LegalZoom.com Investor Presentation Deck

Lz

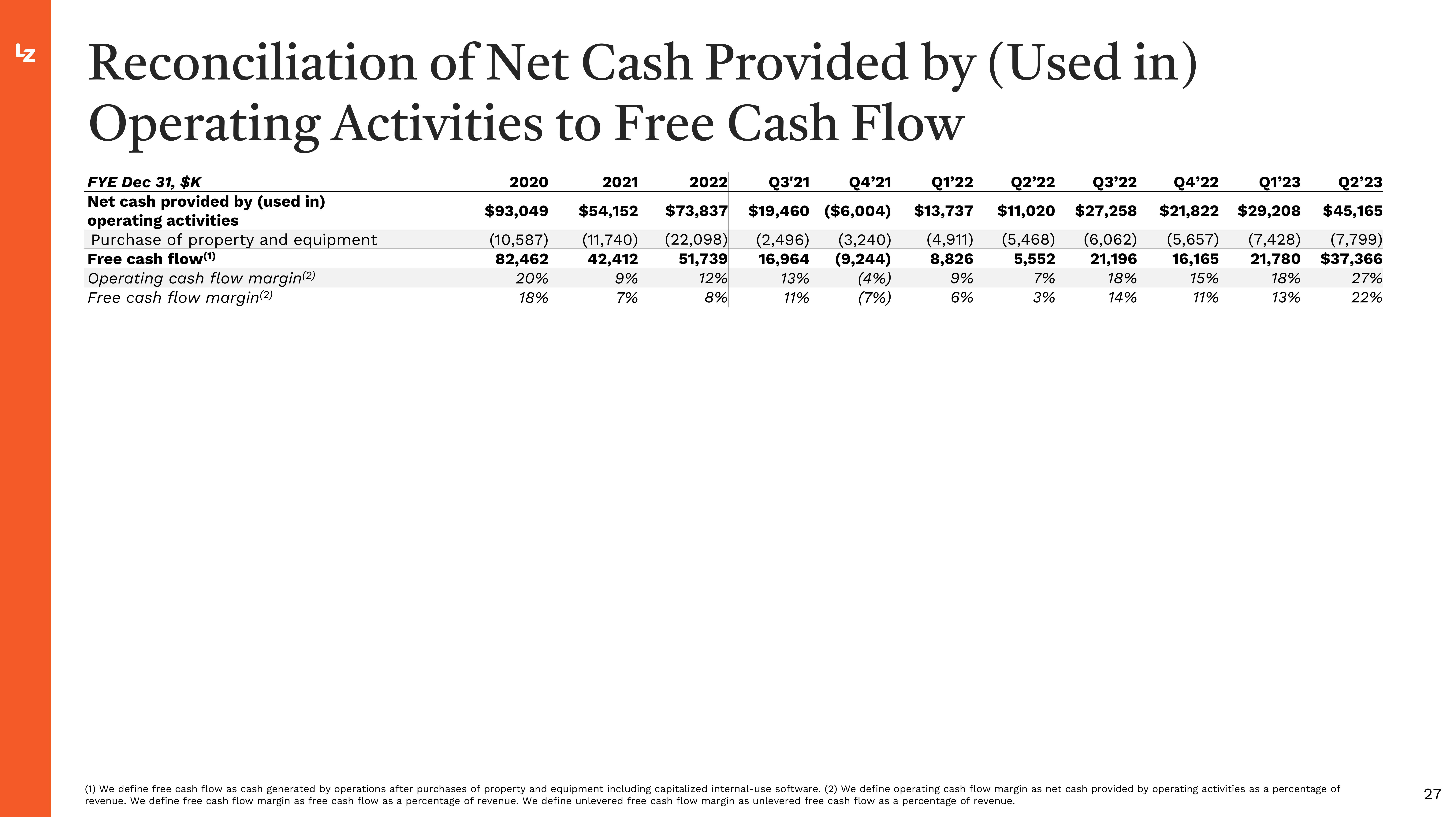

Reconciliation of Net Cash Provided by (Used in)

Operating Activities to Free Cash Flow

FYE Dec 31, $K

Net cash provided by (used in)

operating activities

Purchase of property and equipment

Free cash flow (1)

Operating cash flow margin(2)

Free cash flow margin(2)

2020

2021

$93,049 $54,152

(10,587)

(11,740)

42,412

82,462

20%

18%

9%

7%

Q2'22 Q3'22 Q4'22

2022 Q3'21 Q4'21 Q1'22

Q1'23 Q2'23

$73,837 $19,460 ($6,004) $13,737 $11,020 $27,258 $21,822 $29,208 $45,165

(22,098)

(4,911) (5,468) (6,062) (5,657) (7,428) (7,799)

51,739

8,826 5,552 21,196 16,165 21,780 $37,366

18%

15%

18%

27%

14%

11%

(2,496) (3,240)

16,964 (9,244)

13%

11%

(4%)

12%

8%

9%

6%

7%

3%

(7%)

13%

22%

(1) We define free cash flow as cash generated by operations after purchases of property and equipment including capitalized internal-use software. (2) We define operating cash flow margin as net cash provided by operating activities as a percentage of

revenue. We define free cash flow margin as free cash flow as a percentage of revenue. We define unlevered free cash flow margin as unlevered free cash flow as a percentage of revenue.

27View entire presentation