Freeport Copper Financials

FREEPORT FOREMOST IN COPPER

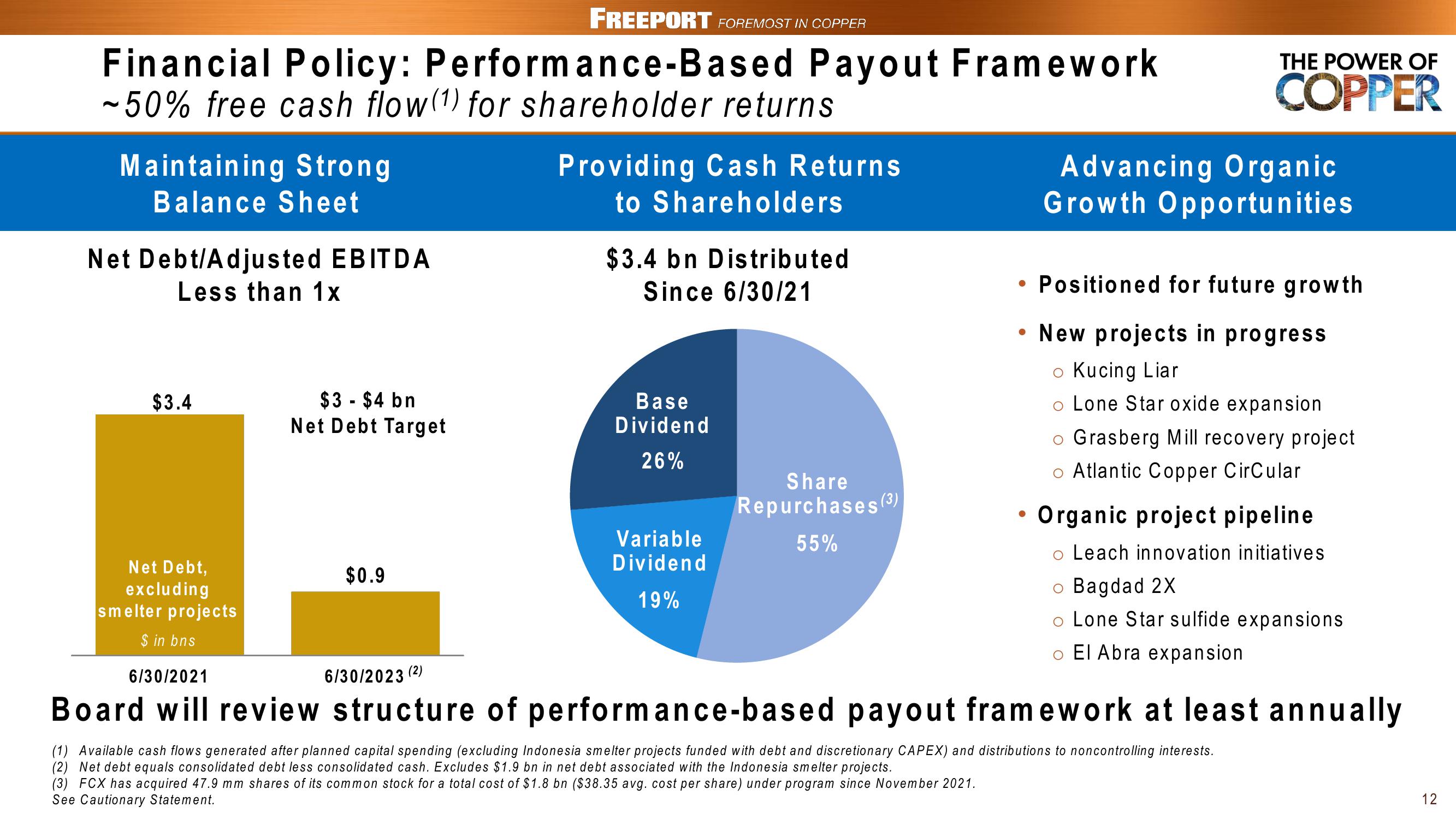

Financial Policy: Performance-Based Payout Framework

-50% free cash flow (1) for shareholder returns

Maintaining Strong

Balance Sheet

Net Debt/Adjusted EBITDA

Less than 1x

$3.4

Net Debt,

excluding

smelter projects

$ in bns

$3-$4 bn

Net Debt Target

$0.9

(2)

6/30/2023

Providing Cash Returns

to Shareholders

$3.4 bn Distributed

Since 6/30/21

Base

Dividend

26%

Variable

Dividend

19%

Share

Repurchases (3)

55%

THE POWER OF

COPPER

●

Advancing Organic

Growth Opportunities

• Positioned for future growth

• New projects in progress

o Kucing Liar

o Lone Star oxide expansion

o Grasberg Mill recovery project

o Atlantic Copper Circular

Organic project pipeline

Leach innovation initiatives

o Bagdad 2X

o Lone Star sulfide expansions

o El Abra expansion.

6/30/2021

Board will review structure of performance-based payout framework at least annually

(1) Available cash flows generated after planned capital spending (excluding Indonesia smelter projects funded with debt and discretionary CAPEX) and distributions to noncontrolling interests.

(2) Net debt equals consolidated debt less consolidated cash. Excludes $1.9 bn in net debt associated with the Indonesia smelter projects.

(3) FCX has acquired 47.9 mm shares of its common stock for a total cost of $1.8 bn ($38.35 avg. cost per share) under program since November 2021.

See Cautionary Statement.

12View entire presentation