Crocs Results Presentation Deck

Financial Outlook

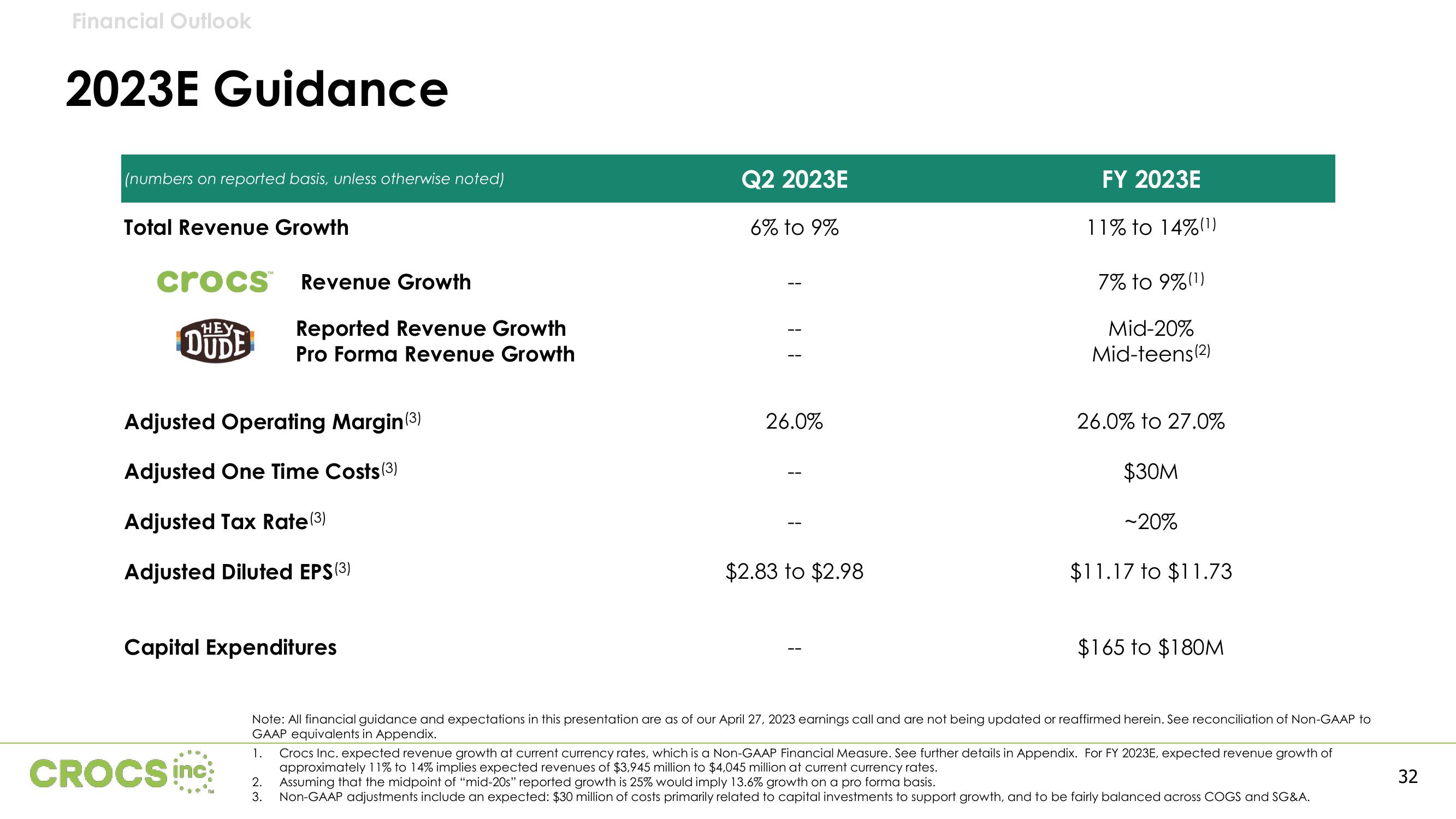

2023E Guidance

(numbers on reported basis, unless otherwise noted)

Total Revenue Growth

crocs™ Revenue Growth

HEY

DUDE

Reported Revenue Growth

Pro Forma Revenue Growth

Adjusted Operating Margin (3)

Adjusted One Time Costs (³)

Adjusted Tax Rate (³)

Adjusted Diluted EPS (3)

Capital Expenditures

CROCS inc

Q2 2023E

6% to 9%

1 1 1

26.0%

$2.83 to $2.98

FY 2023E

11% to 14% (1)

7% to 9% (1)

Mid-20%

Mid-teens(2)

26.0% to 27.0%

$30M

~20%

$11.17 to $11.73

$165 to $180M

Note: All financial guidance and expectations in this presentation are as of our April 27, 2023 earnings call and are not being updated or reaffirmed herein. See reconciliation of Non-GAAP to

GAAP equivalents in Appendix.

1. Crocs Inc. expected revenue growth at current currency rates, which is a Non-GAAP Financial Measure. See further details in Appendix. For FY 2023E, expected revenue growth of

approximately 11% to 14% implies expected revenues of $3,945 million to $4,045 million at current currency rates.

2. Assuming that the midpoint of "mid-20s" reported growth is 25% would imply 13.6% growth on a pro forma basis.

3.

Non-GAAP adjustments include an expected: $30 million of costs primarily related to capital investments to support growth, and to be fairly balanced across COGS and SG&A.

32View entire presentation