W3BCLOUD SPAC

Transaction Summary

Transaction

Size

Valuation

Sponsor

Agreement &

Lock-up

Agreements

Illustrative Pro

Forma

Ownership

at Close(3,4,5,6,7)

W3B CLOUD

■

■

■

■

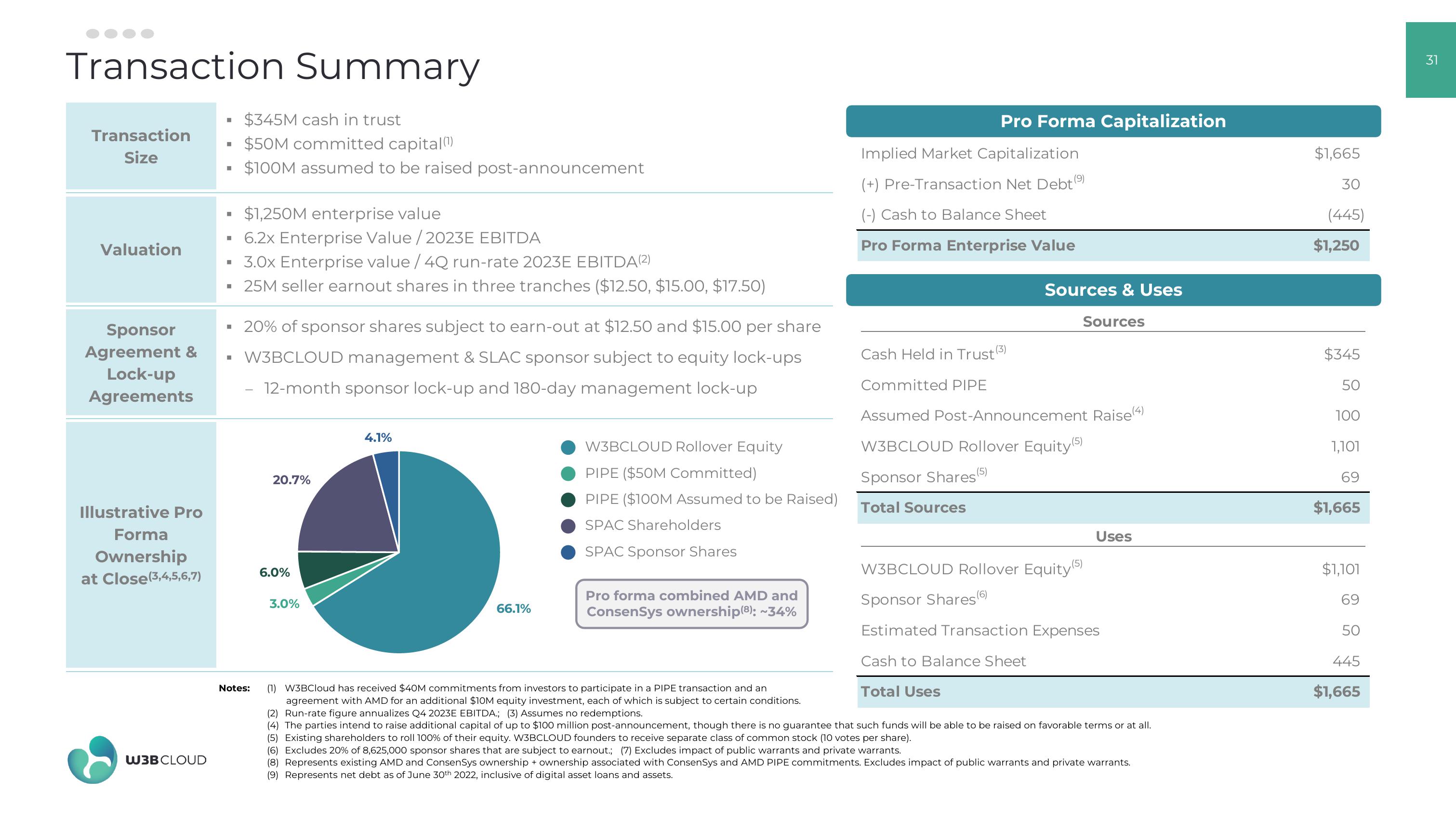

$345M cash in trust

$50M committed capital (¹)

$100M assumed to be raised post-announcement

$1,250M enterprise value

6.2x Enterprise Value/2023E EBITDA

3.0x Enterprise value / 4Q run-rate 2023E EBITDA (²)

25M seller earnout shares in three tranches ($12.50, $15.00, $17.50)

20% of sponsor shares subject to earn-out at $12.50 and $15.00 per share

W3BCLOUD management & SLAC sponsor subject to equity lock-ups

12-month sponsor lock-up and 180-day management lock-up

Notes:

20.7%

6.0%

3.0%

4.1%

66.1%

W3BCLOUD Rollover Equity

PIPE ($50M Committed)

PIPE ($100M Assumed to be Raised)

SPAC Shareholders

SPAC Sponsor Shares

Pro forma combined AMD and

ConsenSys ownership(8): ~34%

Pro Forma Capitalization

Implied Market Capitalization

(+) Pre-Transaction Net Debt (9

(-) Cash to Balance Sheet

Pro Forma Enterprise Value

Sources & Uses

Sources

Cash Held in Trust (3)

Committed PIPE

Assumed Post-Announcement Raise(4)

W3BCLOUD Rollover Equity (5)

Sponsor Shares (5)

Total Sources

Uses

W3BCLOUD Rollover Equity (5)

Sponsor Shares (6)

Estimated Transaction Expenses

Cash to Balance Sheet

Total Uses

(1) W3BCloud has received $40M commitments from investors to participate in a PIPE transaction and an

agreement with AMD for an additional $10M equity investment, each of which is subject to certain conditions.

(2) Run-rate figure annualizes Q4 2023E EBITDA.; (3) Assumes no redemptions.

(4) The parties intend to raise additional capital of up to $100 million post-announcement, though there is no guarantee that such funds will be able to be raised on favorable terms or at all.

(5) Existing shareholders to roll 100% of their equity. W3BCLOUD founders to receive separate class of common stock (10 votes per share).

(6) Excludes 20% of 8,625,000 sponsor shares that are subject to earnout.; (7) Excludes impact of public warrants and private warrants.

(8) Represents existing AMD and ConsenSys ownership + ownership associated with ConsenSys and AMD PIPE commitments. Excludes impact of public warrants and private warrants.

(9) Represents net debt as of June 30th 2022, inclusive of digital asset loans and assets.

$1,665

30

(445)

$1,250

$345

50

100

1,101

69

$1,665

$1,101

69

50

445

$1,665

31View entire presentation