Allwyn SPAC Presentation Deck

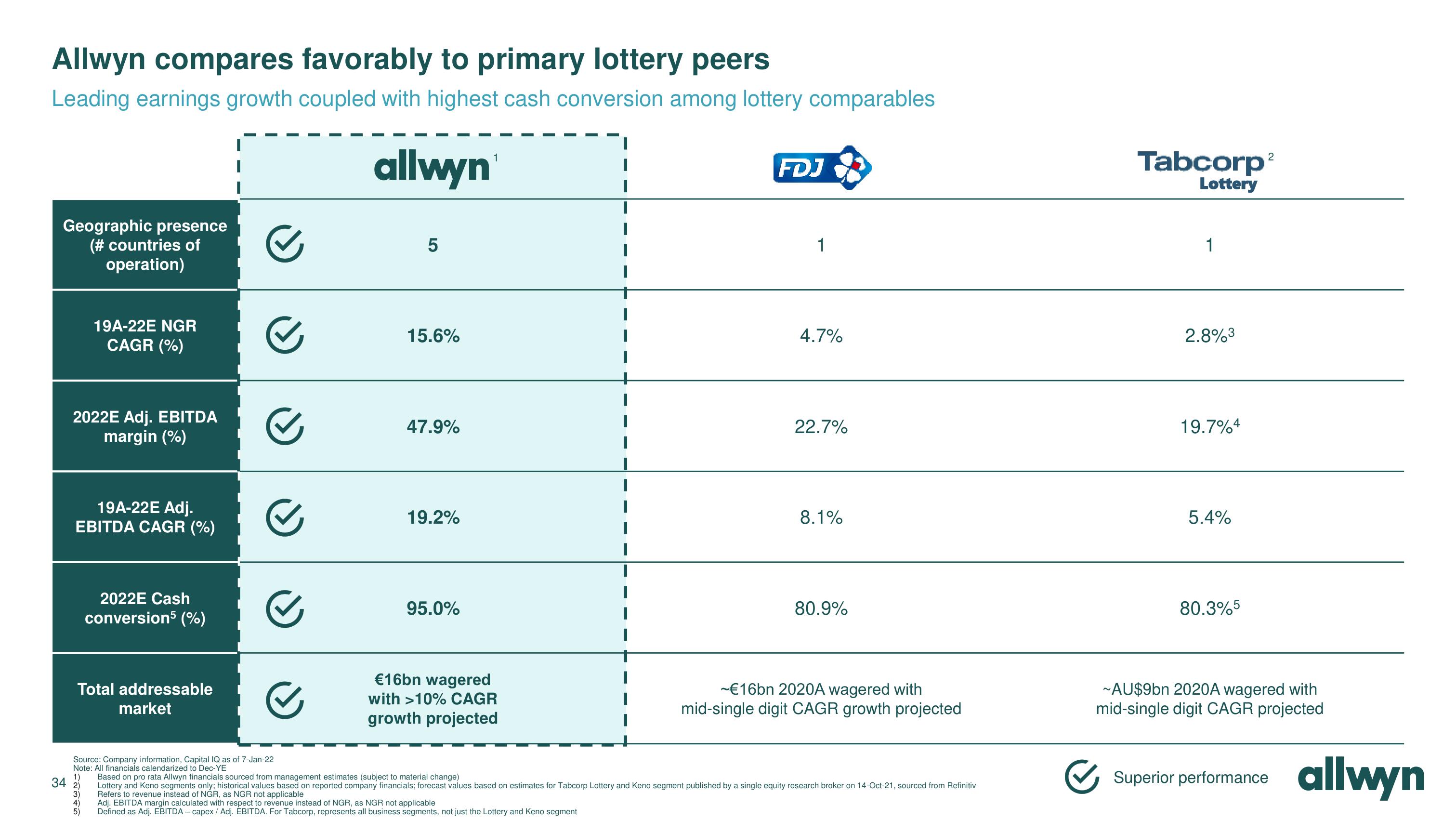

Allwyn compares favorably to primary lottery peers

Leading earnings growth coupled with highest cash conversion among lottery comparables

Geographic presence

(# countries of

operation)

34

19A-22E NGR

CAGR (%)

2022E Adj. EBITDA

margin (%)

19A-22E Adj.

EBITDA CAGR (%)

2022E Cash

conversion5 (%)

Total addressable

market

1)

2)

3)

4)

5)

✔

✔

✔

✔

✔

✔

Source: Company information, Capital IQ as of 7-Jan-22

Note: All financials calendarized to Dec-YE

allwyn

5

15.6%

47.9%

19.2%

95.0%

1

€16bn wagered

with >10% CAGR

growth projected

I

I

FDJ

1

4.7%

22.7%

8.1%

80.9%

€16bn 2020A wagered with

mid-single digit CAGR growth projected

Based on pro rata Allwyn financials sourced from management estimates (subject to material change)

Lottery and Keno segments only; historical values based on reported company financials; forecast values based on estimates for Tabcorp Lottery and Keno segment published by a single equity research broker on 14-Oct-21, sourced from Refinitiv

Refers to revenue instead of NGR, as NGR not applicable

Adj. EBITDA margin calculated with respect to revenue instead of NGR, as NGR not applicable

Defined as Adj. EBITDA - capex / Adj. EBITDA. For Tabcorp, represents all business segments, not just the Lottery and Keno segment

Tabcorp

Lottery

1

2.8%3

19.7%4

5.4%

80.3%5

2

~AU$9bn 2020A wagered with

mid-single digit CAGR projected

Superior performance

allwynView entire presentation