Sonder Results Presentation Deck

Third Quarter 2021 Summary Results

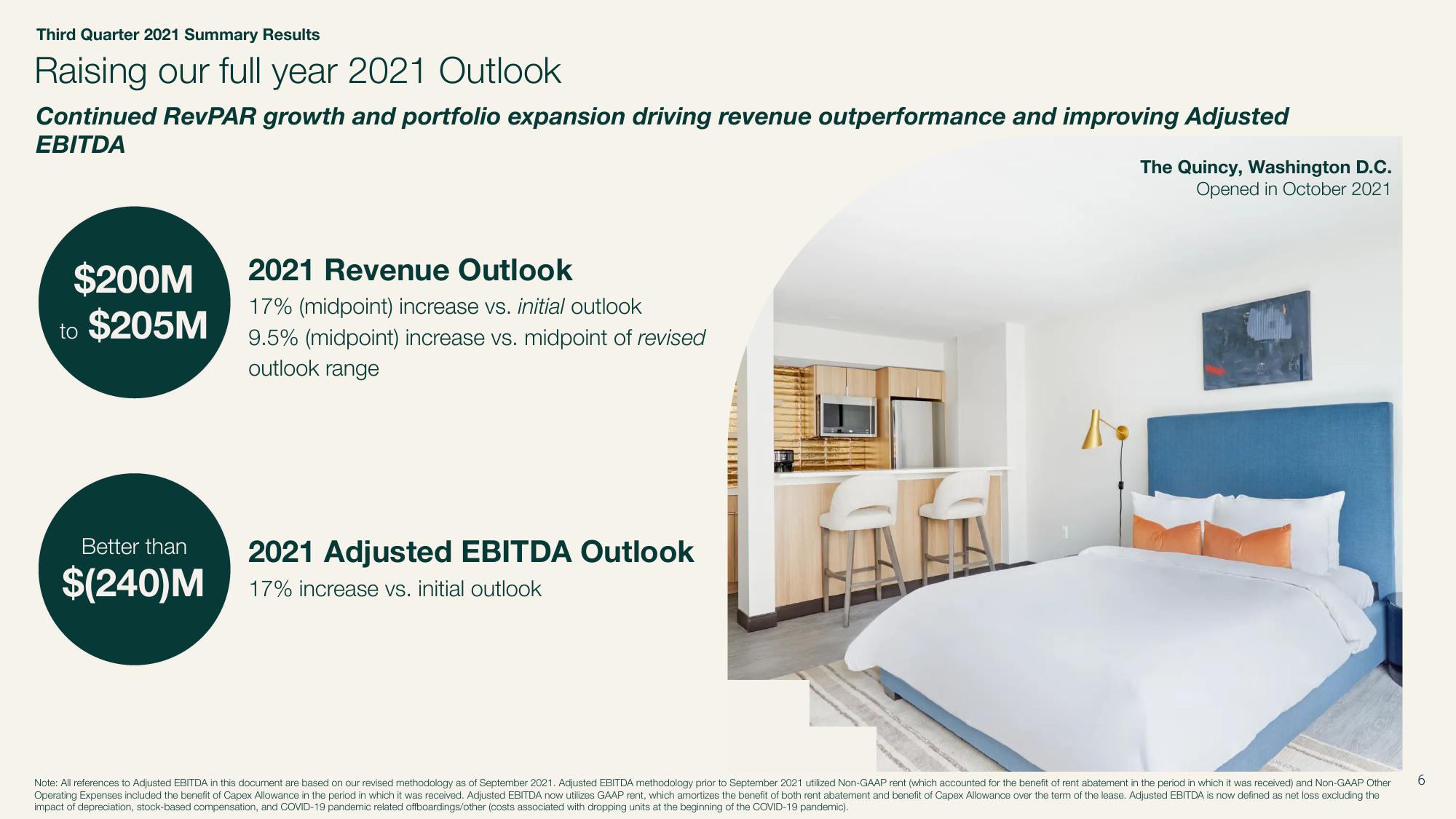

Raising our full year 2021 Outlook

Continued RevPAR growth and portfolio expansion driving revenue outperformance and improving Adjusted

EBITDA

$200M

to $205M

Better than

$(240)M

2021 Revenue Outlook

17% (midpoint) increase vs. initial outlook

9.5% (midpoint) increase vs. midpoint of revised

outlook range

2021 Adjusted EBITDA Outlook

17% increase vs. initial outlook

The Quincy, Washington D.C.

Opened in October 2021

Note: All references to Adjusted EBITDA in this document are based on our revised methodology as of September 2021. Adjusted EBITDA methodology prior to September 2021 utilized Non-GAAP rent (which accounted for the benefit of rent abatement in the period in which it was received) and Non-GAAP Other

Operating Expenses included the benefit of Capex Allowance in the period in which was received. Adjusted EBITDA now utilizes GAAP rent, which amortizes the benefit of both rent abatement and benefit of Capex Allowance over the term of the lease. Adjusted EBITDA is now defined as net loss excluding the

impact of depreciation, stock-based compensation, and COVID-19 pandemic related offboardings/other (costs associated with dropping units at the beginning of the COVID-19 pandemic).

6View entire presentation