Oaktree Real Estate Opportunities Fund VII, L.P.

Purchases

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

Appendix II: Evolution of Six Areas of Focus (Non-U.S.)

Liquidations and

Refinancings

$1,000

($ in millions)

800

600

400

200

0

(200)

(400)

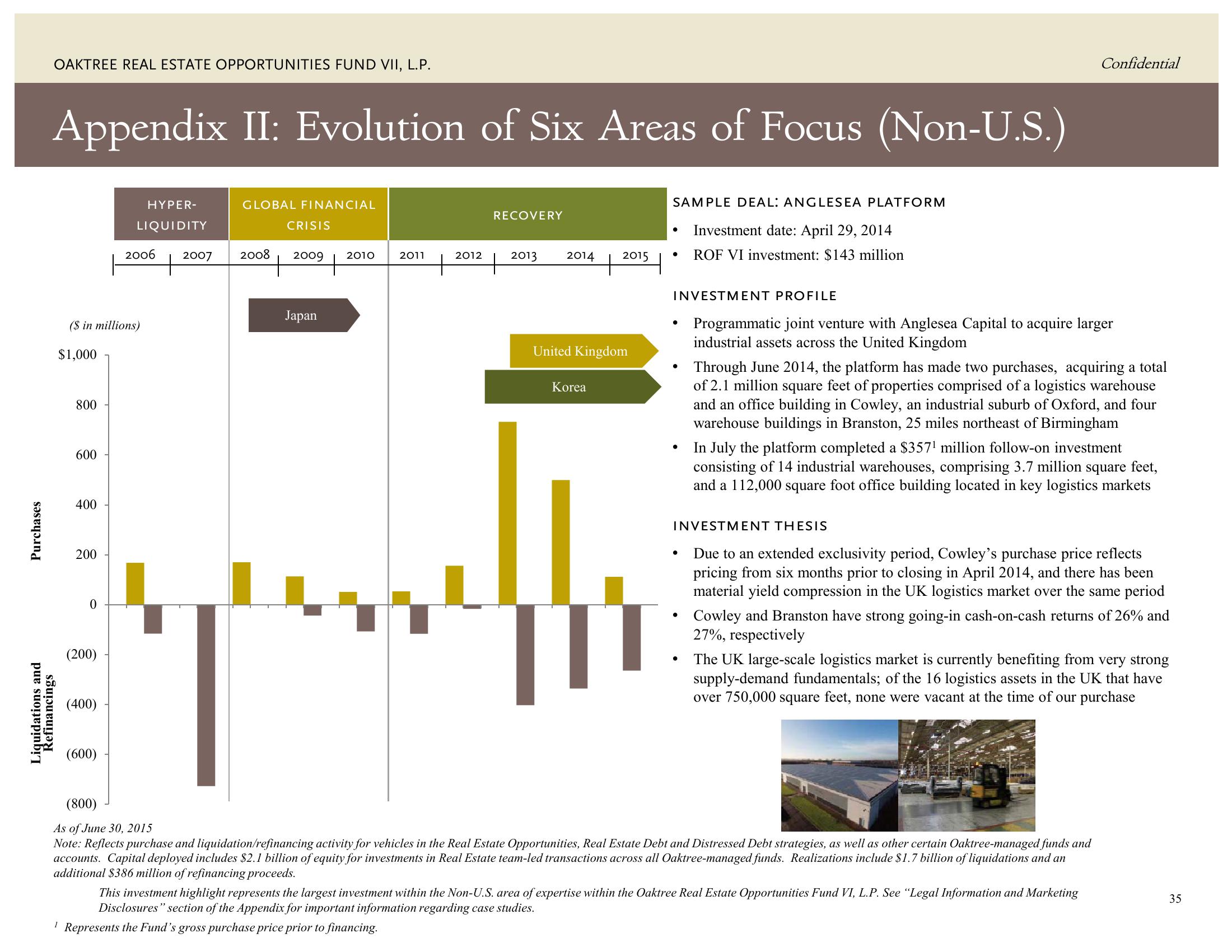

HYPER-

LIQUIDITY

(600)

2006

2007

GLOBAL FINANCIAL

CRISIS

2008 2009 2010

+

Japan

2011

H

2012

RECOVERY

2013

2014

+

Korea

United Kingdom

2015

IL

3

SAMPLE DEAL: ANGLESEA PLATFORM

Investment date: April 29, 2014

ROF VI investment: $143 million

●

INVESTMENT PROFILE

Programmatic joint venture with Anglesea Capital to acquire larger

industrial assets across the United Kingdom

●

●

●

INVESTMENT THESIS

Due to an extended exclusivity period, Cowley's purchase price reflects

pricing from six months prior to closing in April 2014, and there has been

material yield compression in the UK logistics market over the same period

●

Confidential

Through June 2014, the platform has made two purchases, acquiring a total

of 2.1 million square feet of properties comprised of a logistics warehouse

and an office building in Cowley, an industrial suburb of Oxford, and four

warehouse buildings in Branston, 25 miles northeast of Birmingham

In July the platform completed a $357¹ million follow-on investment

consisting of 14 industrial warehouses, comprising 3.7 million square feet,

and a 112,000 square foot office building located in key logistics markets

Cowley and Branston have strong going-in cash-on-cash returns of 26% and

27%, respectively

The UK large-scale logistics market is currently benefiting from very strong

supply-demand fundamentals; of the 16 logistics assets in the UK that have

over 750,000 square feet, none were vacant at the time of our purchase

(800)

As of June 30, 2015

Note: Reflects purchase and liquidation/refinancing activity for vehicles in the Real Estate Opportunities, Real Estate Debt and Distressed Debt strategies, as well as other certain Oaktree-managed funds and

accounts. Capital deployed includes $2.1 billion of equity for investments in Real Estate team-led transactions across all Oaktree-managed funds. Realizations include $1.7 billion of liquidations and an

additional $386 million of refinancing proceeds.

This investment highlight represents the largest investment within the Non-U.S. area of expertise within the Oaktree Real Estate Opportunities Fund VI, L.P. See “Legal Information and Marketing

Disclosures" section of the Appendix for important information regarding case studies.

1 Represents the Fund's gross purchase price prior to financing.

35View entire presentation