILABLE UPON REQUESTView entire presentation