Experienced Senior Team Overview

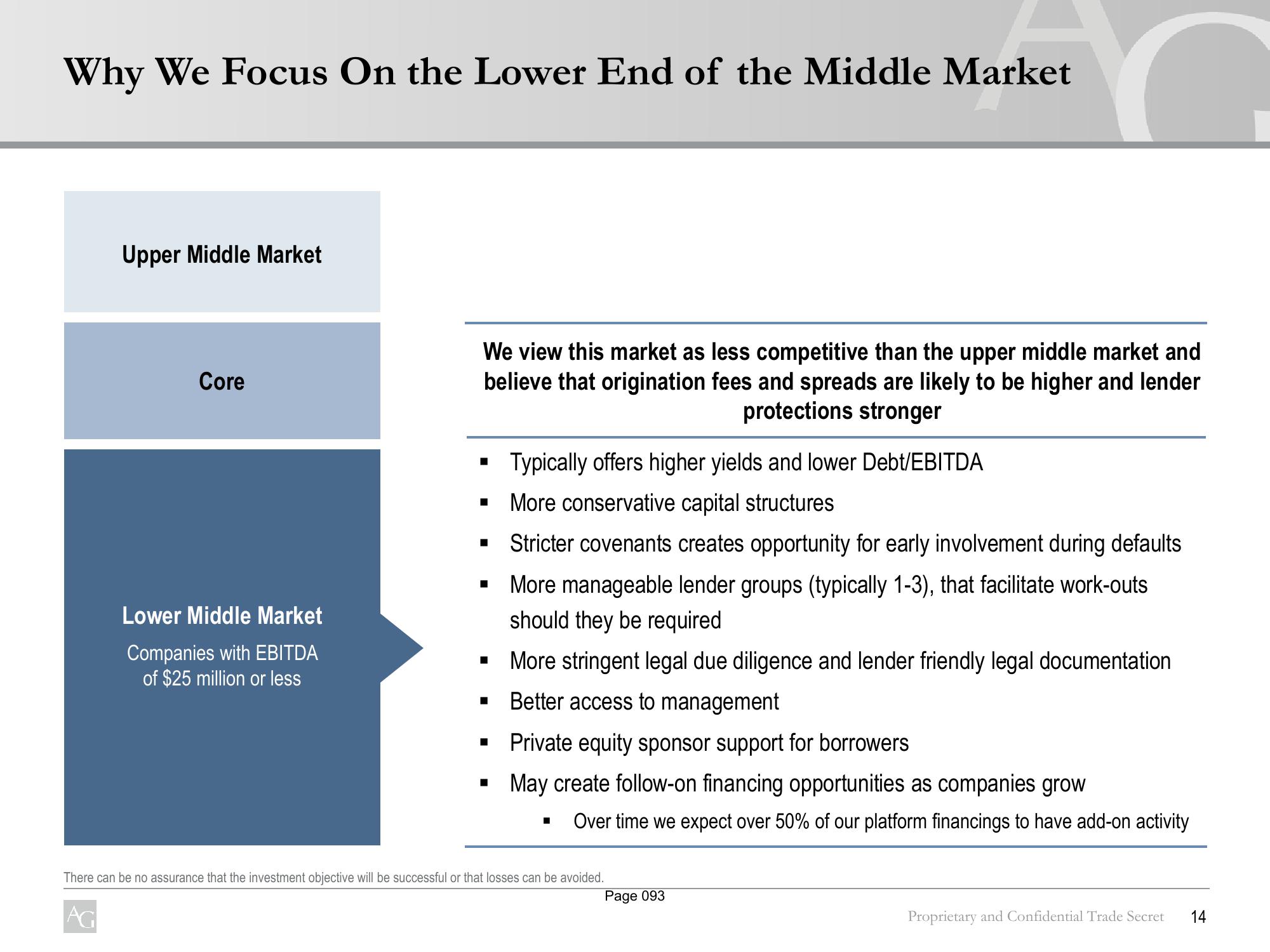

Why We Focus On the Lower End of the Middle Market

Upper Middle Market

Core

Lower Middle Market

Companies with EBITDA

of $25 million or less

We view this market as less competitive than the upper middle market and

believe that origination fees and spreads are likely to be higher and lender

protections stronger

■

Typically offers higher yields and lower Debt/EBITDA

More conservative capital structures

Stricter covenants creates opportunity for early involvement during defaults

More manageable lender groups (typically 1-3), that facilitate work-outs

should they be required

▪ More stringent legal due diligence and lender friendly legal documentation

Better access to management

■

■

Private equity sponsor support for borrowers

May create follow-on financing opportunities as companies grow

C

Over time we expect over 50% of our platform financings to have add-on activity

There can be no assurance that the investment objective will be successful or that losses can be avoided.

AG

Page 093

Proprietary and Confidential Trade Secret 14View entire presentation