Allego SPAC Presentation Deck

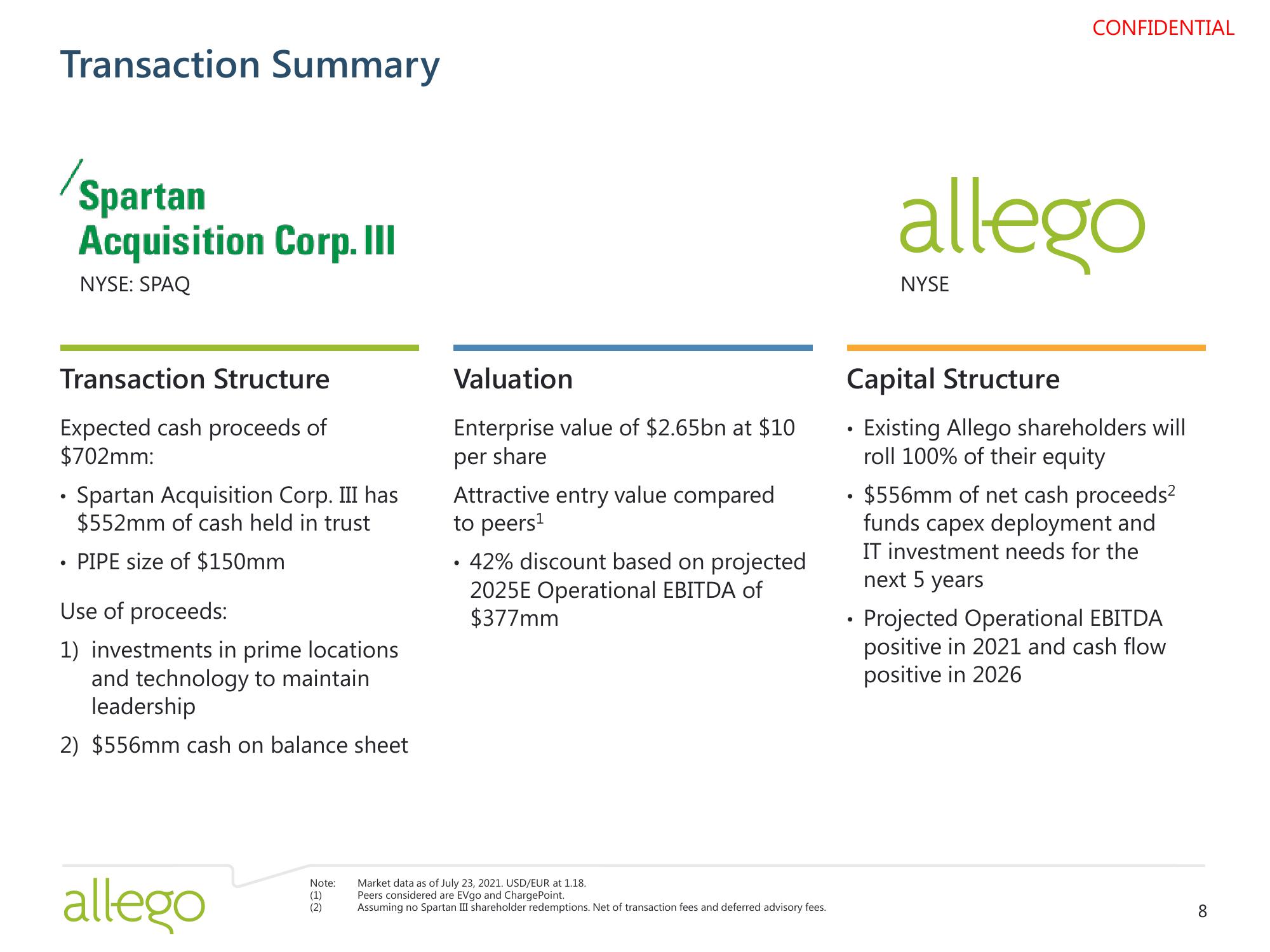

Transaction Summary

Spartan

Acquisition Corp. III

NYSE: SPAQ

Transaction Structure

Expected cash proceeds of

$702mm:

• Spartan Acquisition Corp. III has

$552mm of cash held in trust

PIPE size of $150mm

●

Use of proceeds:

1) investments in prime locations

and technology to maintain

leadership

2) $556mm cash on balance sheet

allego

Note:

(1)

(2)

Valuation

Enterprise value of $2.65bn at $10

per share

Attractive entry value compared

to peers¹

• 42% discount based on projected

2025E Operational EBITDA of

$377mm

Market data as of July 23, 2021. USD/EUR at 1.18.

Peers considered are EVgo and ChargePoint.

Assuming no Spartan III shareholder redemptions. Net of transaction fees and deferred advisory fees.

CONFIDENTIAL

allego

NYSE

Capital Structure

Existing Allego shareholders will

roll 100% of their equity

• $556mm of net cash proceeds²

funds capex deployment and

IT investment needs for the

next 5 years

• Projected Operational EBITDA

positive in 2021 and cash flow

positive in 2026

8View entire presentation