HSBC Investor Event Presentation Deck

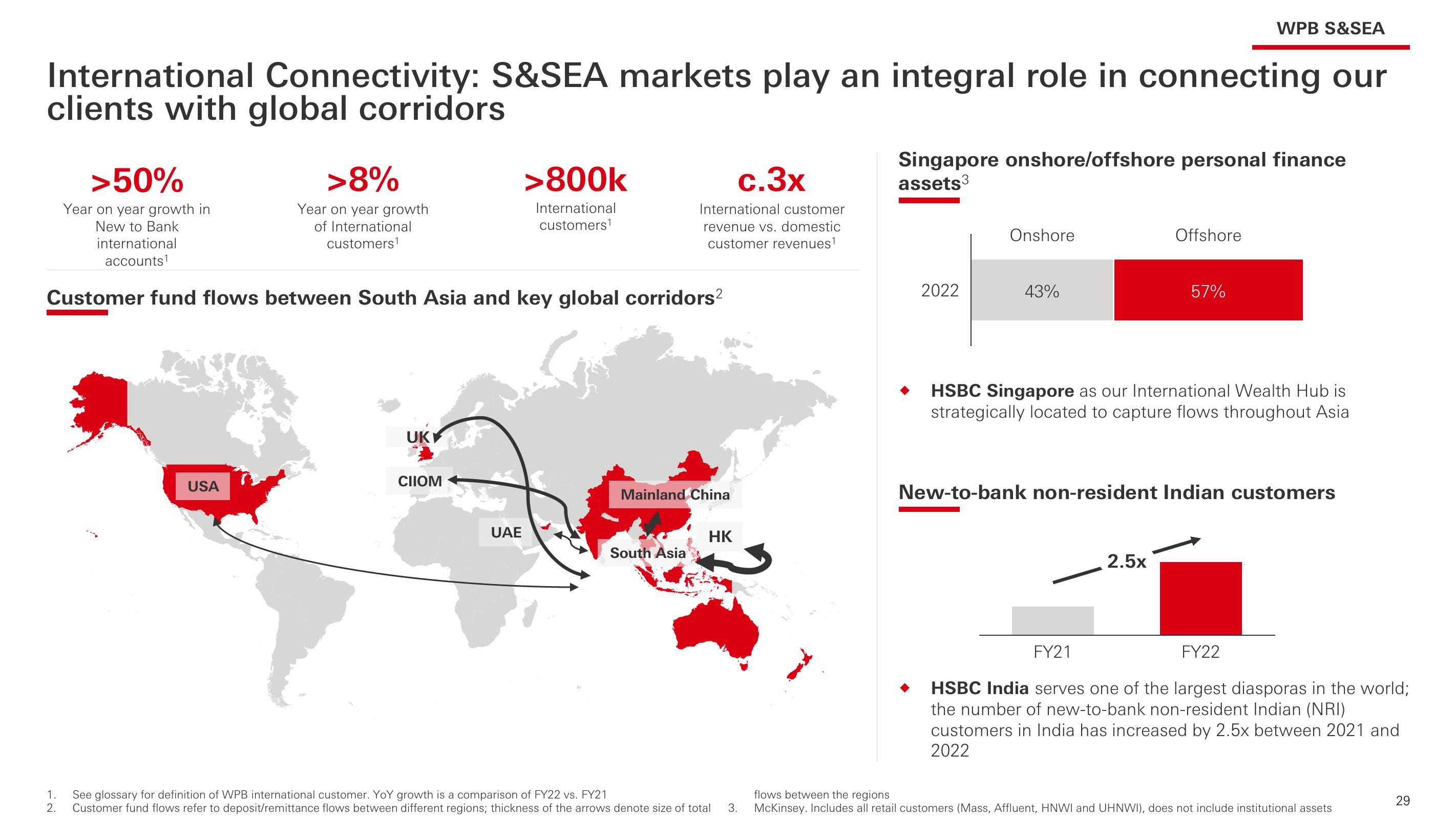

International Connectivity: S&SEA markets play an integral role in connecting our

clients with global corridors

>50%

Year on year growth in

New to Bank

international

accounts¹

>8%

Year on year growth

of International

customers¹

USA

Customer fund flows between South Asia and key global corridors²

UK

CIIOM

>800k

International

customers¹

UAE

c.3x

International customer

revenue vs. domestic

customer revenues¹

Mainland China

South Asia

HK

1.

See glossary for definition of WPB international customer. YoY growth is a comparison of FY22 vs. FY21

2. Customer fund flows refer to deposit/remittance flows between different regions; thickness of the arrows denote size of total

3.

Singapore onshore/offshore personal finance

assets3

2022

Onshore

43%

Offshore

WPB S&SEA

57%

2.5x

HSBC Singapore as our International Wealth Hub is

strategically located to capture flows throughout Asia

New-to-bank non-resident Indian customers

FY21

HSBC India serves one of the largest diasporas in the world;

the number of new-to-bank non-resident Indian (NRI)

customers in India has increased by 2.5x between 2021 and

2022

FY22

flows between the regions

McKinsey. Includes all retail customers (Mass, Affluent, HNWI and UHNWI), does not include institutional assets

29View entire presentation