Sonder Results Presentation Deck

Third Quarter 2021 Summary Results

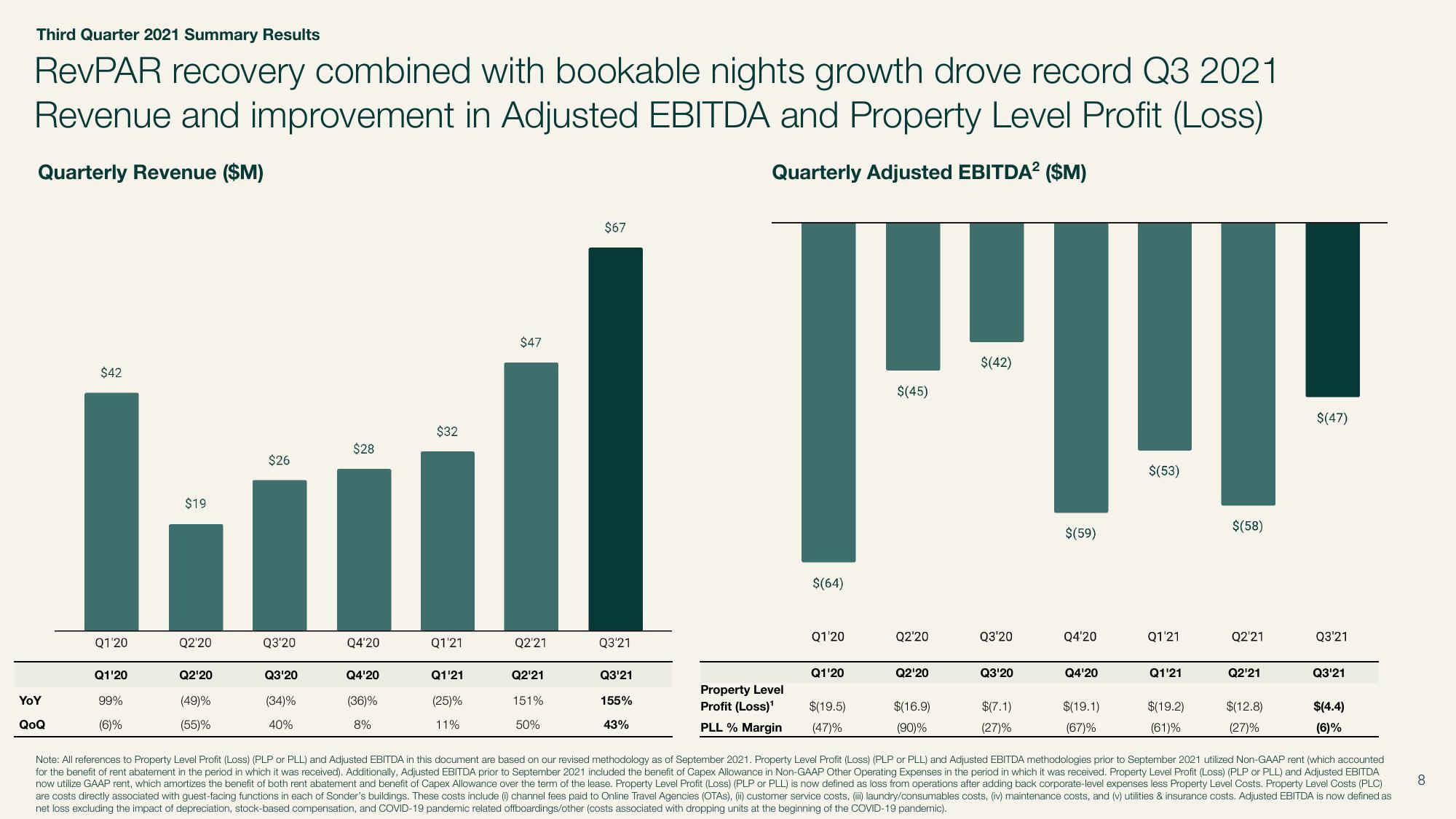

RevPAR recovery combined with bookable nights growth drove record Q3 2021

Revenue and improvement in Adjusted EBITDA and Property Level Profit (Loss)

Quarterly Revenue ($M)

Quarterly Adjusted EBITDA2 ($M)

YoY

QoQ

$42

Q1'20

Q1'20

99%

(6)%

$19

Q2'20

Q2'20

(49)%

(55)%

$26

Q3'20

Q3'20

(34)%

40%

$28

Q4'20

Q4'20

(36)%

8%

$32

Q1'21

Q1'21

(25)%

11%

$47

Q2'21

Q2¹21

151%

50%

$67

Q3'21

Q3'21

155%

43%

$(42)

IT

$(45)

Property Level

Profit (Loss)¹

PLL % Margin

$(64)

Q1'20

Q1'20

$(19.5)

(47)%

Q2'20

Q2'20

$(16.9)

(90)%

Q3'20

Q3'20

$(7.1)

(27)%

$(59)

Q4'20

Q4'20

$(19.1)

(67)%

$(53)

Q1'21

Q1'21

$(19.2)

(61)%

$(58)

Q2'21

Q2¹21

$(12.8)

(27)%

$(47)

Q3'21

Q3'21

$(4.4)

(6)%

Note: All references to Property Level Profit (Loss) (PLP or PLL) and Adjusted EBITDA in this document are based on our revised methodology as of September 2021. Property Level Profit (Loss) (PLP or PLL) and Adjusted EBITDA methodologies prior to September 2021 utilized Non-GAAP rent (which accounted

for the benefit of rent abatement in the period in which it was received). Additionally, Adjusted EBITDA prior to September 2021 included the benefit of Capex Allowance in Non-GAAP Other Operating Expenses in the period in which it was received. Property Level Profit (Loss) (PLP or PLL) and Adjusted EBITDA

now utilize GAAP rent, which amortizes the benefit of both rent abatement and benefit of Capex Allowance over the term of the lease. Property Level Profit (Loss) (PLP or PLL) is now defined as loss from operations after adding back corporate-level expenses less Property Level Costs. Property Level Costs (PLC)

are costs directly associated with guest-facing functions in each of Sonder's buildings. These costs include (i) channel fees paid to Online Travel Agencies (OTAS), (ii) customer service costs, (iii) laundry/consumables costs, (iv) maintenance costs, and (v) utilities & insurance costs. Adjusted EBITDA is now defined as

net loss excluding the impact of depreciation, stock-based compensation, and COVID-19 pandemic related offboardings/other (costs associated with dropping units at the beginning of the COVID-19 pandemic).

8View entire presentation