TPG Results Presentation Deck

First Quarter and Last Twelve Months Highlights

Actual

Non-GAAP

Financial

Measures

($M)

Pro Forma

Non-GAAP

Financial

Measures

($M)

Operating

Metrics

($B)

I

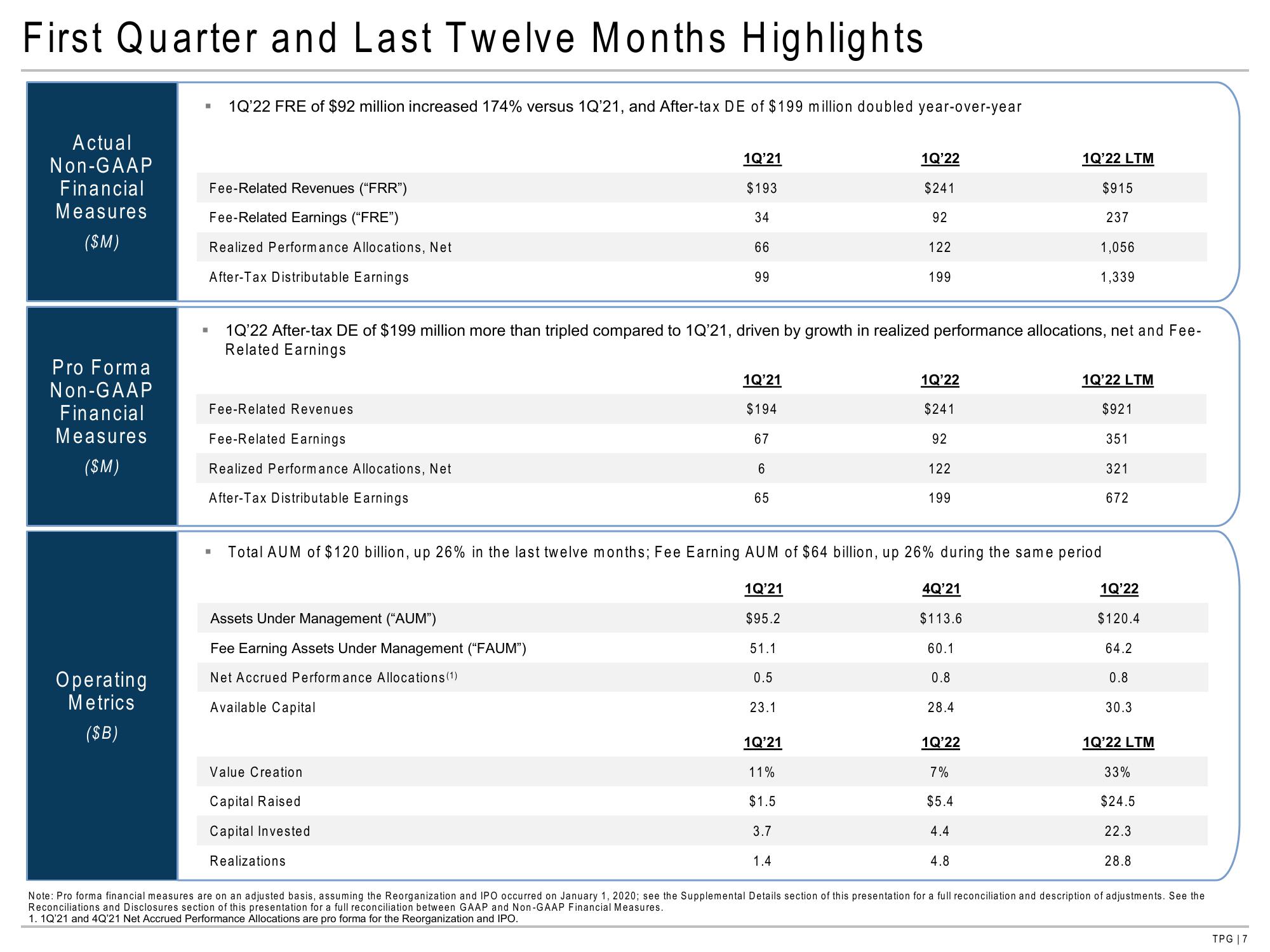

1Q'22 FRE of $92 million increased 174% versus 1Q'21, and After-tax DE of $199 million doubled year-over-year

Fee-Related Revenues ("FRR")

Fee-Related Earnings ("FRE")

Realized Performance Allocations, Net

After-Tax Distributable Earnings

■

Fee-Related Revenues

Fee-Related Earnings

Realized Performance Allocations, Net

After-Tax Distributable Earnings

Assets Under Management ("AUM")

Fee Earning Assets Under Management ("FAUM")

Net Accrued Performance Allocations (1)

Available Capital

1Q'21

$193

34

66

99

1Q'22 After-tax DE of $199 million more than tripled compared to 1Q'21, driven by growth in realized performance allocations, net and Fee-

Related Earnings

Value Creation

Capital Raised

Capital Invested

Realizations

1Q'21

$194

67

6

65

1Q'21

$95.2

51.1

0.5

Total AUM of $120 billion, up 26% in the last twelve months; Fee Earning AUM of $64 billion, up 26% during the same period

23.1

1Q'22

$241

92

122

199

1Q'21

11%

$1.5

3.7

1.4

1Q'22

$241

92

122

199

4Q'21

$113.6

60.1

0.8

28.4

1Q'22

7%

$5.4

1Q'22 LTM

4.4

$915

237

1,056

1,339

4.8

1Q'22 LTM

$921

351

321

672

1Q'22

$120.4

64.2

0.8

30.3

1Q'22 LTM

33%

$24.5

22.3

28.8

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020; see the Supplemental Details section of this presentation for a full reconciliation and description of adjustments. See the

Reconciliations and Disclosures section of this presentation for a full reconciliation between GAAP and Non-GAAP Financial Measures.

1. 1Q'21 and 4Q'21 Net Accrued Performance Allocations are pro forma for the Reorganization and IPO.

TPG 17View entire presentation