Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

APM

TERMINALS

Contents

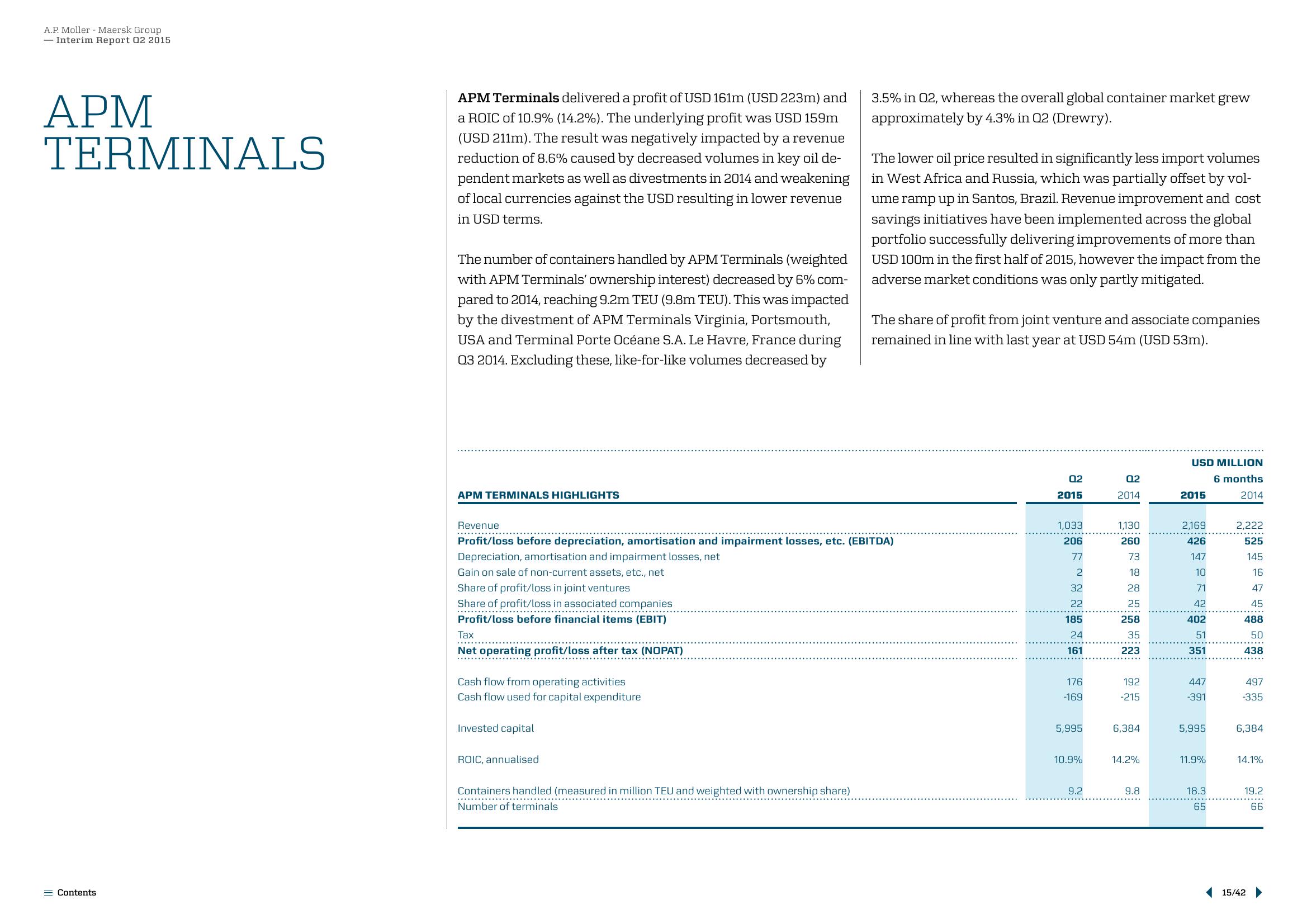

APM Terminals delivered a profit of USD 161m (USD 223m) and

a ROIC of 10.9% (14.2%). The underlying profit was USD 159m

(USD 211m). The result was negatively impacted by a revenue

reduction of 8.6% caused by decreased volumes in key oil de-

pendent markets as well as divestments in 2014 and weakening

of local currencies against the USD resulting in lower revenue

in USD terms.

The number of containers handled by APM Terminals (weighted

with APM Terminals' ownership interest) decreased by 6% com-

pared to 2014, reaching 9.2m TEU (9.8m TEU). This was impacted

by the divestment of APM Terminals Virginia, Portsmouth,

USA and Terminal Porte Océane S.A. Le Havre, France during

03 2014. Excluding these, like-for-like volumes decreased by

APM TERMINALS HIGHLIGHTS

..............

Tax

Net operating profit/loss after tax (NOPAT)

Revenue

Profit/loss before depreciation, amortisation and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Share of profit/loss in associated companies

Profit/loss before financial items (EBIT)

Cash flow from operating activities

Cash flow used for capital expenditure

Invested capital

ROIC, annualised

3.5% in Q2, whereas the overall global container market grew

approximately by 4.3% in 02 (Drewry).

Containers handled (measured in million TEU and weighted with ownership share)

Number of terminals

The lower oil price resulted in significantly less import volumes

in West Africa and Russia, which was partially offset by vol-

ume ramp up in Santos, Brazil. Revenue improvement and cost

savings initiatives have been implemented across the global

portfolio successfully delivering improvements of more than

USD 100m in the first half of 2015, however the impact from the

adverse market conditions was only partly mitigated.

The share of profit from joint venture and associate companies

remained in line with last year at USD 54m (USD 53m).

02

2015

1,033

206

77

2

32

22

185

24

161

176

-169

5,995

10.9%

9.2

02

2014

1,130

260

73

18

28

25

258

35

223

192

-215

6,384

14.2%

9.8

USD MILLION

6 months

2014

2015

2,169

426

147

10

71

42

402

51

351

447

-391

5,995

11.9%

18.3

65

2,222

525

145

16

47

45

488

50

438

497

-335

6,384

14.1%

19.2

66

15/42View entire presentation