Kinnevik Results Presentation Deck

Q1 WAS A QUARTER OF MARKET VOLATILITY AND UNCERTAINTY DURING

WHICH WE REMAINED FOCUSED ON EXECUTING ON OUR 2023 PRIORITIES

Spring Health

Enveda

Note:

Teladoc

Livongo®

Agreena

EQUALITY

GROUP

EQUILE/P

MAKE A DIFFERENCE AND A RETURN

Key Events of The Quarter

Q1 2023

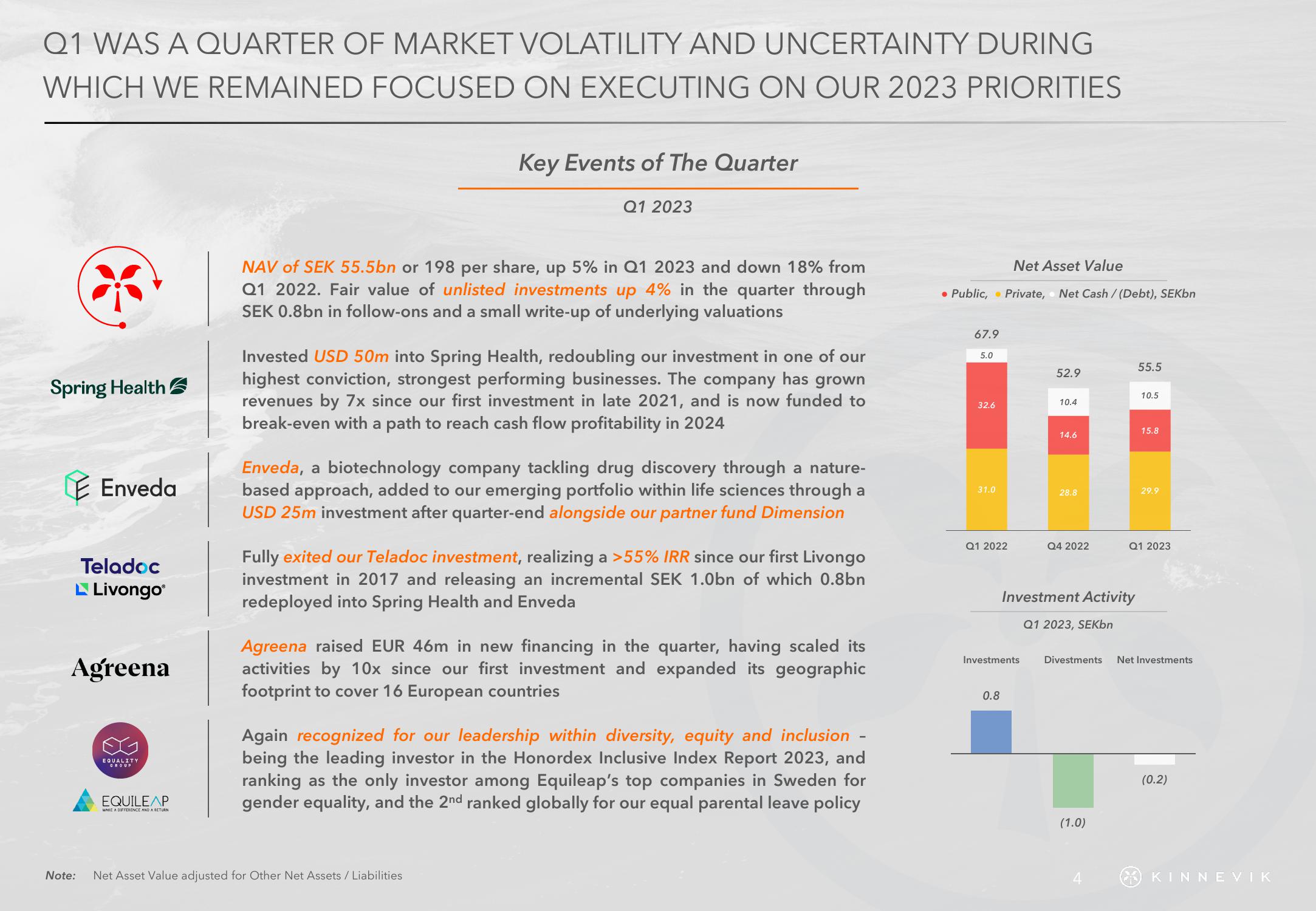

NAV of SEK 55.5bn or 198 per share, up 5% in Q1 2023 and down 18% from

Q1 2022. Fair value of unlisted investments up 4% in the quarter through

SEK 0.8bn in follow-ons and a small write-up of underlying valuations

Invested USD 50m into Spring Health, redoubling our investment in one of our

highest conviction, strongest performing businesses. The company has grown

revenues by 7x since our first investment in late 2021, and is now funded to

break-even with a path to reach cash flow profitability in 2024

Enveda, a biotechnology company tackling drug discovery through a nature-

based approach, added to our emerging portfolio within life sciences through a

USD 25m investment after quarter-end alongside our partner fund Dimension

Fully exited our Teladoc investment, realizing a >55% IRR since our first Livongo

investment in 2017 and releasing an incremental SEK 1.0bn of which 0.8bn

redeployed into Spring Health and Enveda

Agreena raised EUR 46m in new financing in the quarter, having scaled its

activities by 10x since our first investment and expanded its geographic

footprint to cover 16 European countries

Net Asset Value adjusted for Other Net Assets / Liabilities

Again recognized for our leadership within diversity, equity and inclusion

being the leading investor in the Honordex Inclusive Index Report 2023, and

ranking as the only investor among Equileap's top companies in Sweden for

gender equality, and the 2nd ranked globally for our equal parental leave policy

Net Asset Value

• Public, Private, Net Cash / (Debt), SEKbn

67.9

5.0

32.6

31.0

Q1 2022

Investments

0.8

52.9

10.4

14.6

28.8

Q4 2022

Investment Activity

Q1 2023, SEKbn

55.5

(1.0)

10.5

15.8

29.9

Q1 2023

Divestments Net Investments

(0.2)

KINNEVIKView entire presentation