Vale Results Presentation Deck

Vale's Performance in 2022: Finance

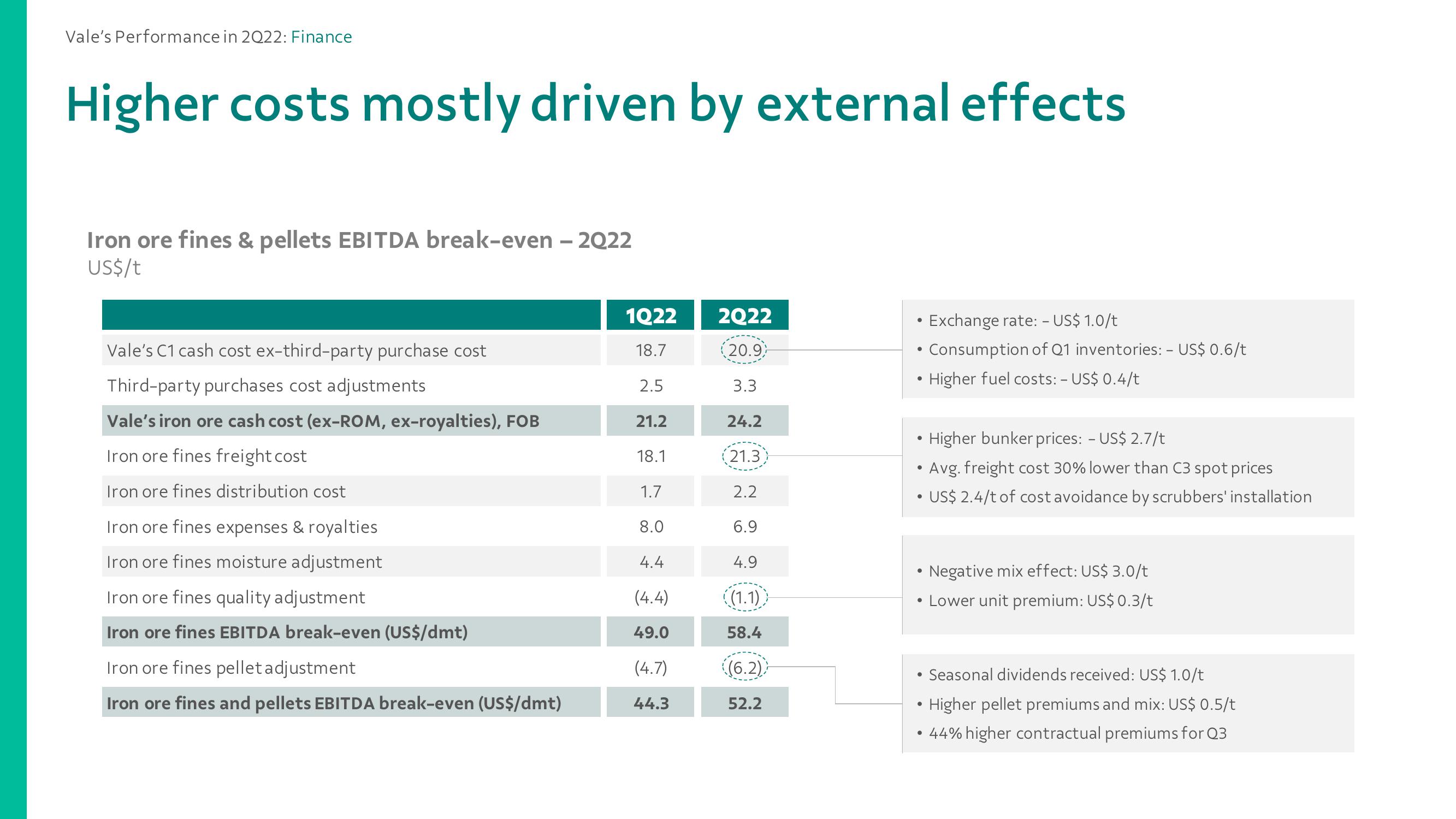

Higher costs mostly driven by external effects

Iron ore fines & pellets EBITDA break-even - 2022

US$/t

Vale's C1 cash cost ex-third-party purchase cost

Third-party purchases cost adjustments

Vale's iron ore cash cost (ex-ROM, ex-royalties), FOB

Iron ore fines freight cost

Iron ore fines distribution cost

Iron ore fines expenses & royalties

Iron ore fines moisture adjustment

Iron ore fines quality adjustment

Iron ore fines EBITDA break-even (US$/dmt)

Iron ore fines pellet adjustment

Iron ore

and pellets EBITDA break-even (US$/dmt)

1Q22

18.7

2.5

21.2

18.1

1.7

8.0

4.4

(4.4)

49.0

(4.7)

44.3

2022

(20.9)

3.3

24.2

(21.3)

2.2

6.9

4.9

((1.1))

58.4

((6.2)

52.2

●

Higher bunker prices: - US$ 2.7/t

Avg. freight cost 30% lower than C3 spot prices

• US$ 2.4/t of cost avoidance by scrubbers' installation

Exchange rate: - US$ 1.0/t

Consumption of Q1 inventories: - US$ 0.6/t

Higher fuel costs: - US$ 0.4/t

Negative mix effect: US$ 3.0/t

• Lower unit premium: US$ 0.3/t

●

●

Seasonal dividends received: US$ 1.0/t

Higher pellet premiums and mix: US$ 0.5/t

44% higher contractual premiums for Q3View entire presentation