Momentus SPAC Presentation Deck

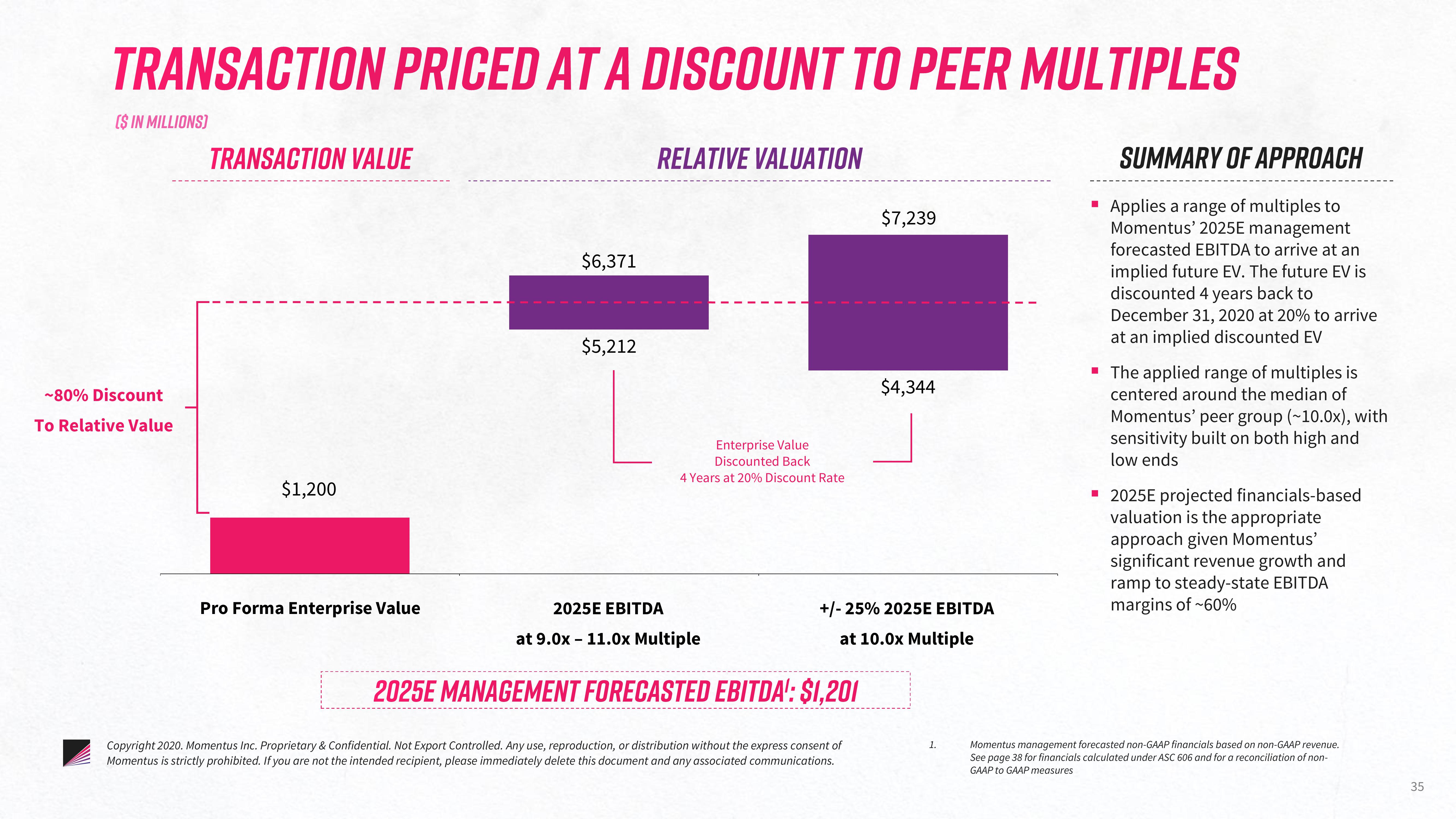

TRANSACTION PRICED AT A DISCOUNT TO PEER MULTIPLES

($ IN MILLIONS)

~80% Discount

To Relative Value

TRANSACTION VALUE

$1,200

Pro Forma Enterprise Value

$6,371

$5,212

RELATIVE VALUATION

Enterprise Value

Discounted Back

4 Years at 20% Discount Rate

2025E EBITDA

at 9.0x - 11.0x Multiple

$7,239

2025E MANAGEMENT FORECASTED EBITDA': $1,201

Copyright 2020. Momentus Inc. Proprietary & Confidential. Not Export Controlled. Any use, reproduction, or distribution without the express consent of

Momentus is strictly prohibited. If you are not the intended recipient, please immediately delete this document and any associated communications.

$4,344

+/-25% 2025E EBITDA

at 10.0x Multiple

1.

■

SUMMARY OF APPROACH

Applies a range of multiples to

Momentus' 2025E management

forecasted EBITDA to arrive at an

implied future EV. The future EV is

discounted 4 years back to

December 31, 2020 at 20% to arrive

at an implied discounted EV

The applied range of multiples is

centered around the median of

Momentus' peer group (~10.0x), with

sensitivity built on both high and

low ends

▪ 2025E projected financials-based

valuation is the appropriate

approach given Momentus'

significant revenue growth and

ramp to steady-state EBITDA

margins of ~60%

Momentus management forecasted non-GAAP financials based on non-GAAP revenue.

See page 38 for financials calculated under ASC 606 and for a reconciliation of non-

GAAP to GAAP measures

35View entire presentation