GlobalFoundries Results Presentation Deck

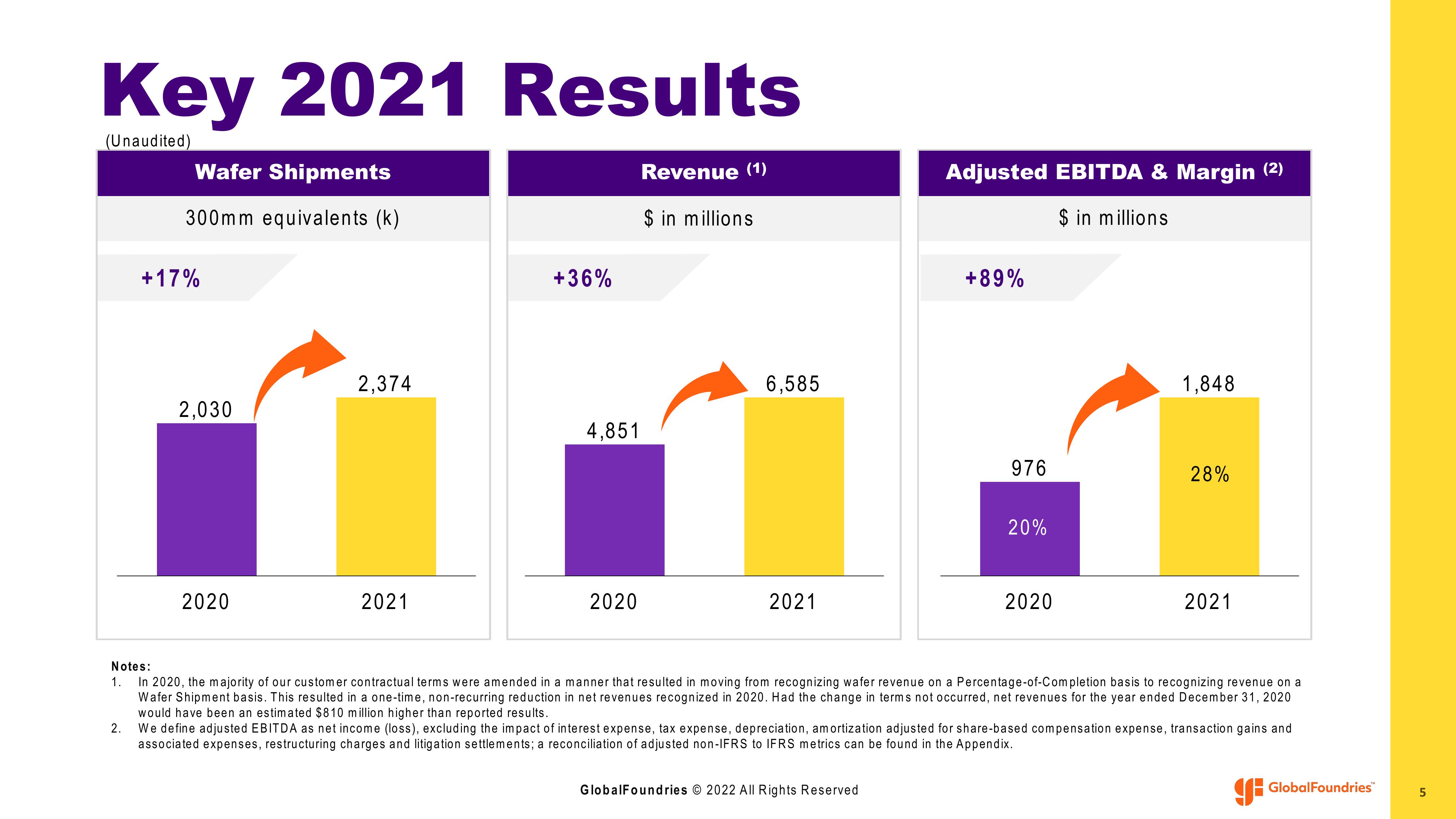

Key 2021 Results

(Unaudited)

Wafer Shipments

300mm equivalents (k)

2.

+17%

2,030

2020

2,374

2021

+36%

4,851

2020

Revenue (1)

$ in millions

6,585

2021

Adjusted EBITDA & Margin (2)

$ in millions

+89%

GlobalFoundries © 2022 All Rights Reserved

976

20%

2020

1,848

28%

Notes:

1. In 2020, the majority of our customer contractual terms were amended in a manner that resulted in moving from recognizing wafer revenue on a Percentage-of-Completion basis to recognizing revenue on a

Wafer Shipment basis. This resulted in a one-time, non-recurring reduction in net revenues recognized in 2020. Had the change in terms not occurred, net revenues for the year ended December 31, 2020

would have been an estimated $810 million higher than reported results.

2021

We define adjusted EBITDA as net income (loss), excluding the impact of interest expense, tax expense, depreciation, amortization adjusted for share-based compensation expense, transaction gains and

associated expenses, restructuring charges and litigation settlements; a reconciliation of adjusted non-IFRS to IFRS metrics can be found in the Appendix.

GlobalFoundries

5View entire presentation