Grove Investor Presentation Deck

GROVE IS THE MARKET LEADER IN ZERO WASTE HOME CARE.

Home + personal care is $1T globally, built on single use plastic. Zero waste leadership will

create a multi-billion dollar brand. That is our opportunity.

1.

2.

A Premier Long Term Brand.

A Unique Entry Point.

8.3x growth since 2017

#1 market share, awareness, and assortment for zero waste HPC

#1 DTC community

Door growth up >100% y/y¹¹

52% gross margins in Q1 2023

WELL POSITIONED + LOW AWARENESS → ATTRACTIVE ENTRY POINT

Net cash position with $100M+ of cash, cash equivalents + available debt¹2)

Clear near term path to profitability

Potential Adj. EBITDA approximately break even in Q3, well ahead of schedule

Record GM of 52.1% in Q1 2023, expected to continue to increase long term

Extraordinary long term customer retention

O CAC optimized down to near-pandemic levels

O Operating efficiency + cost savings still rolling through P&L

y/y Adjusted EBITDA margin improvement of 3,420 bps in Q1 2023

Multiple upside drivers + catalysts

Continued rapid retail distribution growth

Category expansion into wellness

M+A

O

O

As of March 31, 2023

Includes restricted cash of $9M. Refer to Balance Sheet + Available Capital slide later in presentation for additional details

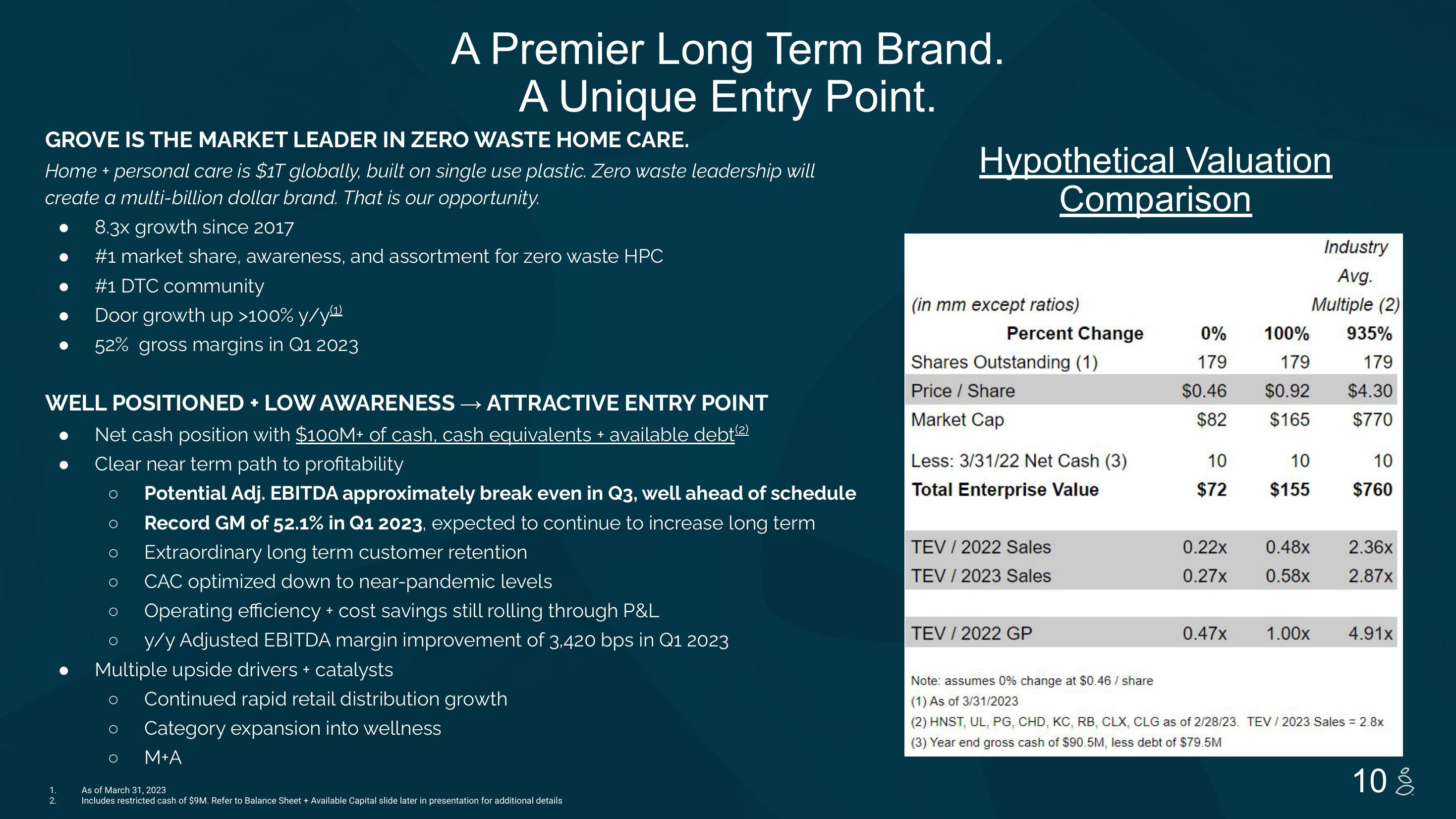

Hypothetical Valuation

Comparison

(in mm except ratios)

Percent Change

Shares Outstanding (1)

Price / Share

Market Cap

Less: 3/31/22 Net Cash (3)

Total Enterprise Value

TEV / 2022 Sales

TEV / 2023 Sales

TEV / 2022 GP

0%

179

$0.46

$82

10

$72

0.22x

0.27x

0.47x

100%

179

$0.92

$165

10

$155

0.48x

0.58x

1.00x

Industry

Avg.

Multiple (2)

935%

179

$4.30

$770

10

$760

2.36x

2.87x

4.91x

Note: assumes 0% change at $0.46 / share

(1) As of 3/31/2023

(2) HNST, UL, PG, CHD, KC, RB, CLX, CLG as of 2/28/23. TEV/2023 Sales = 2.8x

(3) Year end gross cash of $90.5M, less debt of $79.5M

108View entire presentation