Federal Signal Investor Presentation Deck

Why Federal Signal?

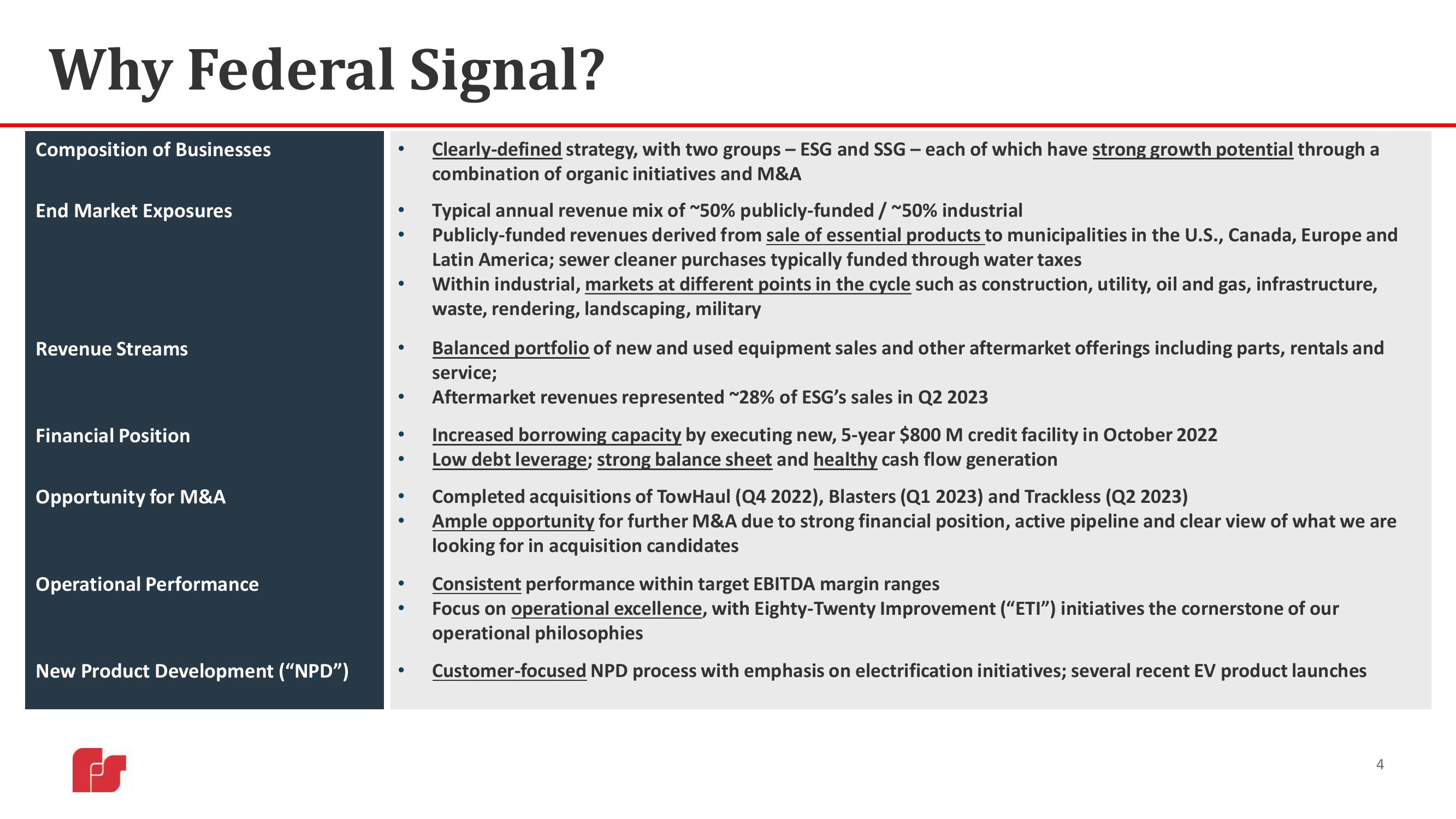

Composition of Businesses

End Market Exposures

Revenue Streams

Financial Position

Opportunity for M&A

Operational Performance

New Product Development ("NPD")

●

●

●

●

Clearly-defined strategy, with two groups - ESG and SSG - each of which have strong growth potential through a

combination of organic initiatives and M&A

Typical annual revenue mix of ~50% publicly-funded / ~50% industrial

Publicly-funded revenues derived from sale of essential products to municipalities in the U.S., Canada, Europe and

Latin America; sewer cleaner purchases typically funded through water taxes

Within industrial, markets at different points in the cycle such as construction, utility, oil and gas, infrastructure,

waste, rendering, landscaping, military

Balanced portfolio of new and used equipment sales and other aftermarket offerings including parts, rentals and

service;

Aftermarket revenues represented ~28% of ESG's sales in Q2 2023

Increased borrowing capacity by executing new, 5-year $800 M credit facility in October 2022

Low debt leverage; strong balance sheet and healthy cash flow generation

Completed acquisitions of TowHaul (Q4 2022), Blasters (Q1 2023) and Trackless (Q2 2023)

Ample opportunity for further M&A due to strong financial position, active pipeline and clear view of what we are

looking for in acquisition candidates

Consistent performance within target EBITDA margin ranges

Focus on operational excellence, with Eighty-Twenty Improvement (“ETI") initiatives the cornerstone of our

operational philosophies

Customer-focused NPD process with emphasis on electrification initiatives; several recent EV product launches

4View entire presentation