Hg Genesis 10, L.P. Recommendation Report

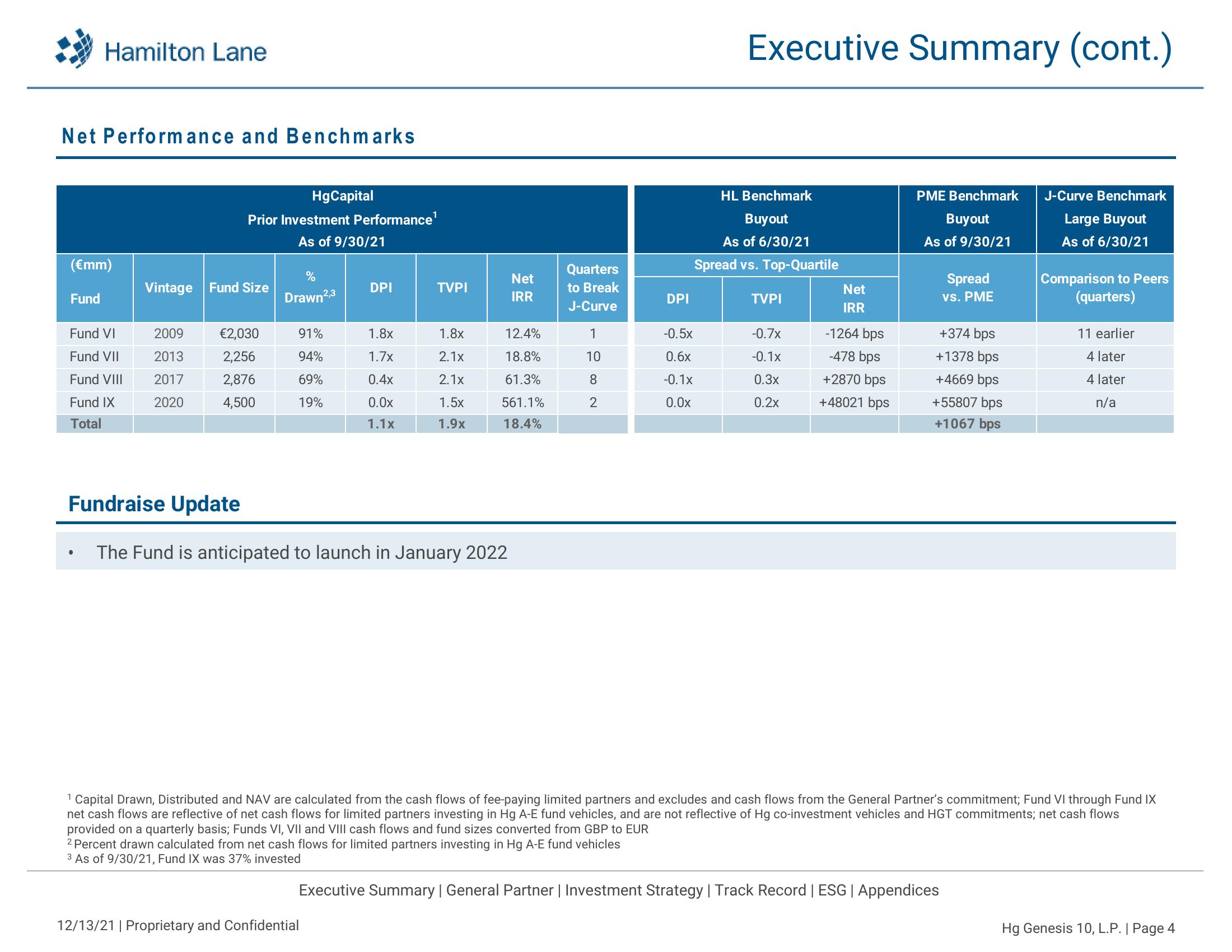

Net Performance and Benchmarks

Hamilton Lane

(€mm)

Fund

Fund VI

Fund VII

Fund VIII

Fund IX

Total

●

HgCapital

Prior Investment Performance¹

As of 9/30/21

Vintage Fund Size

2009

2013

2017

2020

€2,030

2,256

2,876

4,500

%

Drawn

2,3

91%

94%

69%

19%

DPI

1.8x

1.7x

0.4x

0.0x

1.1x

12/13/21 | Proprietary and Confidential

TVPI

1.8x

2.1x

2.1x

1.5x

1.9x

Fundraise Update

The Fund is anticipated to launch in January 2022

Net

IRR

12.4%

18.8%

61.3%

561.1%

18.4%

Quarters

to Break

J-Curve

1

10

8

2

DPI

Executive Summary (cont.)

HL Benchmark

Buyout

As of 6/30/21

Spread vs. Top-Quartile

-0.5x

0.6x

-0.1x

0.0x

TVPI

-0.7x

-0.1x

0.3x

0.2x

Net

IRR

-1264 bps

-478 bps

+2870 bps

+48021 bps

PME Benchmark

Buyout

As of 9/30/21

Spread

vs. PME

+374 bps

+1378 bps

+4669 bps

+55807 bps

+1067 bps

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

J-Curve Benchmark

Large Buyout

As of 6/30/21

Comparison to Peers

(quarters)

1 Capital Drawn, Distributed and NAV are calculated from the cash flows of fee-paying limited partners and excludes and cash flows from the General Partner's commitment; Fund VI through Fund IX

net cash flows are reflective of net cash flows for limited partners investing in Hg A-E fund vehicles, and are not reflective of Hg co-investment vehicles and HGT commitments; net cash flows

provided on a quarterly basis; Funds VI, VII and VIII cash flows and fund sizes converted from GBP to EUR

2 Percent drawn calculated from net cash flows for limited partners investing in Hg A-E fund vehicles

3 As of 9/30/21, Fund IX was 37% invested

11 earlier

4 later

4 later

n/a

Hg Genesis 10, L.P. | Page 4View entire presentation