Kinnevik Results Presentation Deck

OUR NET CASH POSITION PROVIDES US FURTHER FINANCIAL STRENGTH AND

FLEXIBILITY TO CONTINUE TO EXECUTE OUR 2019-23 CAPITAL ALLOCATION PLAN

■

■

■

■

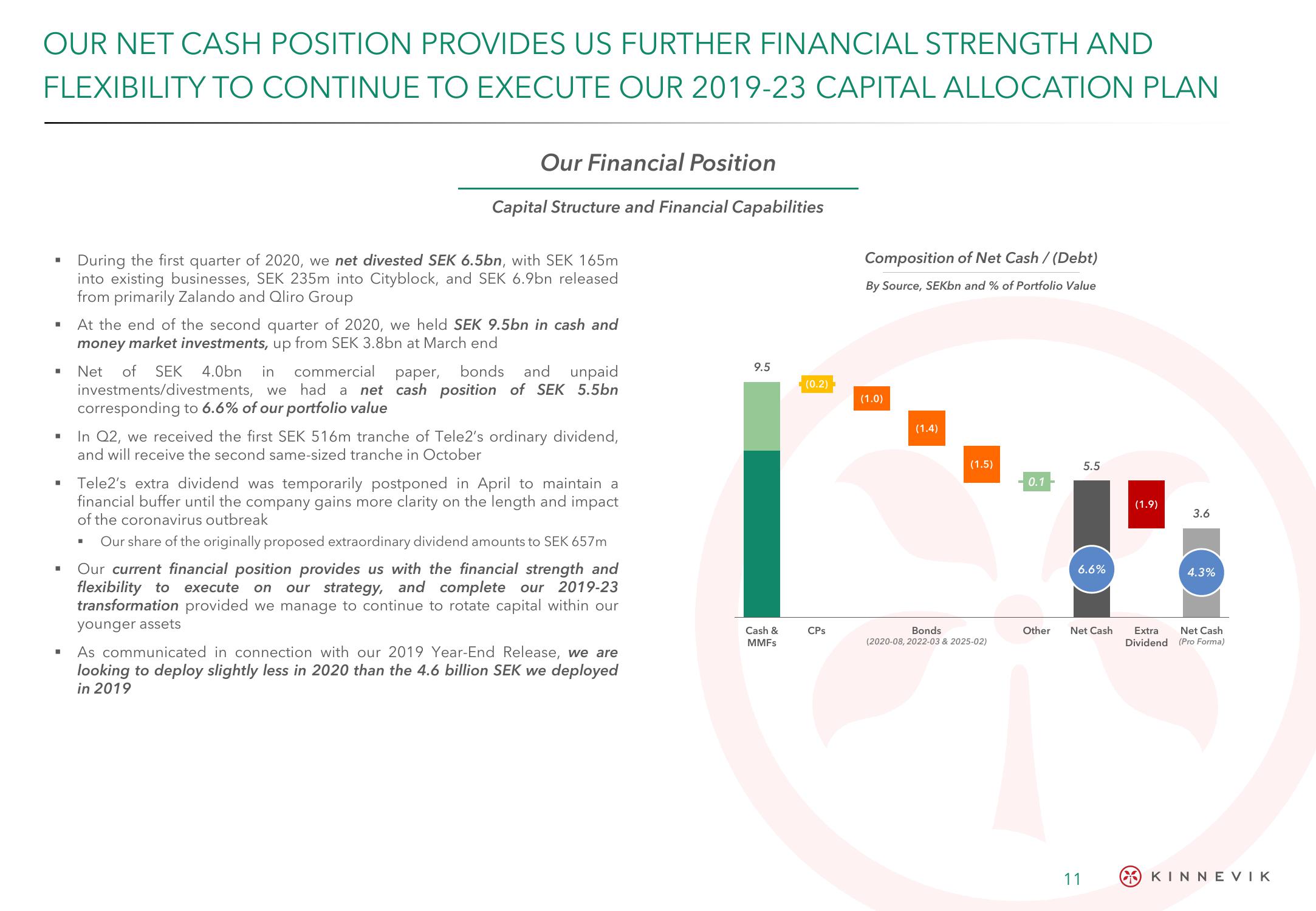

Our Financial Position

Capital Structure and Financial Capabilities

During the first quarter of 2020, we net divested SEK 6.5bn, with SEK 165m

into existing businesses, SEK 235m into Cityblock, and SEK 6.9bn released

from primarily Zalando and Qliro Group

At the end of the second quarter of 2020, we held SEK 9.5bn in cash and

money market investments, up from SEK 3.8bn at March end

Net of SEK 4.0bn in commercial paper, bonds and unpaid

investments/divestments, we had a net cash position of SEK 5.5bn

corresponding to 6.6% of our portfolio value

In Q2, we received the first SEK 516m tranche of Tele2's ordinary dividend,

and will receive the second same-sized tranche in October

Tele2's extra dividend was temporarily postponed in April to maintain a

financial buffer until the company gains more clarity on the length and impact

of the coronavirus outbreak

Our share of the originally proposed extraordinary dividend amounts to SEK 657m

Our current financial position provides us with the financial strength and

flexibility to execute on our strategy, and complete our 2019-23

transformation provided we manage to continue to rotate capital within our

younger assets

As communicated in connection with our 2019 Year-End Release, we are

looking to deploy slightly less in 2020 than the 4.6 billion SEK we deployed

in 2019

9.5

Cash &

MMFs

(0.2)

CPs

Composition of Net Cash / (Debt)

By Source, SEKbn and % of Portfolio Value

(1.0)

(1.4)

(1.5)

Bonds

(2020-08, 2022-03 & 2025-02)

0.1

Other

5.5

6.6%

Net Cash

11

(1.9)

3.6

4.3%

Extra Net Cash

Dividend (Pro Forma)

KINNEVIKView entire presentation