UBS Results Presentation Deck

Global Wealth Management

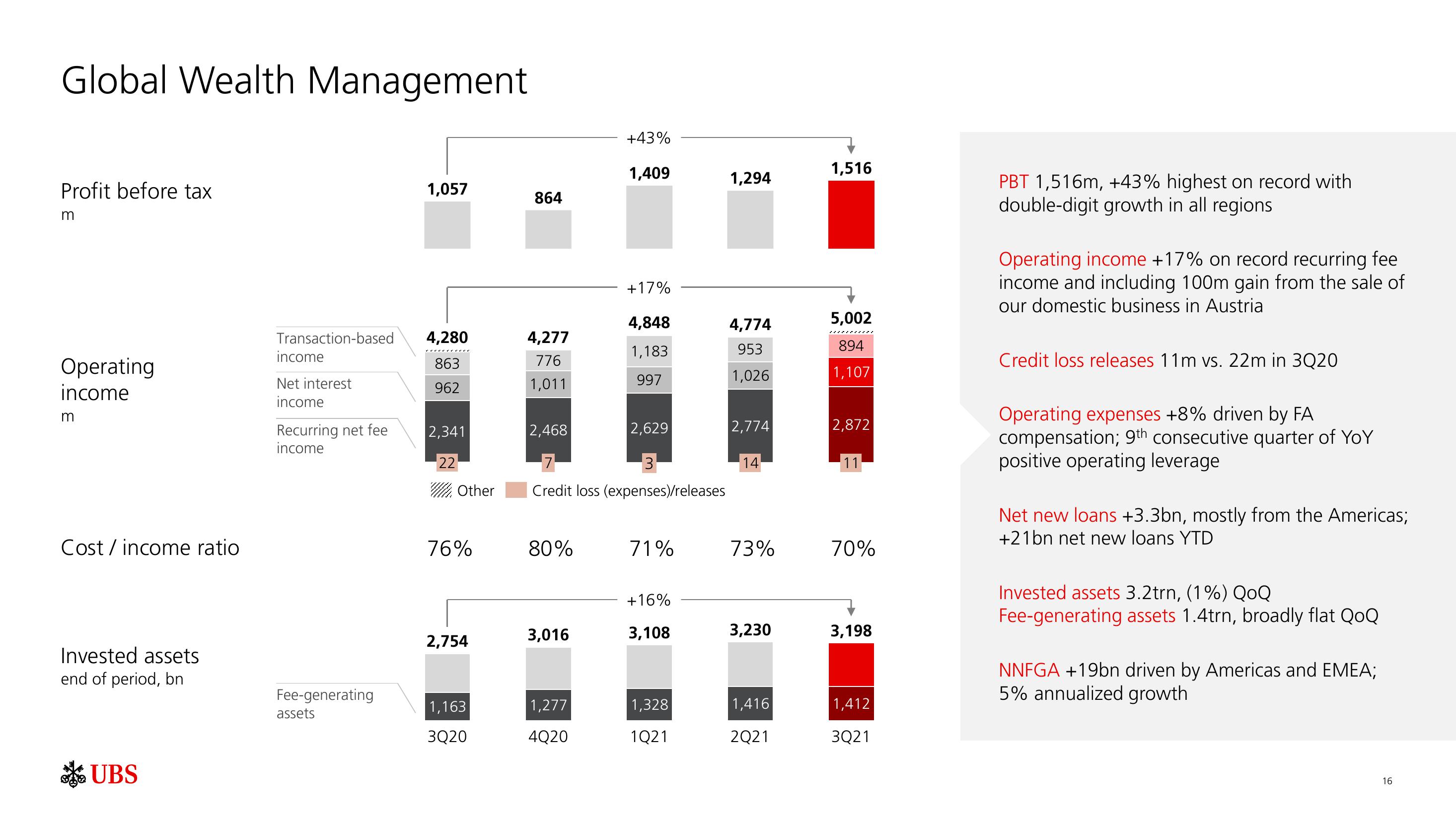

Profit before tax

m

Operating

income

m

Cost/income ratio

Invested assets

end of period, bn

UBS

Transaction-based

income

Net interest

income

Recurring net fee

income

Fee-generating

assets

1,057

4,280

863

962

2,341

22

Other

76%

2,754

1,163

3Q20

864

4,277

776

1,011

80%

2,468

2,629

3

7

Credit loss (expenses)/releases

3,016

+43%

1,409

1,277

4Q20

+17%

4,848

1,183

997

71%

+16%

3,108

1,328

1Q21

1,294

4,774

953

1,026

2,774

14

73%

3,230

1,416

2Q21

1,516

5,002

894

1,107

2,872

11

70%

3,198

1,412

3Q21

PBT 1,516m, +43% highest on record with

double-digit growth in all regions

Operating income +17% on record recurring fee

income and including 100m gain from the sale of

our domestic business in Austria

Credit loss releases 11m vs. 22m in 3Q20

Operating expenses +8% driven by FA

compensation; 9th consecutive quarter of YoY

positive operating leverage

Net new loans +3.3bn, mostly from the Americas;

+21bn net new loans YTD

Invested assets 3.2trn, (1%) QoQ

Fee-generating assets 1.4trn, broadly flat QoQ

NNFGA +19bn driven by Americas and EMEA;

5% annualized growth

16View entire presentation